UCO Bank Online Services/Track Loan Status : ucobank.com

Organization : UCO Bank

Service Name : UCO Bank Online Services

Website : https://www.ucobank.com/english/Home.aspx

| Want to comment on this post? Go to bottom of this page. |

|---|

Contents

UCO Bank Online Services

Founded in 1943, UCO Bank is a commercial bank and a Government of India Undertaking. Its Board of Directors consists of government representatives from the Government of India and Reserve Bank of India as well as eminent professionals like accountants, management experts, economists, businessmen, etc.

Related / Similar Service : epay.unionbankofindia.co.in KV Fee

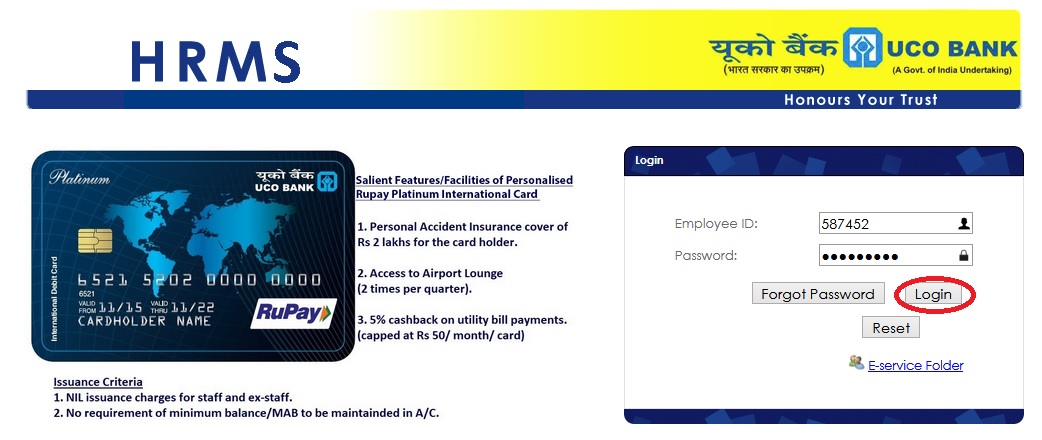

HRMS Login & Password Reset

Go to the official webpage click on the HRMS Login Page link,enter the following details.

Login Details :

1. Enter Your Employee ID Number [25879458]

2. Enter Your Password [********]

3. Click on Login button.

Apply for Home Loan

This housing finance scheme brings to you an excellent opportunity to have your own house or flat. The scheme has been carefully tailored to suit your requirements.

Eligibility :

** Individual (including NRI and PIO) having minimum 21 years of age and maximum 70 years of age (all class of borrower) inclusive of repayment period.

Purpose :

** Purchase and construction of independent house/ready built flat for residential purpose.

** Extension/Repair/Renovation of existing house/flat not more than 50 years old.

** Takeover of home loans availed from other banks/FIs.

** Loan is also available for furnishing of house property.

** Purchase of old house/flat not more than 30 years old.

Quantum of loan :

The area-specific maximum limits for construction/purchase are as under :

| Location/Centre | For Construction/ Purchase/ Takeover A/Cs | For Repair/ Extension/ Renovation |

| Metro/Urban/Semi-urban | No upper limit | Rs.25 lac |

| Rural | No upper limit | Rs.7.5 lac |

Loan Entitlement :

Least of the Loan amount computed under A and B below :

The total deductions existing plus the EMI of the proposed loan would be linked to Gross Monthly Income (GMI) and must not exceed the GMI of the borrower(s) as under:

On the basis of purpose/Cost :

** 90%(loan upto Rs 30 lacs),

** 80%(loan above Rs 30 lacs to Rs 75 lacs) or

** 75% (loan above Rs 75 lacs) of the project cost of construction or purchase price of house/flat as per agreement for sale.

On the basis of monthly income vis-a-vis EMI :

For Indian Residents :

** GMI up to Rs.50,000/- – 60% of GMI

** GMI above Rs.50,000/- and up to Rs.1,00,000/- – 70% of GMI (subject to minimum monthly take home pay of Rs.20,000/-)

** GMI above Rs.1,00,000/- -75% of GMI (subject to minimum monthly take home pay of Rs.30,000/-)

For NRI & PIO :

** GMI Up to Rs. 1,50,000/-

** 50% of Gross Monthly Income

** GMI above Rs. 1,50,000/-

** 60% of Gross Monthly Income

Rate of Interest :

|

Loan slabs |

ROI p.a. w.e.f. 10.12.2018 |

|

Upto Rs 30 Lacs |

MCLR of 1 year i.e 8.70% |

|

Above Rs 30 Lacs to Rs 75 Lacs |

MCLR of 1 year plus 0.10% i.e 8.80% |

|

Above Rs 75 Lacs |

MCLR of 1 year plus 0.25% i.e 8.95% |

Processing Fee :

** 0.5% of the loan amount, minimum Rs.1500/- & maximum Rs. 15000/-.

** 100% waiver of processing charges from 01.11.2018 to 31.03.2019.

Repayment :

** The maximum period of repayment is 30 years/360 EMI but should not be beyond 70 years in case of all class of borrower.

Security :

** EMTD of property financed.

** No third party guarantee

Prepayment charge :

NIL

Tax Benefits :

** Tax relief on principal and interest components of this loan would be available as per provisions prevailing under Income Tax Act.

Check Account Balance Via SMS/ Mobile

UCO Mobile Banking is a technology based new service offering from UCO Bank to its customers for their convenience allowing them to avail selected banking services via their mobile phone using SMS Messaging.

Mobile Banking Services are operated using both PUSH & PULL Messages.

PUSH Messages (Alerts):

** Are the customized alerts. Under this service, customer registered for Mobile Banking facility shall be able to get SMS alerts for various activities on his account. Such messages are those that the Bank chooses to send out to a customer’s mobile phone for which the customer needs to be registered under UCO Mobile Banking Service by submitting one time application to the bank for availing the facility.

PULL Messages (Request) :

** Are those that are initiated by the customer using his mobile phone for obtaining information or performing a transaction in the bank Account, for example ‘balance enquiry’ or ‘cheque status enquiry’.

What can I get alerts for?

Our Mobile Banking Service provides you information in the form of SMS alerts for various activities performed on your account.

** Salary Credit

** Account getting debited

** Account getting credited

** Cheque bounce

** Balance above certain limit

** Balance below a limit

** Bill payment / Bill registration (through e-banking) alert

** Batch alerts

** Promotional alerts

** Greetings

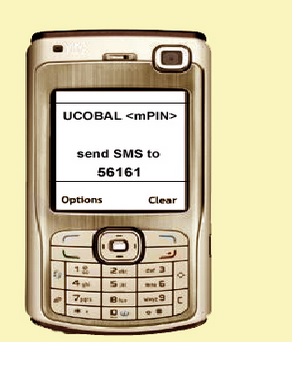

SMS to be sent to 56161 by the customer from his Mobile phone.

Example :

1. For Example for balance enquiry, type the message in the message box of your mobile phone in the following manner and send the same to 56161. You will get system generated response.

UCOBAL <mPIN>

2. For balance enquiry of other account (if more than one accounts are linked)

UCOBAL <mPIN> <14 digit Account number>

How does it work- :

Mobile Banking works through a set of Text Message (SMS) through which you can perform a wide range of information based or query based transactions from your mobile phone, without even making a call.

All you need to do is to type in the specified ‘keyword’ and some other required parameters in the message box of your Mobile phone and send it to 56161.

You will get a system generated response in the form of a text message (SMS) on your mobile phone screen within a few seconds.

UCO Rewards Program

UCO Bank presents UCOBank Rewardz, a loyalty program for all valued customers. Now earn UCO Points every time you pay using your UCO Bank Debit Card, withdraw cash from a UCO Bank ATM, Internet Banking for payments and other services.

As a UCO Bank Debit Card holder, you’re auto-enrolled in this program and have been earning UCO Points for all your swipes.

However, to activate your UCOBank Rewardz account and start redeeming your UCO Points With the recently introduced UCO Savings, you also get the opportunity to earn UCO Points on a variety of banking transactions like setting auto-debits on loans, taking new loans and online opening of Current/Savings account.

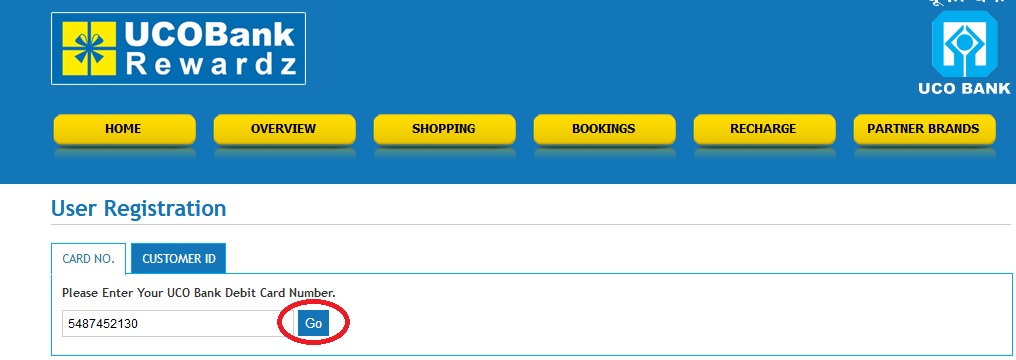

User Registration

Card Number :

1. Please Enter Your UCO Bank Debit Card Number.

2. Click on Go Button.

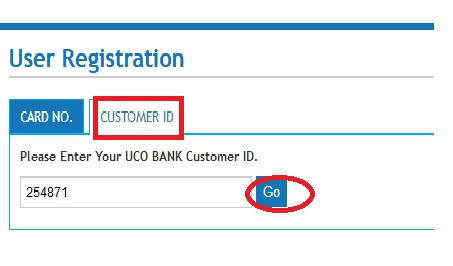

Customer ID :

1. Please Enter Your UCO BANK Customer ID.

2. Click on Go Button

Know Your Reward Points :

1. Entered the correct UCO Bank Debit card number.

2. Click on Check Earn Points button.

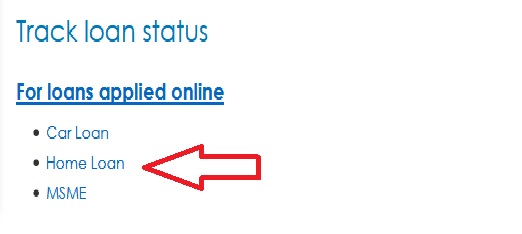

UCO Track Loan Status

For loans applied online :

** Car Loan

** Home Loan

** MSME

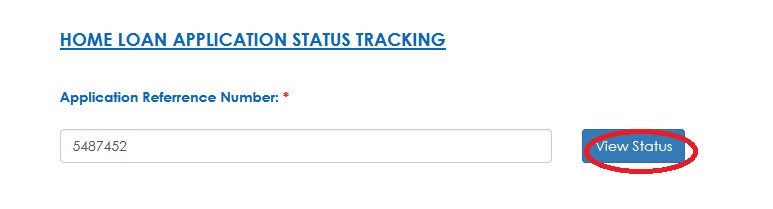

Home Loan Application Status Tracking

1. Enter Application Reference Number

2. Click on Get Status Button.

Online Account Opening

If you have already filled in the Savings Account Form in part before this, please fill in the Reference Number that was provided to you and your Date of Birth. Click on the ‘Submit’ button to access the information that you have already entered and complete the form.

Job Card for Online Account Opening :

All the existing /new customer who would like to open a new account can visit the UCO Bank website and follow the under mentioned steps for the same.

Step 1: Go to the website ucobank.com

Step 2 : On the Right hand side bottom of the homepage, under Apply Online click on the link “ Online Account Opening”.

Step 3 : For opening a new savings/current account click on the link ‘To apply for a new Savings/Current Account, click here’ If you have already used the above option and partially saved the filled application form, please enter the Reference Number and Date of birth and click submit button to edit/update the previously entered details.

Step 4: Fill in all the relevant fields in the application form.

Note: All the fields marked with red border are mandatory.

For Uploading of Document in “Photo identity & Address proof” please choose the file by browsing to the same (Allowable documents are .pdf,.jpg,.jpeg,.png and Maximum file size is 1MB)

Step 5: Click on the save button if you have filled all the mandatory fields. In case you don’t have the correct information or want to complete the same later, please click on partial save button.

Step 6: If you have clicked on save /partial save button after filling the details, an OTP (One Time Password) will be sent to the mobile number entered in the Communication address of the first applicant. Enter the generated OTP and click on submit button.

Step 7: After submitting the form, a link with the option for downloading the PDF file of the application submitted will be shown and also the PDF file be sent to the registered e-mail address of the first applicant.

This completes the process of submitting online account opening form. Once online application is submitted successfully, concerned/nearest branch will contact the customer for necessary KYC verification. After KYC verification account will be opened.

Step 8:- If you have clicked the partial save, please note down the reference number generated. Reference number and Date of Birth will be required to complete the application form in future.

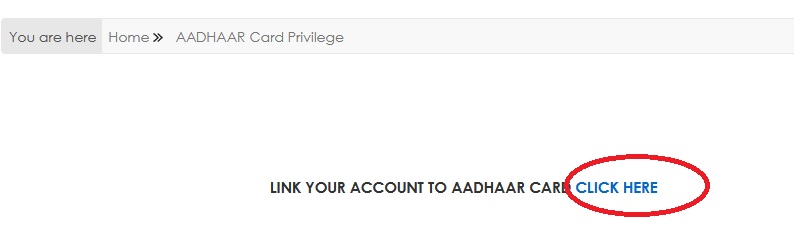

Link Your Account To Aadhaar Card

Dear Customer, Following Channels are Available to Submit Seeding Request. Go to the official website,click on the AADHAAR Card Linkage option in home page.

Aadhaar Number Registration :

Following Channels are Available to Submit Seeding Request

1. Internet Banking* :

** Login To Your Net Banking Account

** Go to Request Tab -> Click on “Linking Of Aadhaar Number”

** Furnish Your correct 12 Digit Aadhaar Number.

** Accept Terms and Click on Submit. Acknowledgment of receipt of seeding request will be displayed on the screen

2. Using SMS* :

** SEND SMS TO 9231008888

** FORMAT OF MESSAGE UCOAADHAAR<12 DIGIT AADHAAR NO><14 DIGIT AC_NO>

** Acknowledgment of receipt of Seeding request will be sent through SMS.

3. Through ATM* :

** SWIPE YOUR ATM/DEBIT CARD IN UCO BANK ATM AND AUTHENTICATE WITH PIN

** Go to “OTHER SERVICES” AND SELECT “AADHAAR SEEDING”

** ENTER YOUR 12 DIGIT AADHAAR NUMBER

** Accept Terms and Click on Submit

** Acknowledgment SLIP seeding request will be printed.

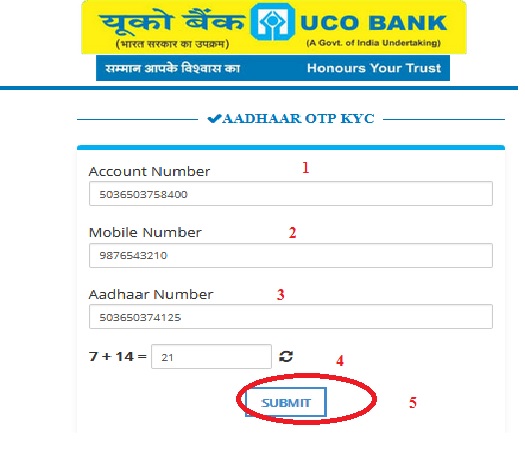

4. OTP based eKYC for Customers :

1. Enter Account Number

2. Enter Mobile Number

3. Enter Aadhaar Number

4. Click on Submit button.

Note*: Seeding Request will be processed by Bank subject to satisfactory verification of AADHAAR credential.

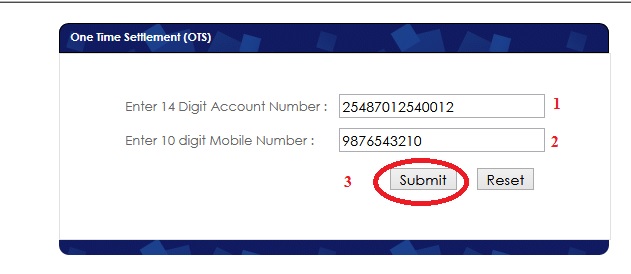

One Time Settlement

OTS Application- Apply Online :

1. Enter 14 Digit Account Number

2. Enter 10 digit Mobile Number

3. Click on Submit Button.

Safe Banking – do’s & don’ts

1. Do not open spam mails. Be especially cautious of e-mails that :

** Come from unrecognized senders.

** Ask you to confirm personal or financial information over the Internet and/or make urgent requests for this information.

** Are not personalized.

** Try to upset you into acting quickly by threatening you with frightening information.

2. Do not click on links, download files or open attachments in e-mails from unknown senders. Be cautious even if the e-mail appears to come from an enterprise you do business with. It is a good practice to call up the concerned to confirm in case the e-mail is unexpected.

3. Communicate personal information only via secure web sites.

In fact:

** When conducting online transactions, look for a sign that the site is secure such as a lock icon on the browser’s status bar or a “https:” URL whereby the “s” stands for “secure” rather than a “http:”.

** Also, check if the website address is correct before conducting online transactions.

4. Protect your computer by installing effective anti-virus / anti-spyware / personal firewall on your computer / mobile phone and update it regularly.

5. Check your online accounts and bank statements regularly to ensure that no unauthorized transactions have been made.

6. Do not disclose details like passwords, debit card grid values, etc. to anyone, even if they claim to be bank employees or on e-mails/links from government bodies like RBI, I.T. Dept., etc

7. Register for SMS alerts to keep track of your banking transactions.

8. If you have to share your mobile with anyone else or send it for repair/maintenance

** Clear the browsing history

** Clear cache and temporary files stored in the memory as they may contain your account numbers and other sensitive information

** Block your mobile banking applications by contacting your bank. You can unblock them when you get the mobile back.

9. Do not save confidential information such as your debit/credit card numbers, CVV numbers or PIN’s on your mobile phone.

10. Do not leave your cheque book unattended. Always keep it in a safe place, under lock and key.

11. Whenever you receive your cheque book, please count the number of cheque leaves in it. If there is a discrepancy, bring it to the notice of the Bank immediately.

12. Your card is for your own personal use. Do not share your PIN or card with anyone, not even your friends or family.

13. “Shoulder surfer” can peep at your PIN as you enter it. So stand close to the ATM machine and use your body and hand to shield the keypad as you enter the PIN.

14. Press the ‘Cancel’ key before moving away from the ATM. Remember to take your card and transaction slip with you.

15. If your ATM card is lost or stolen, report it to your card-issuing bank immediately.

16. While talking on phone never disclose:

** 4 digit ATM/IVR PIN

** 6 digit 3D secure PIN

** OTP password word

** Internet banking password

** CVV ( Card Verification Value )

Contact Us :

UCO Bank Head Office,

10, B T M Sarani, Kolkata – 700 001

West Bengal

India.