commercialtax.gujarat.gov.in Get Form No 403 Online : Commercial Tax

Organization : Gujarat Commercial Tax

Facility : Get Form No 403 Online

Applicable For : India

Website : https://commercialtax.gujarat.gov.in/vatwebsite/home/home.jsp

| Want to comment on this post? Go to bottom of this page. |

|---|

Contents

Gujarat Commercial Tax Get Form No 403

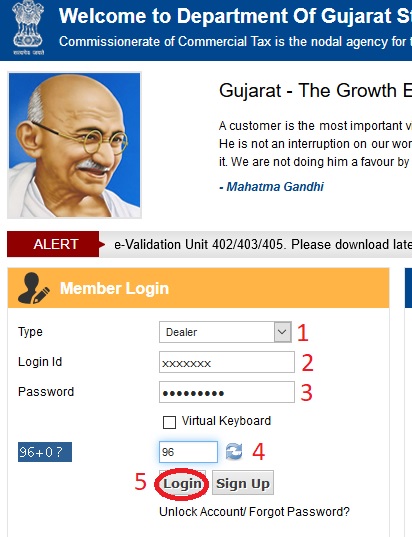

Please enter your TIN No. as user Id, your Password and log in as “Dealer” on left top of the website.

Related / Similar Service : admis.hp.nic.in Obtain Approval for Building Plan

Step 1 : Select Type

Step 2 : Enter Login Id

Step 3 : Enter Password

Step 4 : Solve Simple Math Problem

Step 5 : Click Login Button

1. You find a link named e-Services- e Check Post- followed by “403 Series Generation”.

2. Click to get a box in which you need to write quantity of 403 forms required by you.

3. Submit the request to get the series of numbers.

4. Save the generated number series to your computer for further use.

5. Now there are two Options for you :

i) Either you, as registered dealer generate form 403 on your computer and send it to your consigner to other State

ii) or convey the generated series numbers to the consigner to generate form 403 at their end.

To get form 403 from website A dealer (Consigner/Consignee/Transport Agent/Commission Agent) has to follow following steps.

Here you need not have user Id and Password to log in to the website

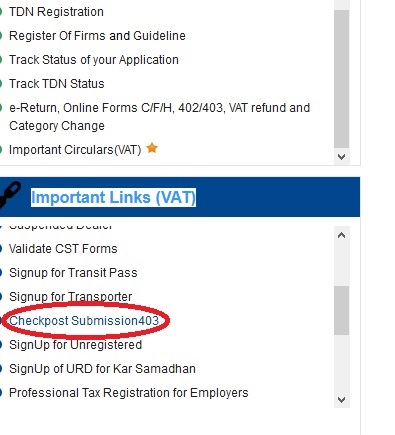

1. Click Checkpost Submission403 link under Important Links (VAT) section available in the home page.

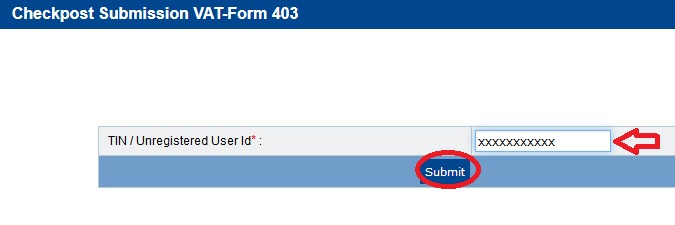

Enter TIN / Unregistered User Id* & click submit button

2. The center of the page showing two links, 403 for specified goods and 403 for non specified goods.

3. Click the link of Specified or Non Specified Goods as per your requirement and commodity.

4. By clicking on “File Download Message” appears on your screen. Please opt for save button

5. Please save the downloaded template on Hard Drive of your computer.

6. After due filling the template, please go again to the download screen- (Shown above) (Step B and C) on website.

7. Select form 403, give your e-mail address and link the template path by browse button & start uploading the template.

8. You will be given message of “Please Wait, Data is being Validated” followed by Message “No Error found in Uploaded Sheet” As soon as this message display, please enter submit button below.

9. You can have print out of receipt but first click PDF link, a form 403 with Bar code appears on screen.

Requirements :

** Windows Operating System (98 and Higher versions)

** MS Office (Office XP and above version)

** Adobe acrobat Reader (Version 5.0 and above)

** MS Internet Explorer (Version 5.0 and above)

** Internet connectivity (Plug to surf or Broadband)

** DMP-Inkjet or Laser Printer to get print outs.

(Inkjet or Laser printer is recommended as print outs of DMP may cause difficulty for bar code machine at check post)

Important Points :

1. Please see that your vehicle should pass from the check post mentioned in the form 403.

2. Generated Bar coded form is allowed to use once only. Copy cannot be possible.

3. You can include more than one commodity in single form.

4. Have to get more than one form for more than one dealer in single truck.

5. There shall be different forms for different consignee.

6. You will receive a mail from department on your given mail address.

Download Instructions to Get Form No 403 : https://www.indianin.org/uploads-new/Govt/10-English.pdf

New User Registration

Step 1 : Enter TIN

Step 2 : Enter Mobile No

Step 3 : Enter Email

Step 4 : Select Registration Effective Date

Step 5 : Enter Security Question

Step 6 : Enter Security Answer

Step 7 : Accept Terms & Conditions

Step 8 : Click Submit Button

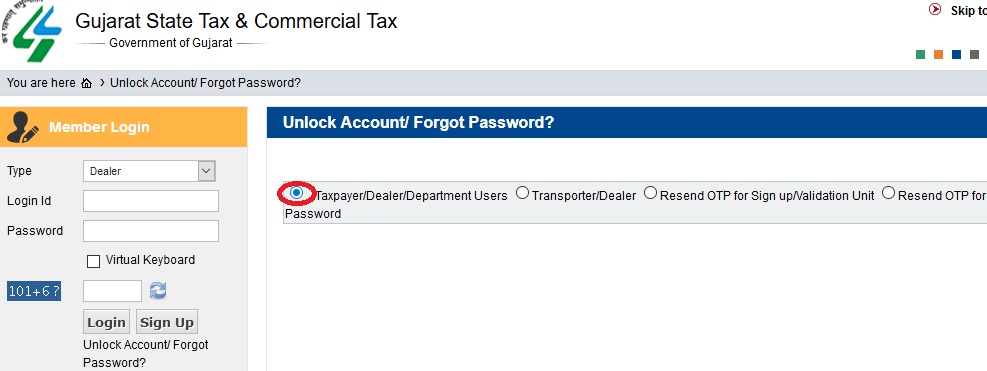

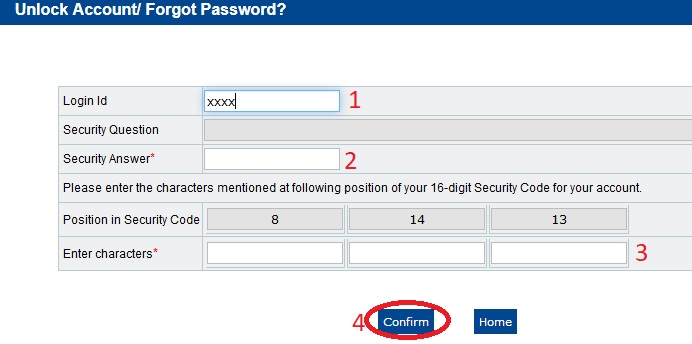

Unlock Account/ Forgot Password? :

Select any one of the option below

1. Taxpayer/Dealer/Department Users

2. Transporter/Dealer

3. Resend OTP for Sign up/Validation Unit

4. Resend OTP for Unlock Account/Reset Password

Taxpayer/Dealer/Department Users :

Step 1 : Enter Login Id

Step 2 : Enter Security Answer

Step 3 : Enter characters

Please enter the characters mentioned at following position of your 16-digit Security Code for your account.

Step 4 : Click Confirm Button

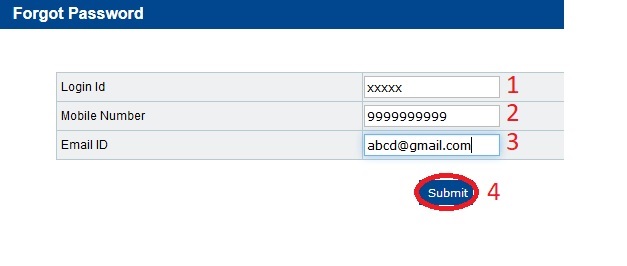

Transporter/Dealer :

Step 1 : Enter Login Id

Step 2 : Enter Mobile Number

Step 3 : Enter Email ID

Step 4 : Click Submit Button

Resend OTP for Signup :

Enter Login Id & click submit button

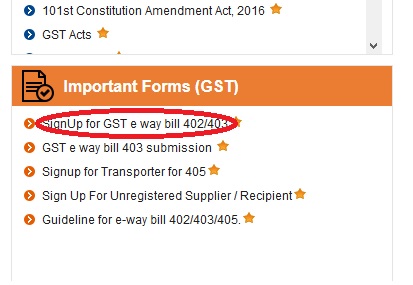

GST e way bill 402/403

Go to the link of SignUp for GST e way bill 402/403 available under Important Forms(GST) section in Commercial Tax home page.

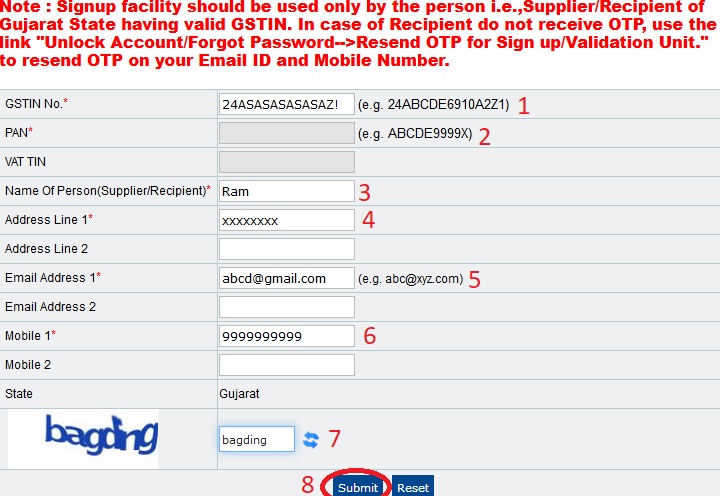

Step 1 : Enter GSTIN No

14th character of GSTIN No must be Z. GSTIN No must be started with 24.

Step 2 : Enter PAN

Step 3 : Enter Name Of Person(Supplier/Recipient)

Step 4 : Enter Address Line 1

Step 5 : Enter Email

Step 6 : Enter Mobile 1

Step 7 : Enter Captcha

Step 8 : Click Submit Button

Signup facility should be used only by the person i.e.,Supplier/Recipient of Gujarat State having valid GSTIN. In case of Recipient do not receive OTP, use the link “Unlock Account/Forgot Password–>Resend OTP for Sign up/Validation Unit.” to resend OTP on your Email ID and Mobile Number.

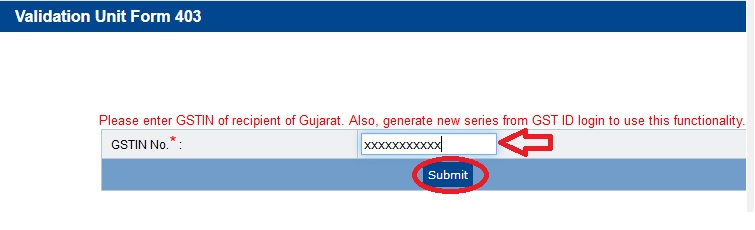

GST e way bill 403 Submission

Please enter GSTIN of recipient of Gujarat. Also, generate new series from GST ID login to use this functionality.

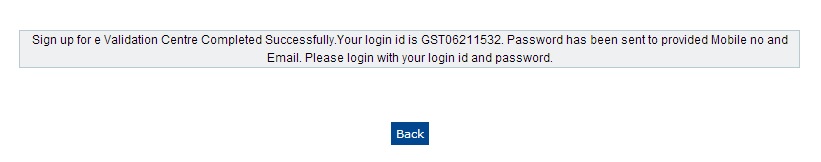

You will receive the following message.

Thereafter login with Login ID and password sent on Mobile No. and e mail.

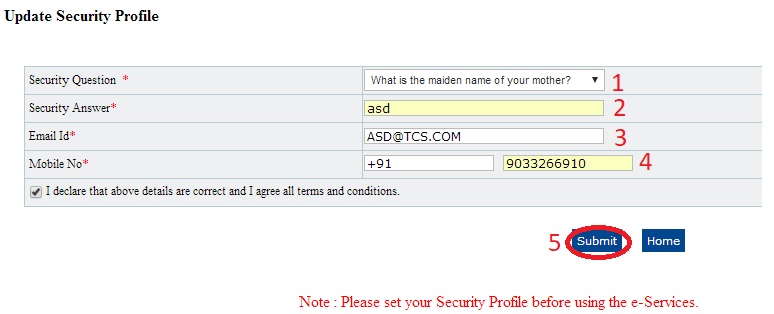

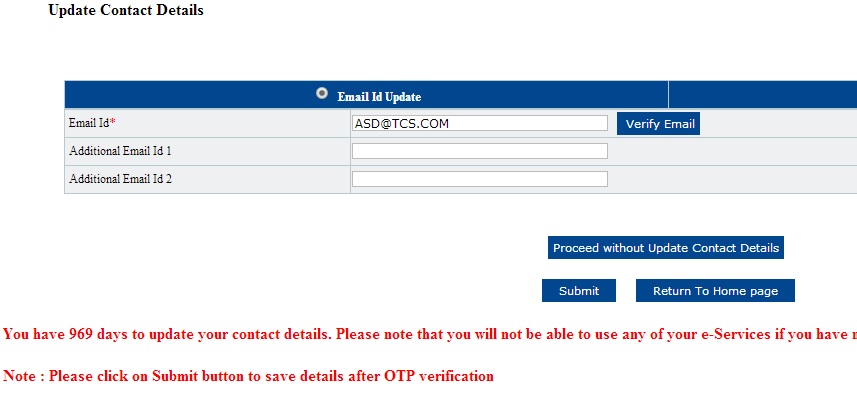

Update security profile for forgot password option.

Step 1 : Select Security Question

Step 2 : Enter Security Answer

Step 3 : Enter Email ID

Step 4 : Enter Mobile Number

Step 5 : Click Submit Button

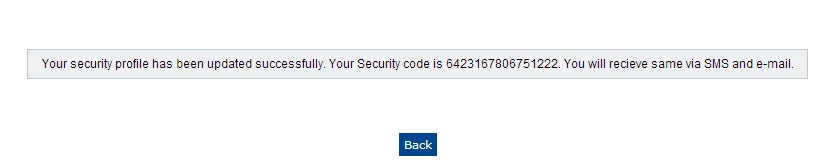

Security profile has been set successfully and security code send via SMS on register mobile number and e-mail.

Verify email and mobile number with OTP

You have 969 days to update your contact details. Please note that you will not be able to use any of your e-services if you have not updated contact details within the time limit.

Note : Please click on Submit button to save details after OTP verification

Download GST e way bill 403 Guidelines : https://www.indianin.org/uploads-new/Govt/10guide.pdf

GST FAQs

What is Goods and Service Tax (GST)?

It is a destination based tax on consumption of goods and services. It is proposed to be levied at all stages right from manufacture up to final consumption with credit of taxes paid at previous stages available as setoff.

Which are the commodities proposed to be kept outside the purview of GST?

Alcohol for human consumption, Petroleum Products viz. petroleum crude, motor spirit (petrol), high speed diesel, natural gas and aviation turbine fuel& Electricity.

What will be status of Tobacco and Tobacco products under the GST regime?

Tobacco and tobacco products would be subject to GST.

Who will decide rates for levy of GST?

The CGST and SGST would be levied at rates to be jointly decided by the Centre and States. The rates would be notified on the recommendations of the GST Council

Whether the composition scheme will be optional or compulsory?

Optional.

Answered Questions

How can I get duplicate Receipt of e-Return?

Login on Website -> History -> Return History -> Enter Tax Period. Dealer can also view purchase details of made from Cancelled dealer/Invalid TIN.

What is TDN?

TDN is Tax Deduction Number.