npscra.nsdl.co.in NPS Atal Pension Yojana Scheme : National System Trust

Organisation : National Pension System Trust NSDL e-Gov.

Scheme Name : Atal Pension Yojana

Applicable States/ UTs : All Over India

Website : https://npscra.nsdl.co.in/entities-in-nps.php

| Want to comment on this post? Go to bottom of this page. |

|---|

Contents

NPS Atal Pension Yojana Scheme

** The Government of India is extremely concerned about the old age income security of the working poor and is focused on encouraging and enabling them to join the National Pension System (NPS).

Related / Similar Scheme : Pradhan Mantri Awas Yojana Housing Scheme

** Under the APY, the subscribers would receive the fixed minimum pension of Rs. 1000 per month, Rs. 2000 per month, Rs. 3000 per month, Rs. 4000 per month, Rs. 5000 per month, at the age of 60 years, depending on their contributions, which itself would be based on the age of joining the APY.

** The minimum age of joining APY is 18 years and maximum age is 40 years.

Benefit of APY

** Fixed pension for the subscribers ranging between Rs. 1000 to Rs. 5000, if he joins and contributes between the age of 18 years and 40 years.

** The contribution levels would vary and would be low if subscriber joins early and increase if he joins late.

Eligibility

** Atal Pension Yojana (APY) is open to all bank account holders.

** The Central Government would also co-contribute 50% of the total contribution or Rs. 1000 per annum, whichever is lower, to each eligible subscriber account, for a period of 5 years

** The Government co-contribution is payable to eligible PRANs by PFRDA after receiving the confirmation from Central Record Keeping Agency at such periodicity as may be decided by PFRDA.

Age Limit

Age of joining and contribution period :

** The minimum age of joining APY is 18 years and maximum age is 40 years.

** The age of exit and start of pension would be 60 years.

** Therefore, minimum period of contribution by the subscriber under APY would be 20 years or more.

How To Apply

Online Subscriber Registration

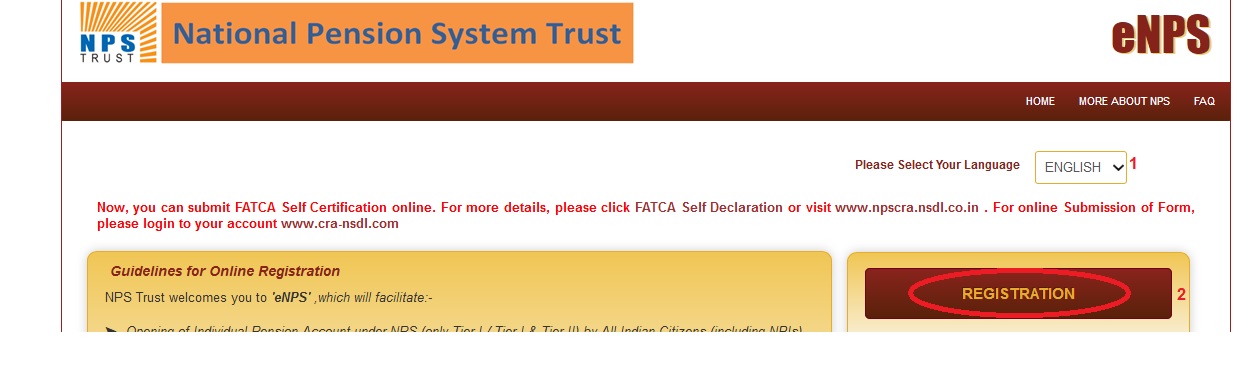

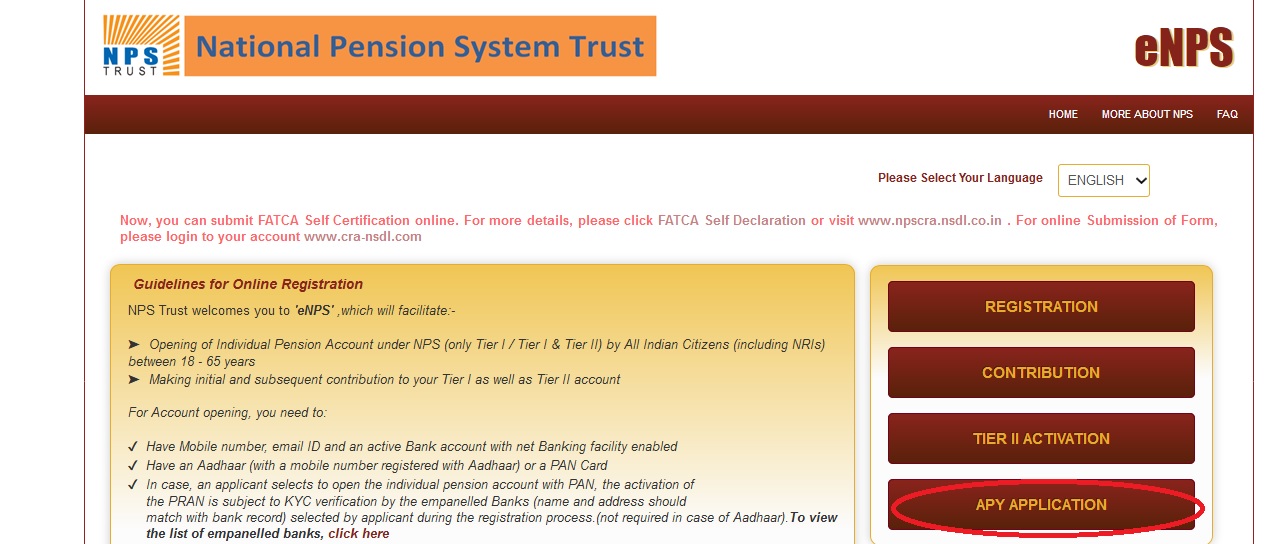

Go to the official website enps.nsdl.com. On the homepage, click “Registration” button or directly click Online Subscriber Registration

Online Subscriber Registration :

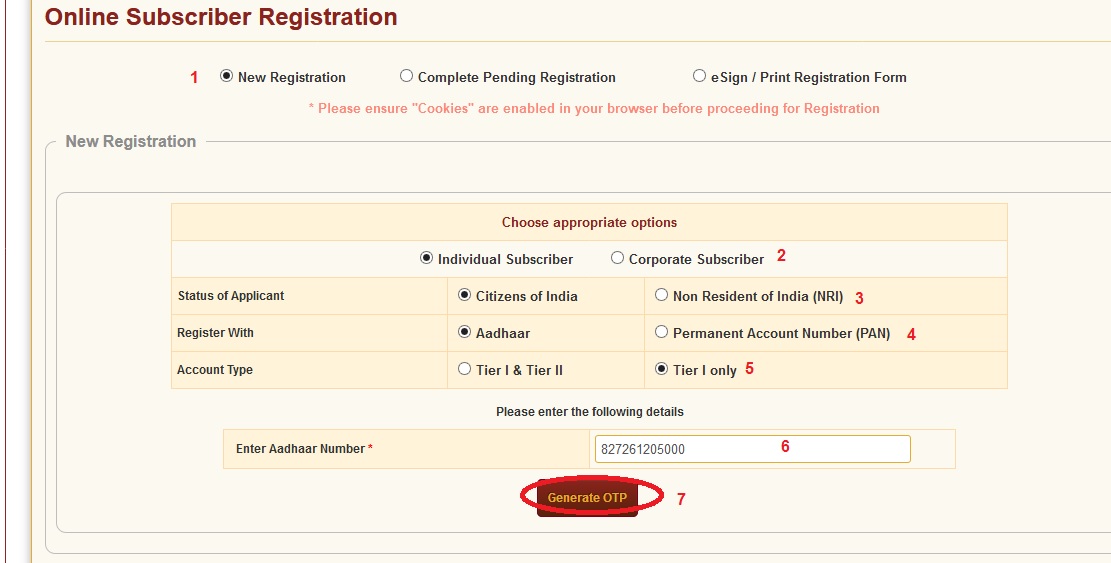

Step 1 : Click New Registration option

Step 2 : Choose appropriate options [Individual Subscriber/ Corporate Subscriber]

Step 3 : Select Status of Applicant [Citizens of India/Non Resident of India (NRI)

Step 4 : Select Register With [Aadhaar /Permanent Account Number (PAN)]

Step 5 : Select Account Type [Tier I & Tier II/ Tier I only]

Step 6 : Enter Aadhaar Number [258925635874]

Step 7 : Click Generate OTP Button

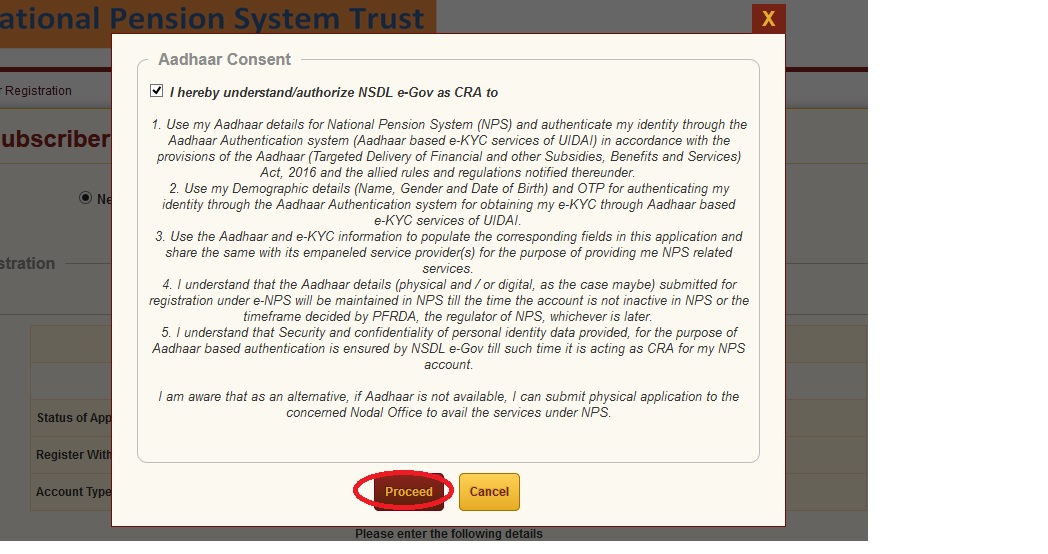

Step 8 : Click the Check Box Option [I hereby understand/authorize NSDL e-Gov as CRA to]

Step 9 : Click Proceed button and then generate OTP on your registered mobile number. After entering OTP, click “Continue” button.

eSign / Print Registration Form

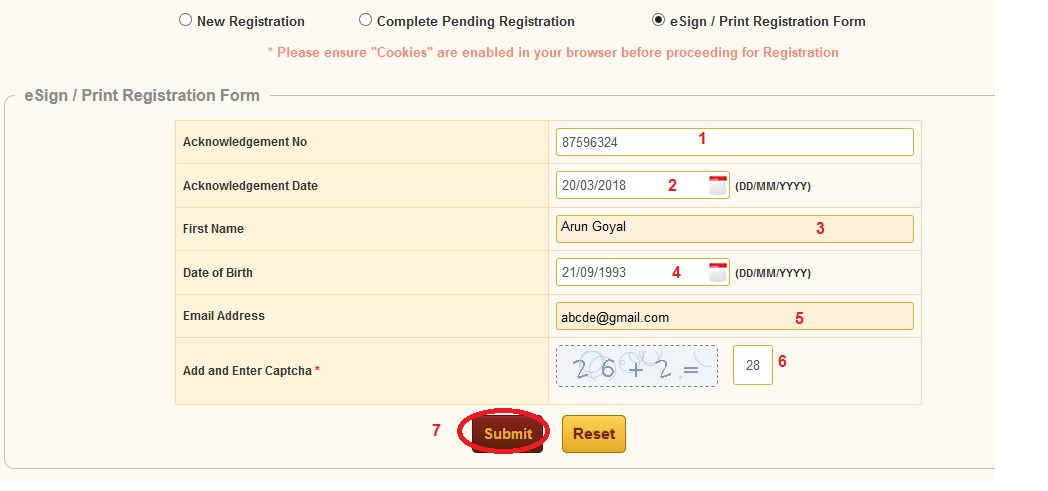

Click the eSign / Print Registration Form option then follow the below steps.

Step 1 : Enter Your Acknowledgement No

Step 2 : Enter Your Acknowledgement Date (DD/MM/YYYY)

Step 3 : Enter Your First Name [ Palivela Sriman]

Step 4 : Enter Your Date of Birth (DD/MM/YYYY)

Step 5 : Enter Your Email Address

Step 6 : Enter Add & Enter Captcha Code

Step 7 : Click Submit button to get your print out form.

Online APY Application Form

Go to the official website enps.nsdl.com

Click on the “APY Application” Tab in home page.APY Subscriber form will be opened.

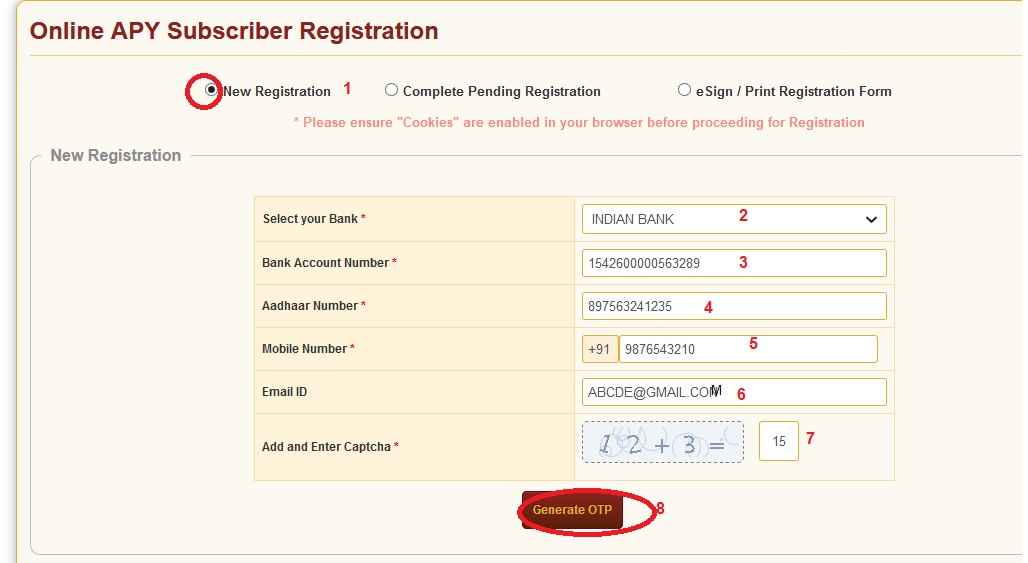

Online APY Subscriber Registration :

New Registration :

Step 1 : Select your Bank *[IOB/BOI/SBI]

Step 2 : Enter Your Bank Account Number *[15203600009836521]

Step 3 : Enter Your Aadhaar Number *[879523657841]

Step 4 : Enter Your Mobile Number * [9876543210]

Step 5 : Enter Your Email ID [abcde@gmail.com]

Step 6 : Add and Enter Captcha Code [26+2=28]

Step 7 : Click generate OTP Button. Atal Pension Yojana Online Application Form will be displayed.

** The Fill personal details, family details and generate acknowledgement number. After acknowledgement Id is generated, enter bank / branch details & account number for bank verification.

** Next fill the pension amount, contribution frequency, nominee and upload the supporting documents and make payment to complete the atal pension yojana online registration process.

** If the registration process is successful, then bank will debit your account for 1st subscription and will generate Permanent Retirement Account Number (PRAN).

** Finally candidates can e-sign the Atal Pension Yojana Online form for verification.

Enrolment & Subscriber Payment

** All bank account holders under the eligible category may join APY with autodebit facility to accounts, leading to reduction in contribution collection charges.

** The subscribers should keep the required balance in their savings bank accounts on the stipulated due dates to avoid any late payment penalty.

** The subscribers are required to opt for a monthly pension from Rs. 1000 – Rs. 5000 and ensure payment of stipulated monthly contribution regularly.

** Each subscriber will be provided with an acknowledgement slip after joining APY which would invariably record the guaranteed pension amount, due date of contribution payment, PRAN etc.

Funding of APY

Government would provide

(i) fixed pension guarantee for the subscribers;

(ii) would co-contribute 50% of the total contribution or Rs. 1000 per annum, whichever is lower, to eligible subscribers;

(iii) would also reimburse the promotional and development activities including incentive to the contribution collection agencies to encourage people to join the APY.

Penalty For Default

Banks are required to collect additional amount for delayed payments, such amount will vary from minimum Rs. 1 per month to Rs 10/- per month as shown below :

** Rs. 1 per month for contribution upto Rs. 100 per month.

** Rs. 2 per month for contribution upto Rs. 101 to 500/- per month.

** Rs. 5 per month for contribution between Rs 501/- to 1000/- per month.

** Rs. 10 per month for contribution beyond Rs 1001/- per month.

Discontinuation of payments of contribution amount shall lead to following :

** After 6 months account will be frozen.

** After 12 months account will be deactivated.

** After 24 months account will be closed.

Exit & Pension Payment

** Upon completion of 60 years, the subscribers will submit the request to the associated bank for drawing the guaranteed monthly pension.

** Exit before 60 years of age is not permitted, however, it is permitted only in exceptional circumstances, i.e., in the event of the death of beneficiary or terminal disease.

Table of contribution levels, fixed monthly pension of Rs. 1,000 per month to subscribers and his spouse and return of corpus to nominees of subscribers and the contribution period under Atal Pension Yojana

| Age of

Joining |

Years of

Contribution |

Indicative

Monthly Contribution (in Rs.) |

Monthly Pension

to the subscribers and his spouse (in Rs.) |

Indicative Return of

Corpus to the nominee of the subscribers (in Rs.) |

| 18 | 42 | 42 | 1,000 | 1.7 Lakh |

| 20 | 40 | 50 | 1,000 | 1.7 Lakh |

| 25 | 35 | 76 | 1,000 | 1.7 Lakh |

| 30 | 30 | 116 | 1,000 | 1.7 Lakh |

| 35 | 25 | 181 | 1,000 | 1.7 Lakh |

| 40 | 20 | 291 | 1,000 | 1.7 Lakh |

Table of contribution levels, fixed monthly pension of Rs. 2,000 per month to subscribers and his spouse and return of corpus to nominees of subscribers and the contribution period under Atal Pension Yojana

| Age of

Joining |

Years of

Contribution |

Indicative

Monthly Contribution (in Rs.) |

Monthly Pension

to the subscribers and his spouse (in Rs.) |

Indicative Return of

Corpus to the nominee of the subscribers (in Rs.) |

| 18 | 42 | 84 | 2,000 | 3.4 lakh |

| 20 | 40 | 100 | 2,000 | 3.4 lakh |

| 25 | 35 | 151 | 2,000 | 3.4 lakh |

| 30 | 30 | 231 | 2,000 | 3.4 lakh |

| 35 | 25 | 362 | 2,000 | 3.4 lakh |

| 40 | 20 | 582 | 2,000 | 3.4 lakh |

Table of contribution levels, fixed monthly pension of Rs. 3,000 per month to subscribers and his spouse and return of corpus to nominees of subscribers and the contribution period under Atal Pension Yojana

| Age of

Joining |

Years of

Contribution |

Indicative

Monthly Contribution (in Rs.) |

Monthly Pension

to the subscribers and his spouse (in Rs.) |

Indicative Return of

Corpus to the nominee of the subscribers (in Rs.) |

| 18 | 42 | 126 | 3,000 | 5.1 Lakh |

| 20 | 40 | 150 | 3,000 | 5.1 Lakh |

| 25 | 35 | 226 | 3,000 | 5.1 Lakh |

| 30 | 30 | 347 | 3,000 | 5.1 Lakh |

| 35 | 25 | 543 | 3,000 | 5.1 Lakh |

| 40 | 20 | 873 | 3,000 | 5.1 Lakh |