epfindia.gov.in PMRPY Pradhan Mantri Rojgar Protsahan Yojana Scheme : Employees’ Provident Fund Organisation

Organisation : Employees’ Provident Fund Organisation, India EPFO

Scheme Name : PMRPY Pradhan Mantri Rojgar Protsahan Yojana Scheme

Applicable States/ UTs : All Over India

Website : https://epfindia.gov.in/site_en/

| Want to comment on this post? Go to bottom of this page. |

|---|

EPFO Pradhan Mantri Rojgar Protsahan Yojana Scheme

** The Pradhan Mantri Paridhan Rojgar Protsahan Yojana (PMRPY) Scheme has been designed to incentivise employers for generation of new employment, where Government of India will be paying the 8.33% EPS contribution of the employer for the new employment.

Related / Similar Scheme : pmaymis.gov.in PMAY

** In the case of the textile (apparel) sector, the employers are also eligible to get the 3.67% EPF contribution paid by the Government as mentioned in the PMRPY on-line form under Pradhan Mantri Paridhan Rojgar Protsahan Yojana (PMPRPY).

Eligibility Criteria

** Establishments registered with the EPFO should also have a Labour Identification Number (LIN) allotted to them under the Shram Suvidha Portal. The LIN will be the primary reference number for all communication to be made under the PMRPY Scheme.

** The eligible employer must have added new employees to his establishment.

** Establishments should have a valid PAN

** Establishments should have a valid Bank Account details.

** Establishments should have submitted their ECR for the month of March 2016

** The New Employee must have a Universal Account Number (Aadhaar seeded) issued after 01.04.2016 and not have worked in any EPFO registered establishment in the past.

** To avail benefits under the scheme, the new employee must be earning upto (and including) Rs 15,000 per month.

** The details of the new employee will be verified from the EPFO database of establishments and member details.

** The PMRPY scheme is targeted for employees earning wages less than or equal to Rs 15,000/- per month.

** Thus, new employees earning wages more than Rs 15,001/- per month will not be eligible.

** The employers will continue to get the 8.33% contribution paid by the Government for these eligible new employees for the next 3 years, from the date of acquiring a new UAN or 09.08.2016, whichever is later, provided they continue in employment in any EPFO registered establishment.

The industry sector/sub-sectors covered by this component are the following NIC Codes :

(1) NIC 1410: Manufacture of wearing apparel, except fur apparel

(2) NIC 1430: Manufacture of knitted and crocheted apparel

(3) NIC 1392: Manufacture of made – ups textile ,except apperal

** The Scheme will be in operation for a period of 3 years and the Government of India will continue to pay the 8.33% EPS contribution to be made by the employer for the next 3 years.

** That is, all new eligible employees will be covered under the PMRPY Scheme till 2019-20.

How To Apply

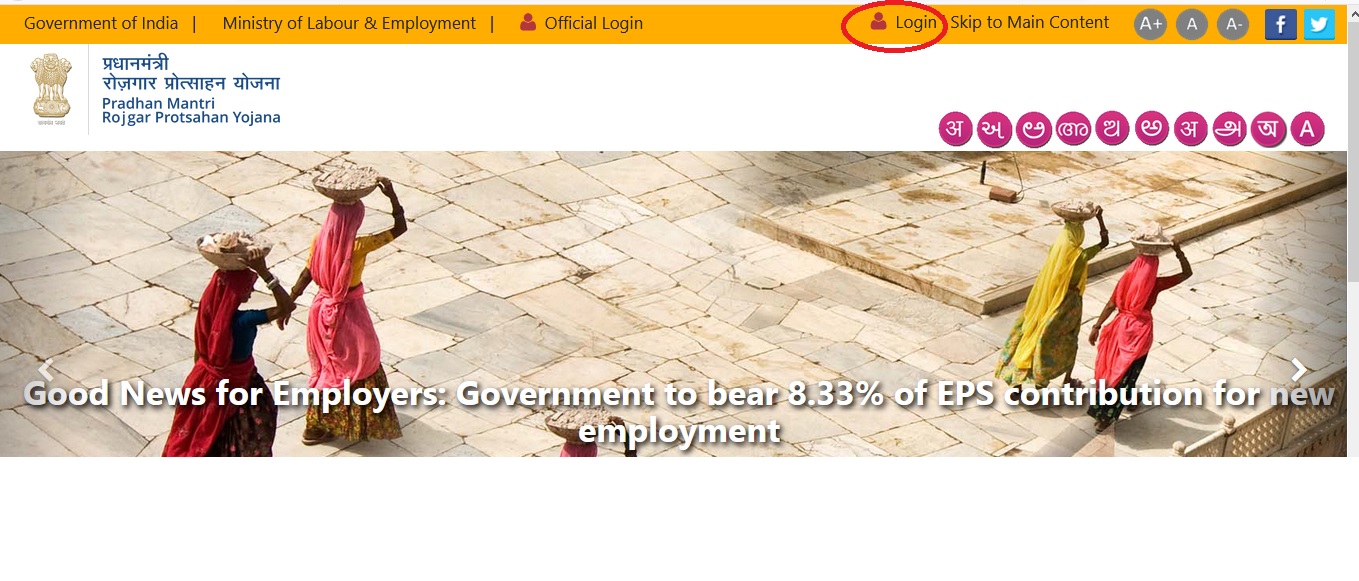

Go to the EPFo official web page epfindia then click Pradhan Mantri Rojgar Protsahan Yojana tab.

The following screen showing the homepage of PMRPY portal would appear, For employer to login into the PMRPY portal, the link “Login” on the right top of the screen at homepage On clicking “Login”, the following screen would appear

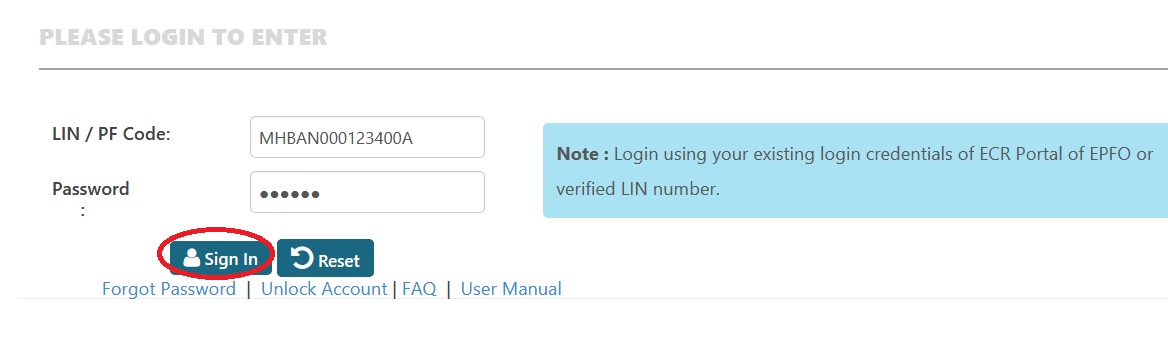

Please Login To Enter :

Step 1 : Enter Your LIN / PF Code [MHBAN000123400A]

Step 2 : Enter Your Password

Step 3 : Click Sign In button.

Note : Login using your existing login credentials of ECR Portal of EPFO or verified LIN number.

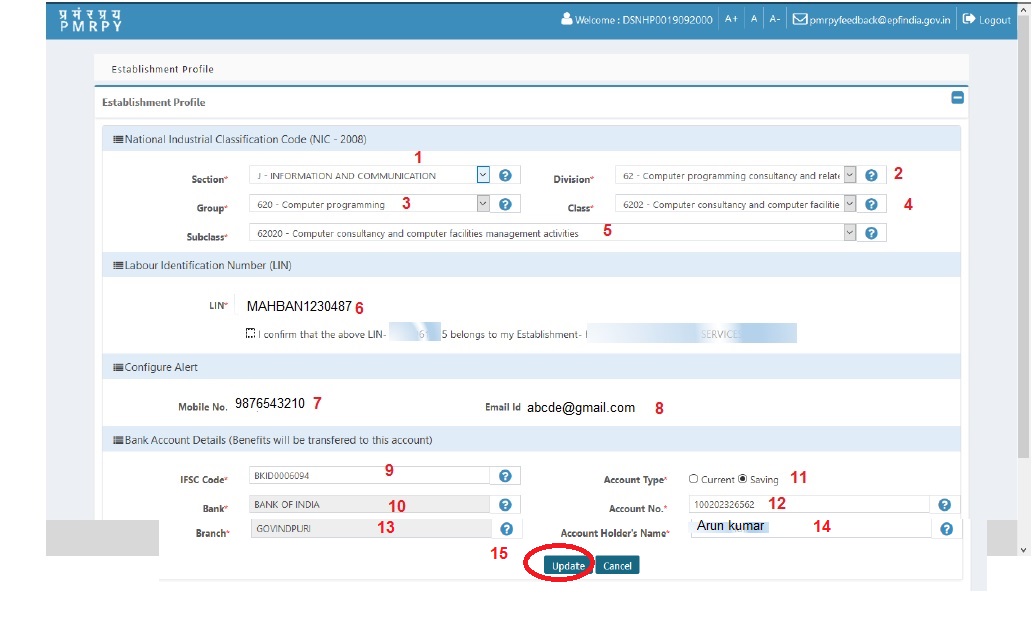

On first time login, the Establishment profile page would appear.

The employer would have to provide the following details :

(a) National Industrial Classification Code (NIC-2008)

(b) Bank Account details

Establishment profile :

Step 1 : Select Your Section

Step 2 : Select Your Group

Step 3 : Select Your Sub Class

Step 4 : Select Your Division

Step 5 : Select Your Class

Step 6 : Enter Your LIN Number

Configure Alert :

Step 7 : Enter Your Mobile Number

Step 8 : Enter Your Email ID

Bank Account Details :

Step 9 : Enter IFSC Code No.

Step 10 : Select Bank Name

Step 11 : Select Bank Account Type [Current/Savings]

Step 12 : Enter Your Account Number.

Step 13 : Select Bank Branch name

Step 14 : Enter Account Holders Name

Step 15 : After furnishing the required details, the employer has to click the “Update” button, the following screen would appear

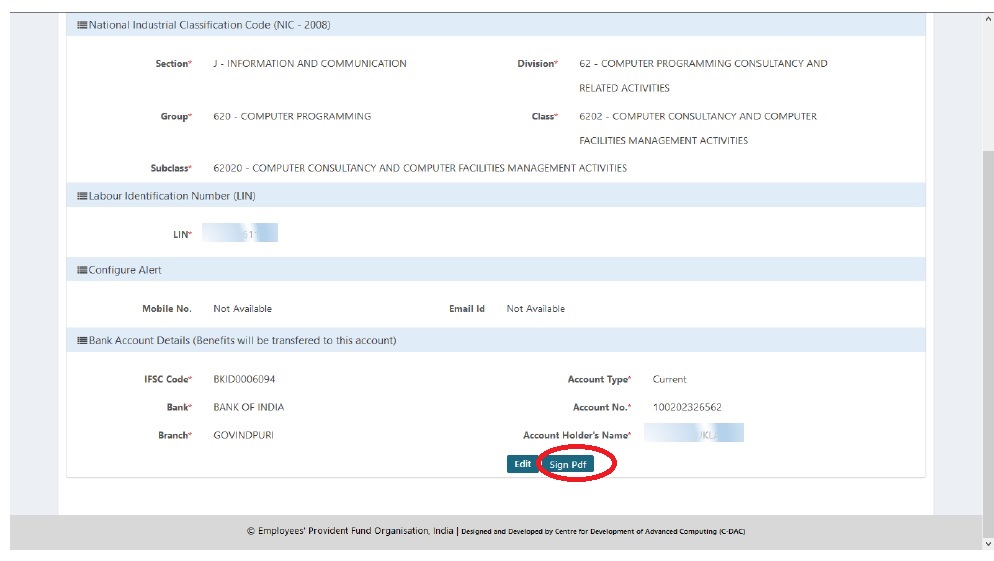

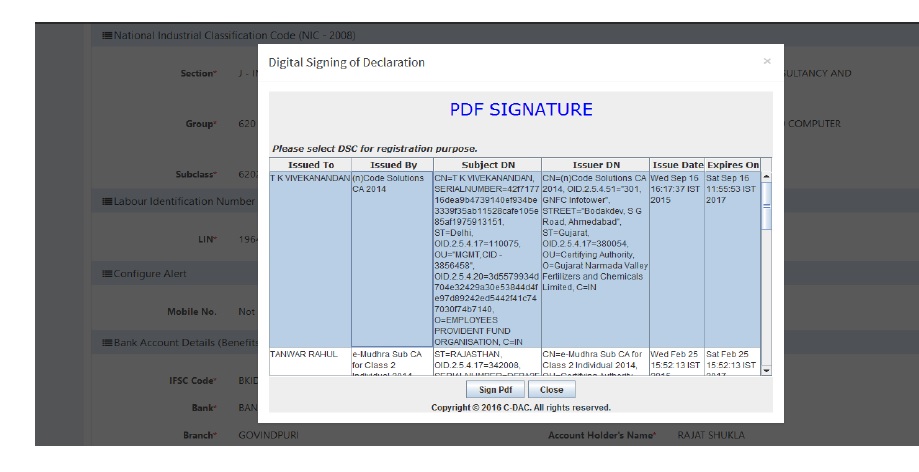

To digitally sign the furnished information and the declaration, the employer should click on “Sign Pdf” button. The following screen would appear to enable the selection of digital signature

After selection of digital signatures, the “Sign Pdf” button is to be selected to initiate the digital signing.

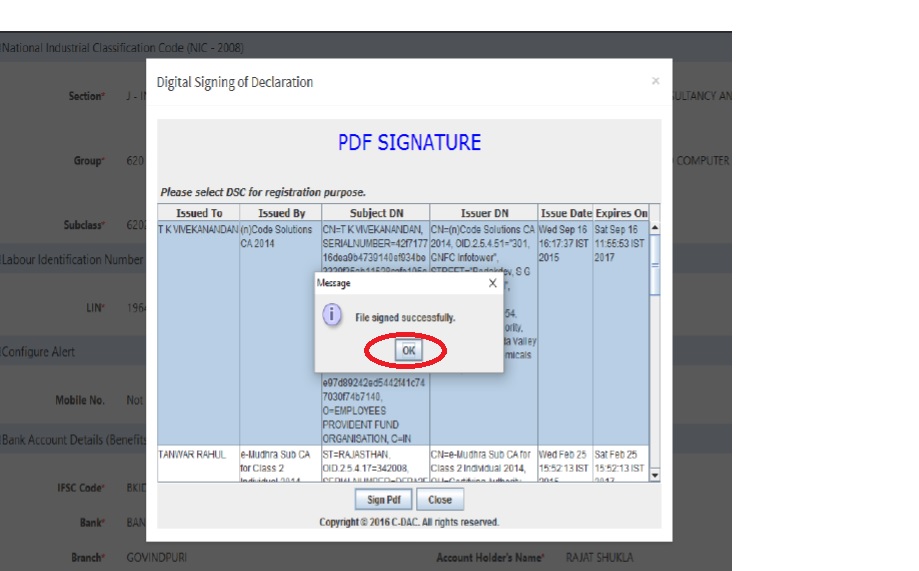

After successful digital signing, the following screen would appear Click OK Button.

The Pdf file, as digitally signed, can be viewed by clicking on the PDF under “View Pdf” column.

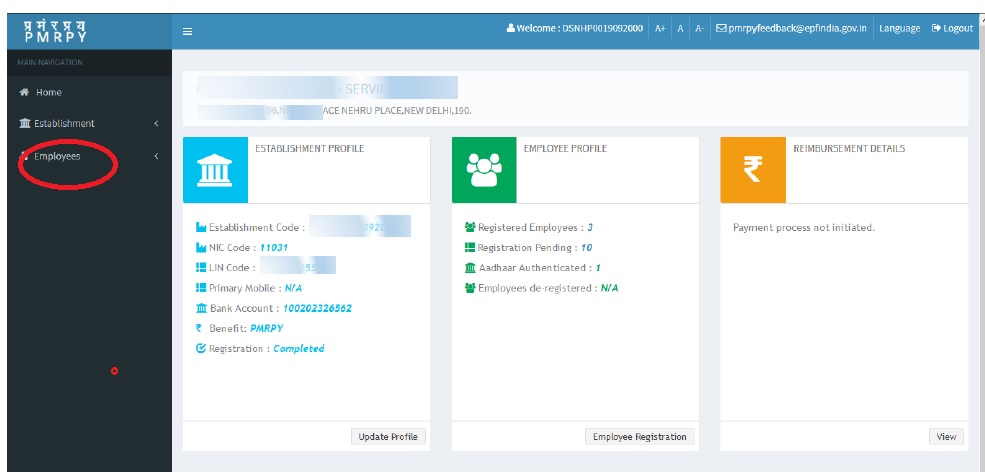

Post login by employer, the homepage of establishment on PMRPY portal would appear as below

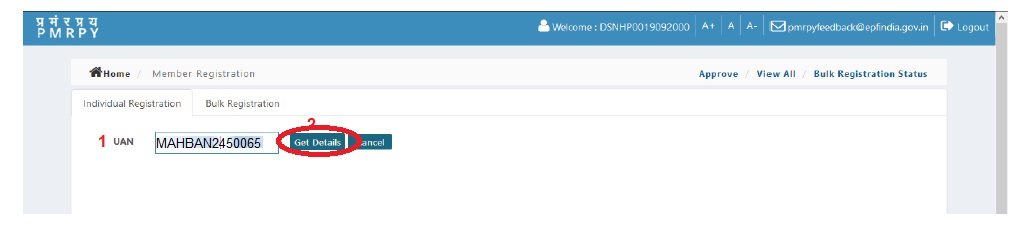

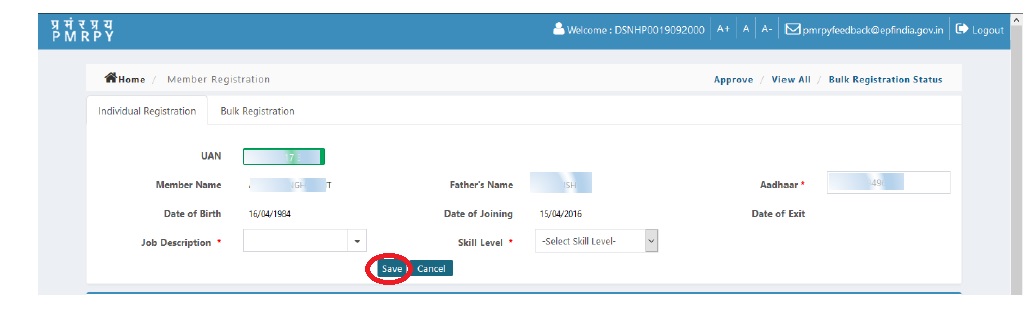

For individual registration, the employer has to enter the individual UAN, which has been seeded with Aadhaar.

Step 1 : Enter UAN Number

Step 2 : Click Get Details button the member details i.e. name of member, father’s name, date of birth, date of joining and Aadhaar of the member are displayed.

Member Details Screen will be displayed After checking the details, the employer has to click “Save” button to save the details of the member.

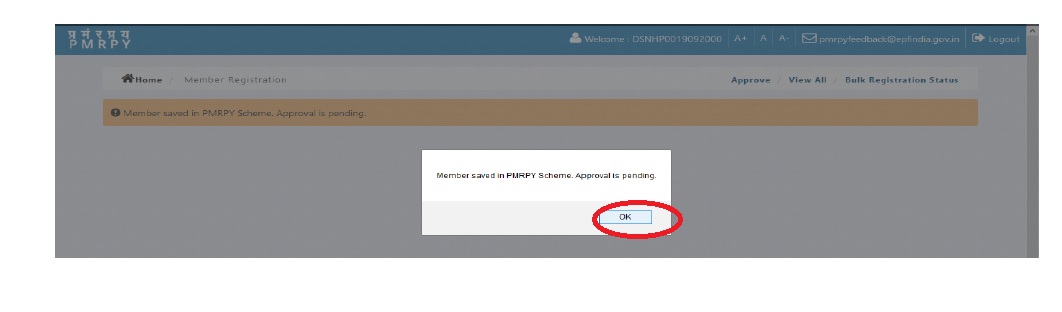

The following screen would appear Click OK button,the details of the members furnished by the employer has to be digitally signed by the employer.

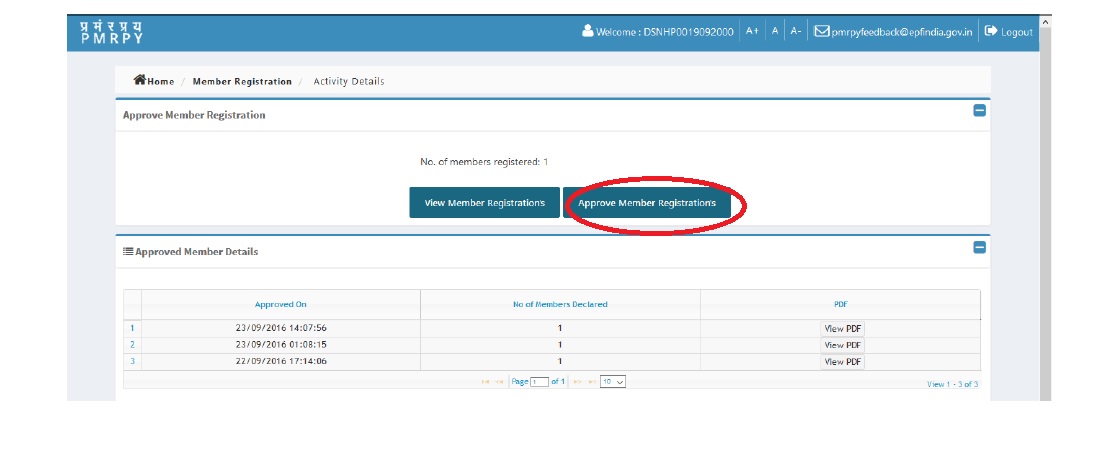

To digitally sign the furnished information, the employer should click on “Approve Member Registrations” button.

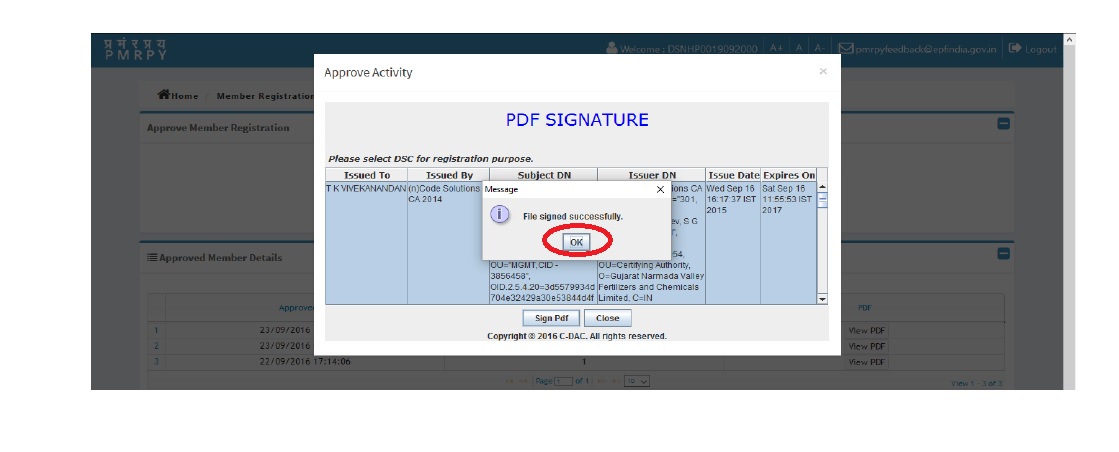

The following screen would appear to enable the selection of digital signature the same procedure to follow the digital signatures

After that employer will file ECR on Unified Portal and employees registered in PMRPY Portal and eligible for PMRPY benefit for that particular month will get upfront benefit in ECR.