GHMC : Check Property Tax Dues Online Hyderabad

Organization : Greater Hyderabad Municipal Corporation

Service Name : Check Property Tax Dues

Applicable State/UT: Telangana

Website : https://onlinepayments.ghmc.gov.in/#

| Want to comment on this post? Go to bottom of this page. |

|---|

Contents

How To Check GHMC Property Tax Dues?

You can follow the below guidelines to check Property Tax Dues.

Related / Similar Service : GHMC Trade License Online Entry

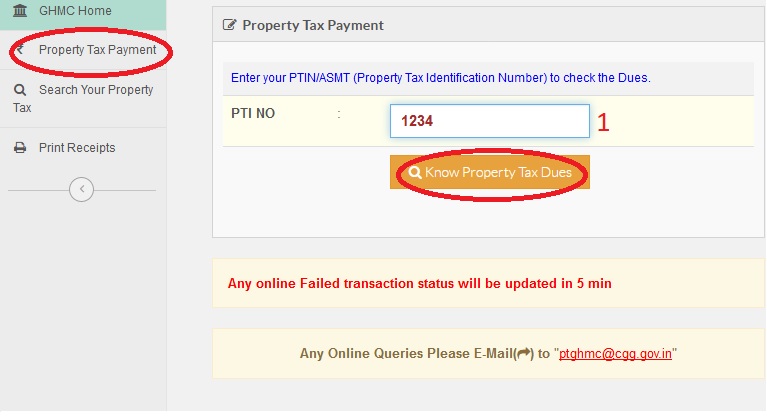

1. Go to Online Payment of Property Tax available in the GHMC home page as shown below

Enter your PTIN/ASMT (Property Tax Identification Number) to check the Dues shown below

Any online Failed transaction status will be updated in 5 min

Any Online Queries Please E-Mail() to “ptghmc [AT] cgg.gov.in”

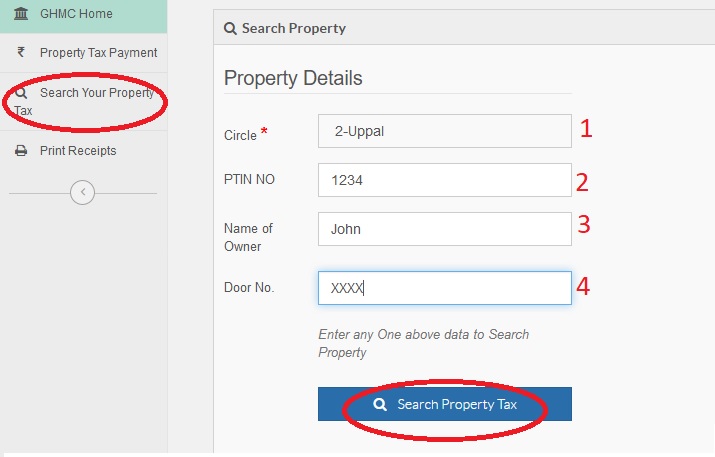

How To Search Your Property Tax?

Enter any One below data to Search Property

1. Select Circle *

2. Enter PTIN NO

3. Enter Name of Owner

4. Enter Door No.

5. Click Search Property Tax Button

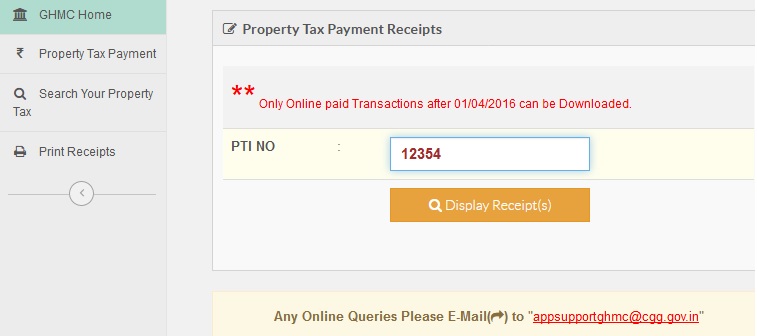

Print Receipts

** Only Online paid Transactions after 01/04/2016 can be Downloaded

1. Enter PTIN Number as shown below

2. Click Display Receipts Button

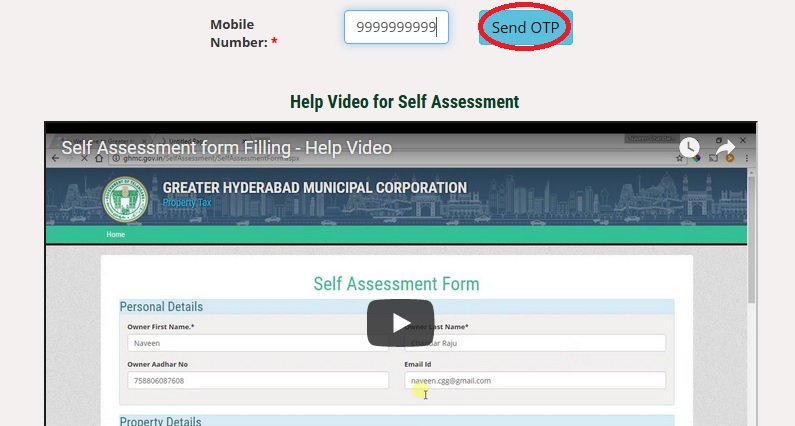

Self Assessment of Property Tax

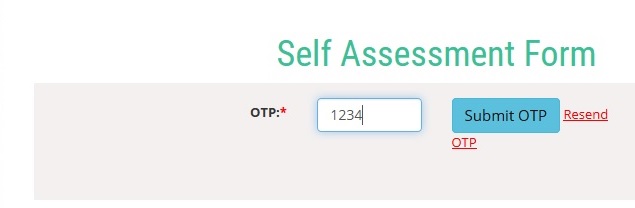

** Enter Mobile Number shown below

** Click Send OTP Button

You will be receiving a valid OTP number to your mobile with time validity.

Enter OTP & click submit OTP button

You will be asked to fill the details to complete self assessment form.

Step 1 : Personal Details

1. Owner First Name

2. Owner Last Name

3. Owner Aadhar Number

4. Email ID

Step 2 : Property Details

1. Circle

2. Locality

3. Pin Code

4. Building Permission Number

5. Door Number

6. Building Type

7. Occupation Certificate Number

Step 3 : Measurement Details

1. Classification of Building

2. Building Nature of Use

3. Occupation Type

4. Floor Number

5. Length

6. Width

7. Area Sq. Ft

Step 4 : Click Save Button

You will get confirmation message as “Your application has been successfully submitted. Please make note of the application number for further reference”.

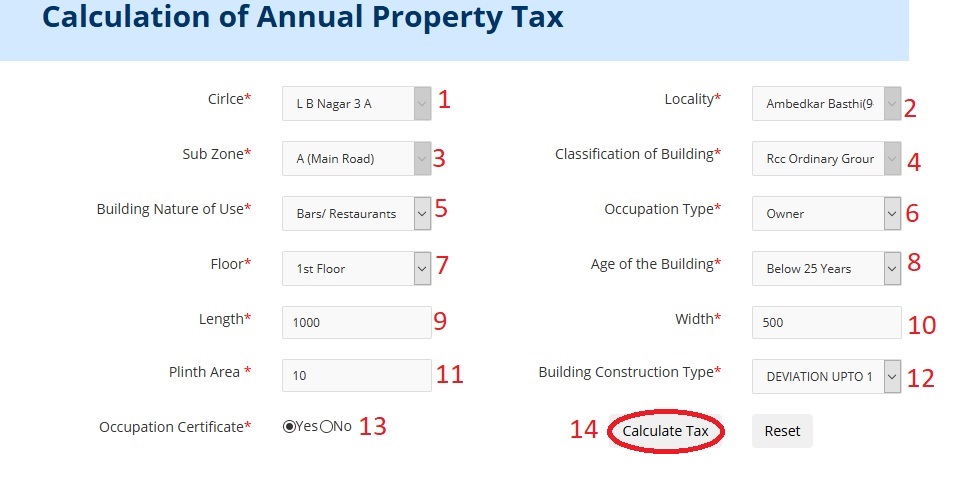

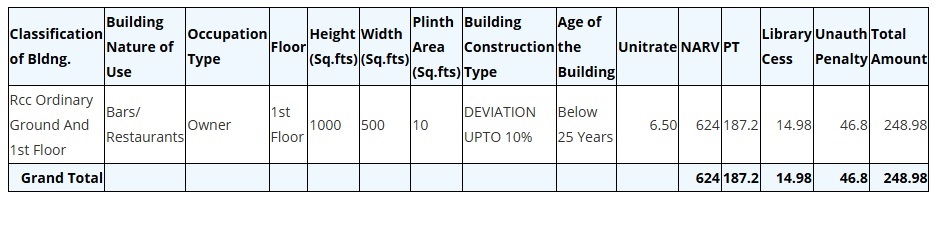

Calculation of Annual Property Tax

Follow the below steps to proceed for annual calculation of property tax.

Step 1 : Select Circle*

Step 2 : Select Locality*

Step 3 : Select Sub Zone*

Step 4 : Select Classification of Building*

Step 5 : Select Building Nature of Use*

Step 6 : Select Occupation Type*

Step 7 : Select Floor*

Step 8 : Select Age of the Building*

Step 9 : Enter Length* (Ft)

Step 10 : Enter Width* (Ft)

Step 11 : Enter Plinth Area * (Sq.fts)

Step 12 : Select Building Construction Type*

Step 13 : Select Occupation Type *

Step 14 : Click Calculate Tax Button

You will get the total amount calculation as below.

Note: The above property tax calculation is an approximate value and it may vary upon exact location of the building and other parameters.

New Assessment Of Property Tax :

1. The applicant should submit the application with relevant documents to the concerned Deputy Commissioners / CSC

2. The concerned tax inspector/ VO/AMC/TI to inspect the building physically and also verify whether it is having clear title or any litigation such as government land, wakf land, ULC land or any court dispute etc.,

3. Then assess the property tax as per prevailing rates of residential and as per Area Based Unit, Rates (ABUR) of non-residential properties, duly conducting Physical inspection.

4. A unique Property Tax Identification number (PTIN) is generated for the new assessment, with a new House Number.

List of Documents Required :

i. Registered Sale Deed / Gift Deed / Partition attested by Gazetted Officer.

ii. Link Documents attested by Gazetted Officer.

iii. Building Sanction Plan (Xerox)

iv. Occupancy Certificate.

Mutation Procedure

** The applicant should submit the relevant documents to the concerned Deputy Commissioner / CSC for Mutation / Transfer of title, which are got registered prior to 01.06.2016.

** The Mutation Fee i.e., 0.1% of Market Value shall be paid through Demand Draft in favour of the Commissioner, GHMC.

** The concerned Tax Inspector should verify the premises before change of name physically

** Then verify whether the existing property Tax of the premises is as per Bench Mark rate or not.

** The Deputy Commissioners, will approve the mutation, subject to payment of all property tax dues.

** Mutation Proceedings shall be served to the applicant.

Documents Required :

i. Notice of transfer under Section 208 of GHMC Act, duly signed by both the Vendor and Vendee.

ii. Attested copies of property documents and link documents.

iii. Latest Encumbrance Certificate.

iv. Non-Judicial Stamp paper for Rs.20/- for each copy of document.

v. Undertaking on Notarized Affidavit cum indemnity bond on Rs.50/- stamp paper.

vi. Up to date Tax Receipt.

vii. Copy of Death Certificate / Succession Certificate / Legal Heir Certificate.

viii. Mutation Fee @ Rs.0.1% of the Market Value.

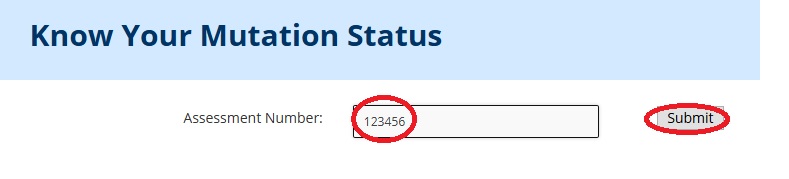

Know Your Mutation Status

Enter Assessment Number as shown below and click Submit Button

Online Mutation Timelines

Department : LET&F

Service : Registration of principal employer’s establishment under provision of The Contracts Labour

Time Limit : 30 Days

Service : License for contractors under provision of The Contracts Labour

Time Limit : 30 Days

Service : Registration under The Building and Other Construction Workers

Time Limit : 15 Days

Service : Registration of Establishment under Inter State Migrants Workmen

Time Limit : 30 Days

Service : License for contractors under provision of The Contracts Labour

Time Limit : 15 Days

Time Limits For Operation :

Department : LET&F

Service : Registration under Shops and Establishments Act

Time Limit : 30 Days

Service : Registration of Establishment under the Inter State Migrants Workmen

Time Limit : 30 Days

Service : Renewal of Registration under Shops and Establishments Act

Time Limit : 30 Days

Service : Renewal of Consent for Operation

Time Limit : Green – 7 days; Orange – 21 days; Red – 30 days

Service : Renewal of factory License

Time Limit : 3 Days

Service : Renewal of Boilers License

Time Limit : 7 Days

Other Services :

Department : LET&F

Service : Approval for boiler manufacturer and renewal

Time Limit : 21 days

Department : LET&F

Service : Approval for boiler erector and renewal

Time Limit : 21 days

Department : EFS&T Department

Service : Tree transit permission

Time Limit : 30 days

Department : TR&B/ PR&RD / MA&UD (ULBs / UDAs) / I&C Forest/Tribal welfare/ Revenue (LA) Depts

Service : Obtaining ‘Right of Way permission for electricity connection

Time Limit : 7 days

Department : Revenue(CT & Excise) Department

Service : Registration for Professional Tax

Time Limit : 1 day

Department : Health & Family Welfare Department

Service : Retail Drug License (Pharmacy) and renewal

Time Limit : 14 days

Department : Health & Family Welfare Department

Service : Wholesale drug license

Time Limit : 14 days

Department : Health & Family Welfare Department

Service : Renewal of Drug Manufacturing License

Time Limit : 14 days

Department : Consumer Affairs, Food & Civil Supplies

Service : Trade License

Time Limit : 15 days

Department : Revenue (R & S)

Service : Document registration

Time Limit : 1 day

Department : Revenue (LA), MA&UD, I&C PR&RD

Service : Mutation of Land or Property

Time Limit : 15 days

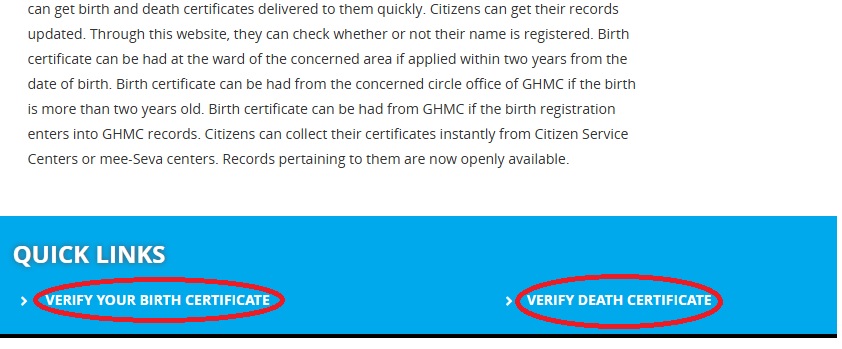

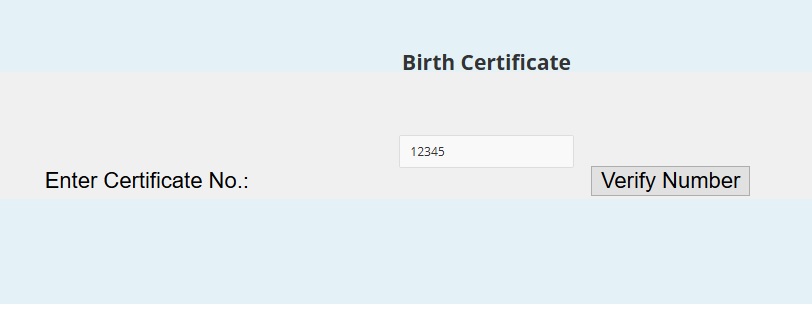

Birth and Death Verification

Go to the link of Birth/ Death certificate available in GHMC home page.

Home Page : https://www.ghmc.gov.in/

Then click Verify Birth/ Death Certificate

** Enter Certificate Number as shown below

** Click Verify Number

1. Citizens can access Birth / Death Certificates based on the request submitted in CSC / MeeSeva centers.

2. The certificates will be issued after verification of the details by the concerned officers from hospitals and ward offices.

3. They verify the records and enter / update with digitally signed birth / death details in a module based on the request submitted by the citizen.

4. Birth certificate can be had at the ward of the concerned area if applied within two years from the date of birth.

5. Birth certificate can be had from the concerned circle office of GHMC if the birth is more than two years old.

6. Citizens can collect their certificates instantly from Citizen Service Centers or mee-Seva centers.

FAQs On GHMC

Frequently Asked Questions (FAQs) On GHMC Greater Hyderabad Municipal Corporation

My house number is 2-2-647/71. Please inform the PTIN number and what is the due amount in the name of owner M.KRISHNA MURTHY?

Property Tax Identification Number :

PTIN is a 10 digit number

** First number is common for all circles

** 2,3 digits circle number

** 4,5 digits Revenue wards

** the last 5 digits is the serial No.

Let me know whether ghmc is accepting offline property tax payments.

You can pay your Property tax in any of the eSeva centers located in Hyderabad and Secunderabad.

You can also pay your Property tax at GHMC Citizen service centres

What is PTIN Number?

A unique PTIN” (Property Tax Identification Number) is alloted for each Tax Assessee.

The PTIN/ASMT is Fourteen digits for old PTINs and Ten digits for new PTINs.

I was born in the year 1953, 16th January, at Hyderabad. Now I need a birth certificate. Can you please help me out as how to obtain in the absence of my parents who have already passed away. Further, my husband is from Bapatla and his date birth is 1st April, 1948. Further his parents too passed away. Therefore, please help us in this issue. Kindly do the needful and oblige.

I)For already registered births/deaths, they can request for birth certificate in any of the mee seva Centers in twinscities or mee sevaonline.com.

II)Walk into any mee seva center and fill in the application form available at mee seva for certificate request. Based on your details mee seva operator will verify the data whether the birth/death is already registered?

III)If registered, pay the required fee amount of Rs.20/ per certificate and mee seva service charges Rs.15/- and required courier charges as per the option below

IV)Applicant can choose the option for delivery of certificate:

1) At mee seva Rs.15/-

2) Within GHMC Limits Rs.25/-

3) With in AP (out side of GHMC) Rs.40/-

4) With in India Rs.60/-

V)If the applicant chooses the option 1, applicant has to come to mee seva for collecting the certificate/s after 3 working days(excluding the date of application).

VI)If option 2 or 3 the certificate/s will be courier to applicant address after receiving the certificate/s from the GHMC Circle offices.

My house number is 12-7-134/RBG/G-1708. We want to know PTIN number and tax amount to pay online. Our gated community is RAINBOW VISTAS CYBERCITY BUILDERS, MOOSAPET, HYDERABAD 500018.