ewaybillgst.gov.in GST e-Way Bill System

Organisation : Goods and Services Tax

Facility : e-Way Bill System

Applicable For : All India

Website : https://ewaybillgst.gov.in/

| Want to comment on this post? Go to bottom of this page. |

|---|

Contents

GST e-Way Bill System

The GST system provides a provision of e-Way Bill, a document to be carried by the person in charge of conveyance, generated electronically from the common portal.

Related / Similar Service : services.gst.gov.in Track Provisional ID Status

Objectives

** Single e-Way Bill for movement of the goods throughout the country.

** To prevent the evasion of tax.

** Hassle free movement of goods across India.

** Tracking the movement of goods with e-Way Bill number.

** Easier verification of the e-Way Bill by officers.

e-Way Bill Registration

The registration mechanism for the GST taxpayers for the e-Way Bill system is a simple process. One time GST taxpayer needs to register on this system.

E-Way Bill system provides the users to generate the e-Way Bills from different modes. There are like Web based, SMS based, android app based, API based and Suvidha based.

Step 1 : Go to the official website of Goods and Services Tax e – Way Bill System through the URL provided above.

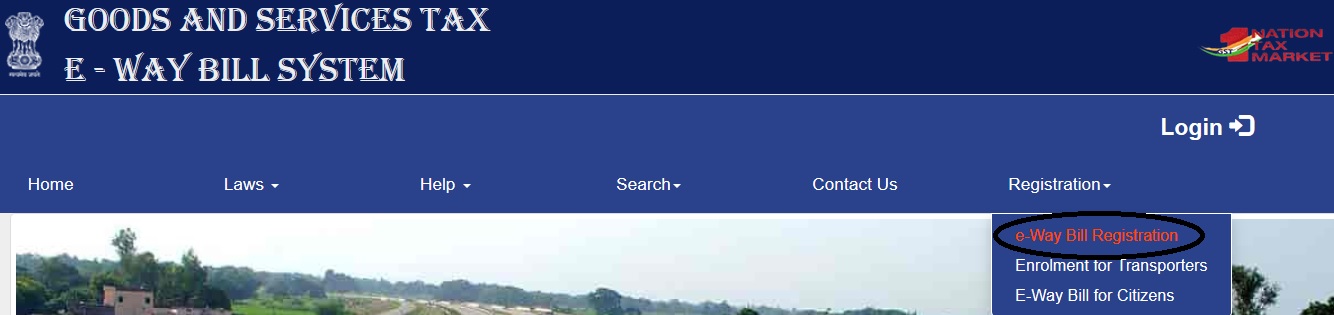

Step 2 : On the e-Way Bill portal, a first time GSTIN can register by clicking on the ‘e-way bill Registration’ link under registration option

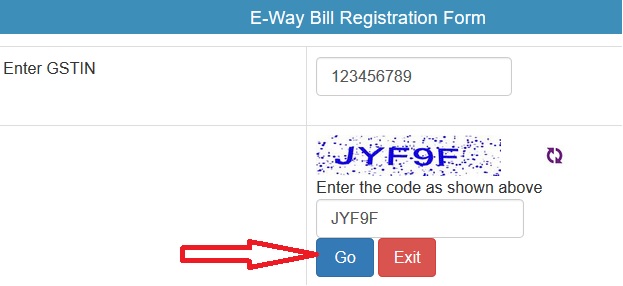

Step 3 : The user needs to enter his/her GSTIN number along with the displayed captcha and shall click ‘Go’ to submit the request.

Step 4 : Once the request is submitted Applicant name, Trade name, Address, Mail ID and Mobile Number are auto populated once the user enters his/her GSTIN number along with displayed captcha.

Note :

If the details have been changed or are incorrect, the user needs to click ‘Update from GST Common Portal’.

Step 5 : User needs to click on ‘Send OTP’ to get the OTP. Once OTP is received on the registered mobile number, user needs to enter the OTP and click on ‘verify OTP’ to verify the same and validate.

Step 6 : Next, the user needs to provide his choice of User ID or username, which he/she plans to use to operate his account on this system. Username should be about 8 to 15 alphanumeric characters and can include special characters.

Step 7 : After authenticating these details, the system generates the 15 characters of Transporter ID and user credentials for him. The enrolment form asks for his PAN details, business type, business place, Aadhaar or mobile authentication.

Step 8 : For enrolling, the un-registered transporter has to open the e-Way Bill portal and select the ‘Enrolment for Transporters’ option.

Step 9 : The user has to select the State and enter his legal name as given in his PAN and PAN number.

Step 10 : The user has to then select the type of enrolment and constitution of business (Partnership, Proprietorship, Public/Private Limited etc.)

Step 11 : After that he will enter his business details and contact details.

Step 12 : The user has to then enter his Aadhaar number related details, if Aadhaar card is available with him and verify them through OTP sent to his registered mobile. If the Aadhaar number is not available, user has to enter the mobile number and mobile is authenticated by sending the OTP to it.

Step 13 : The user can then upload the Address and ID proofs (PoA and PoI) by clicking on respective ‘Upload’ buttons.

Step 14 : Once the user clicks the ‘Save’ button, the system generates the 15 digits TRANS ID. This TRANS ID, he can provide to his clients to enter in the e-way bill so as to enable the transporter to enter the vehicle number for movements of goods.

Forgot Password?

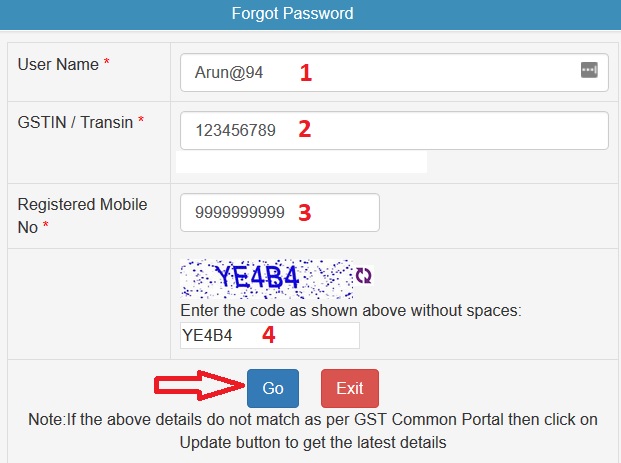

If the e-Way Bill user forgets his password for his username, he needs to enter the following details to reset your password.

Step 1 : Enter the User Name [Arun@94]

Step 2 : Enter the GSTIN / Transin [123456789]

Step 3 : Enter your Registered Mobile No [9999999999]

Step 4 : Enter the code as shown above without spaces

Step 5 : Click Go button

Forgot User Name?

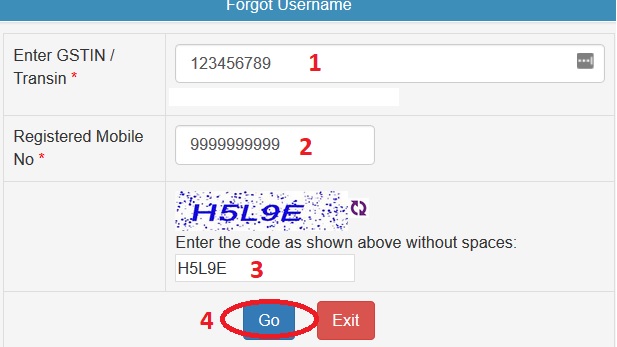

If the user of the e-Way Bill system has forgotten his username, he needs to enter the basic information of GSTIN.

Step 1 : Enter Your GSTIN / Transin [123456789]

Step 2 : Enter YourRegistered Mobile No [9999999999]

Step 3 : Enter the code as shown above without spaces

Step 4 : Click on Go button

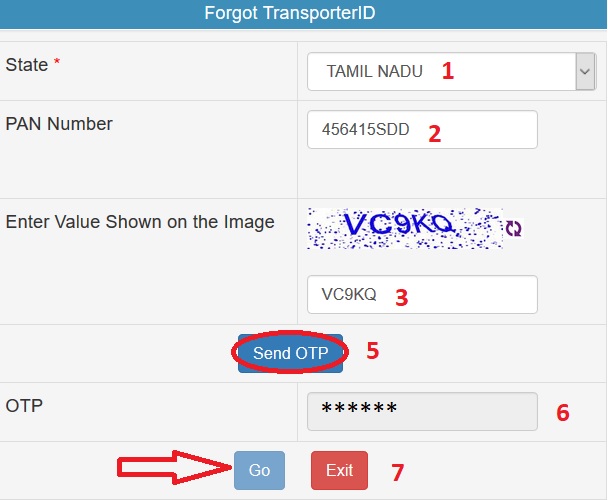

Forgot Transporter ID?

If the user forgot his Transporter ID then enter the following details to recover the Id.

Step 1 : Select the State [Tamil Nadu]

Step 2 : Enter your PAN Number [456415SDD]

Step 3 : Enter Value Shown on the Image

Step 4 : Click on the Send OTP button

Step 5 : Enter the OTP

Step 6 : Click Go button

Taxpayer Search

Enter the following details for Taxpayer Search

Step 1 : Enter Your GSTIN No. [45645451]

Step 2 : Enter Value Shown on the Image

Step 3 : Click on the Go button

Transporters Search

Follow the below steps to Search your Transporter details

Step 1 : Enter GSTIN/Trans ID [123456789]

Step 2 : Enter Captcha

Step 3 : Click Go button

Search Product/Services

To Search your Product details you have to enter the following details,

Step 1 : Enter HSN Code (or) Enter Product Name [Cotton]

Step 2 : Enter Captcha

Step 3 : Click on Go button

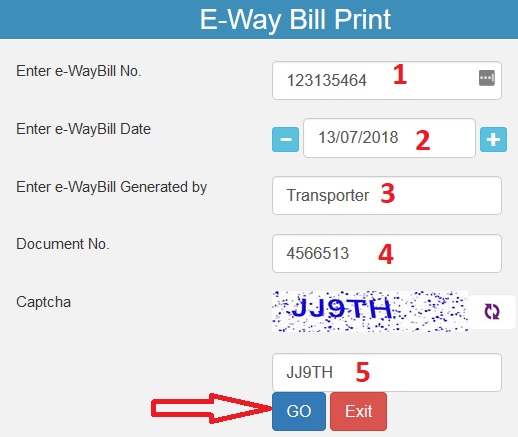

Search e-Way Bill

To search your e-Way bill visit the official website and Select e-Way bill link under Search tab in the Menu bar.

Step 1 : Enter your e-WayBill No. [123135464]

Step 2 : Enter your e-WayBill Date [13/07/2018]

Step 3 : Enter e-WayBill Generated by [Transporter]

Step 4 : Enter your Document No. [4566513]

Step 5 : Enter the Captcha code

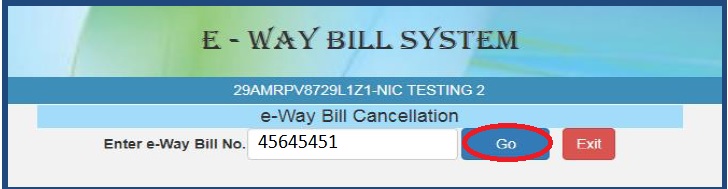

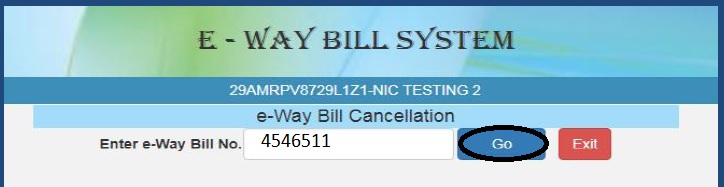

Cancel E-way bill

The provision has been provided to the taxpayer to cancel the E-way bill for various reasons like goods are not being moved, incorrect entry in the E-way bill entered by him etc.

Step 1 : When user selects the ‘Cancel’ sub-option under ‘E-way bill’ option, then the user needs to enter the 12 digit e-Way Bill number and select go.

Step 2 : That particular e-way bill will be displayed, and after giving a suitable reason for the cancellation of e-Way Bill, the user can cancel the e-way bill.

Note :

The e-Way Bill once generated cannot be deleted. However, it can be cancelled by the generator within 24 hours of generation.

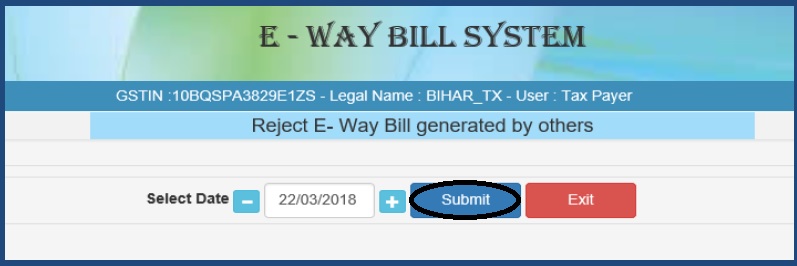

Rejecting e-Way Bill

** If the recipient is not getting the consignment mentioned in the e-Way Bill, he/she can reject them using this option.

** A user needs to the select the e-Way Bill number by selecting the date on which the e-Way Bill was generated and click submit button.

** The system will show all the e-way bills generated on that particular date, select the concern e-Way Bill and shall reject the e-Way Bill by checking the check box on the right side of the e-Way Bill.

Note :

If the acceptance or rejection is not communicated within 72 hours from the time of generation of e-Way Bill

If I have to cancel GST number then what I will do. Please tell me.