propertytax.thanecity.gov.in Pay Property Tax Online : Thane Municipal Corporation

Organisation : Thane Municipal Corporation

Facility: Pay Property Tax Online

State : Maharashtra

Website : https://propertytax.thanecity.gov.in/

| Want to comment on this post? Go to bottom of this page. |

|---|

Contents

How To Pay Thane Municipal Property Tax?

Citizen portal provides an easy to use interface to the citizens to pay their property tax online as per their convenience. Citizens can Search Property Details, View, and Pay property tax.

Related / Similar Service : RSBY Apply For Smart Card & Check Status

Go to the link of Property Tax payment of Thane Municipal Corporation.

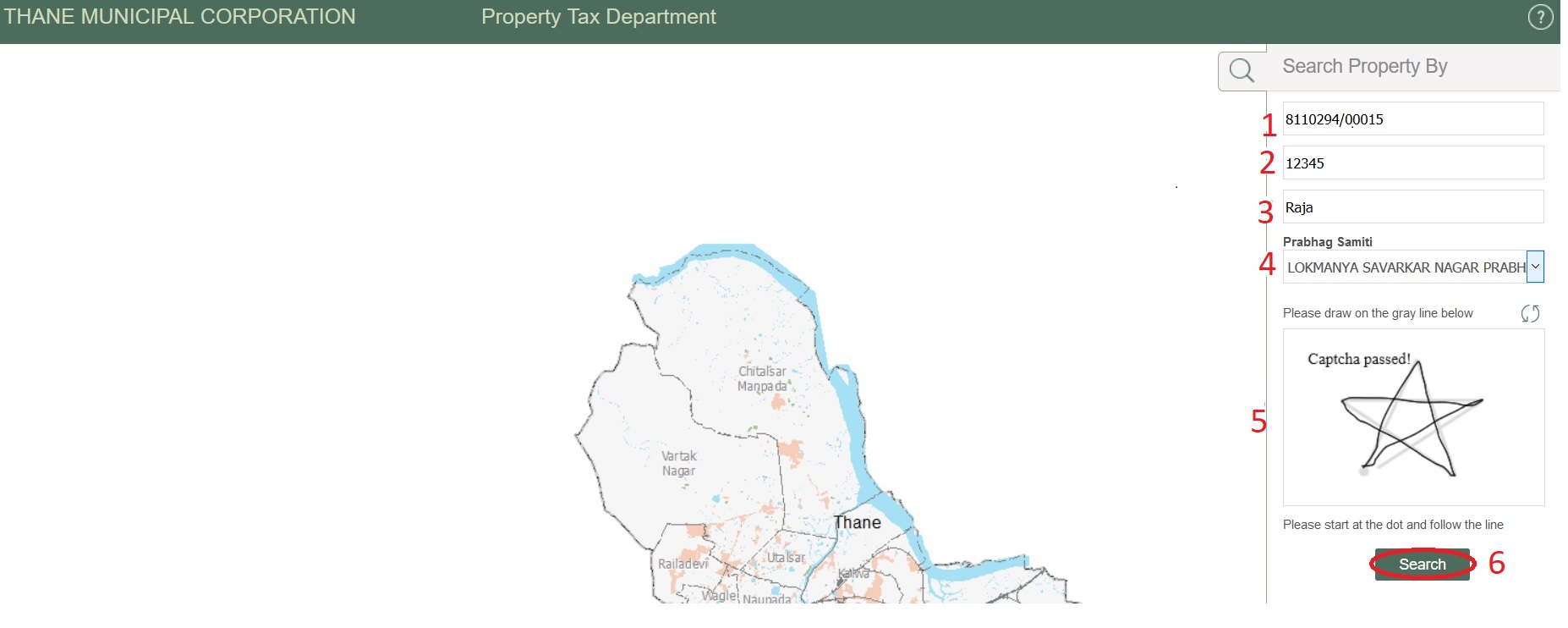

Step 1 : Enter PTIN

Step 2 : Enter Sub Code

Step 3 : Enter Owner name

Step 4 : Select Prabhag Samiti

Step 5 : Please draw on the gray line (Please start at the dot and follow the line)

Step 6 : Click Search Button

List of matching result will appear from which she/he will select one to view details. The property will be located on the map and the details of the property will be displayed.

Property Information window providing the following details of the property with common PTN will appear:

** PTN – Enter the Property Tax Number

** Prabhag Samiti

** Block

** Building Name

** Owner Name

** Address

Click “Photo” icon to view photo of the building.

Additional details like Total Bill Amount, Penalty and Payable Amount will also be displayed.

Click “View Bill” to view the property tax bill.

Click “Pay Bill” to pay the property tax online.

How To Do Deemed Registration For VAT Holders?

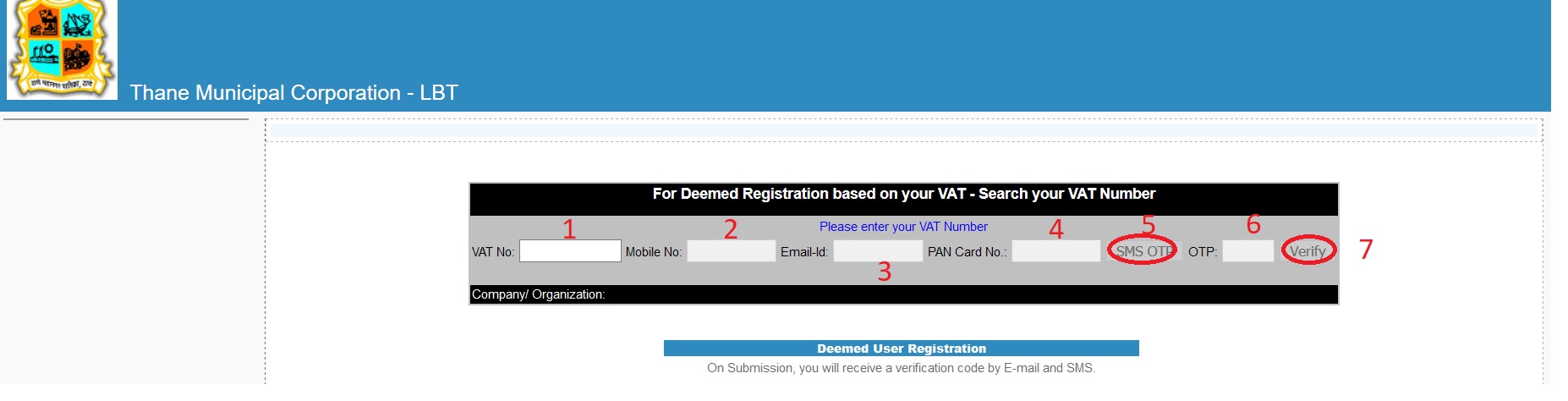

In the Deemed Registration window, you can search your VAT Number.

Website : http://203.129.224.87:8080/TMCLBT/App/

Click VAT Holders Registration

Step 1 : Enter your VAT No

Step 2 : Enter your Mobile No

Please note that system will send you OTP (One Time Password) on this Mobile Number.

Step 3 : Enter your Email-Id

Step 4 : Enter your PAN Card No

Step 5 : Click SMS OTP Button

System will send you your One Time Password through SMS on the mobile Number.

Step 6 : Enter OTP Received

Step 7 : Click Verify Button

On Submission, you will receive a verification code by E-mail and SMS.

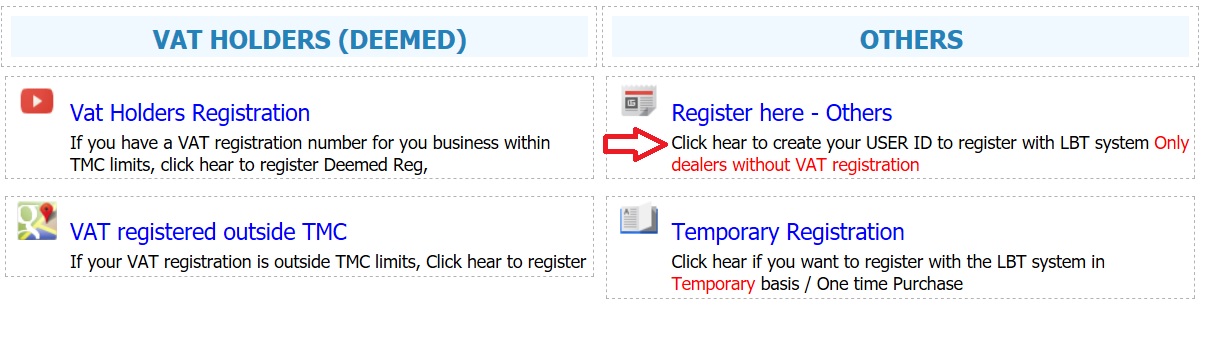

Registration For Others

(Dealers without Registration)

Click on Dealers without registration link available in the VAT home page.

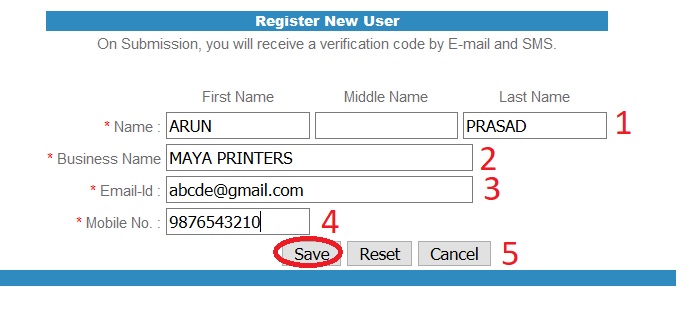

Click the Create New User link to view the Register New User form. On the form fill up the following details

** Your First, Middle and Last Name

** Your Business Name

** Your primary Email Address on which all electronic communication from the website will be sent

** Your Mobile Number on which all SMS communication from the website will be sent

Step 1 : Enter your Name

Step 2 : Enter your Business Name

Step 3 : Enter your Email-Id

Step 4 : Enter your Mobile No

Step 5 : Click Save Button

Upon Clicking “Save” an Email containing the User Name and Password is sent to the entered Email Address.

You will receive confirmation message as “Thank You for registering on LBT System. Consider your E-Mail as your UserName & password is provided on your email id”.

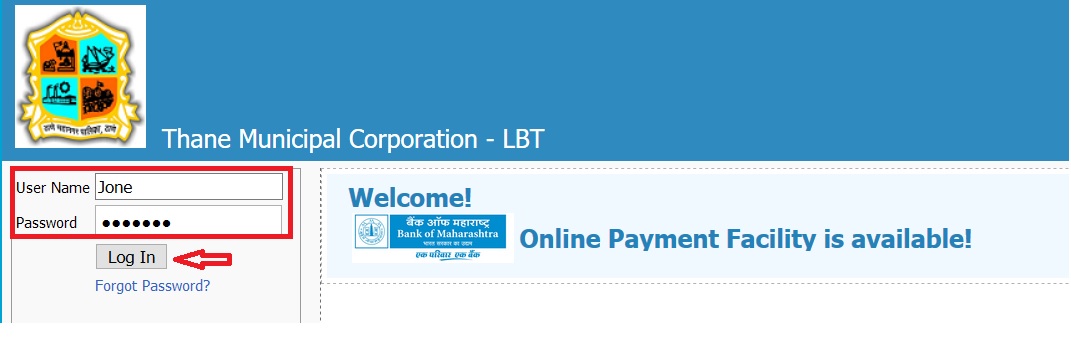

Enter your User Name and Password in the Login Box and click the “Log In” Button

** Your User Name is the Email Address that you entered in the Create User Form

** The Password is mailed to you to the Email Address that you entered in the Create User Form

User First Time Login & Change Password :

As soon as you Login for the first time, you are asked to change your Old Password. When you save your new password, you will be logged out of the System and asked to Login once again using your New Password. This is done for Security Reasons.

Dealer Registration – Form A :

After the first successful login, the Dealer Registration Form is displayed. This form captures additional

details of the business. Fields marked with * are compulsory, they include

** Date of Commencement

** Status of Applicant

** Business Nature

** Constitution of Business

Select the appropriate options from the drop down list and scroll down

After completing company details, click on Select Commodity

A screen will appear, type the nature of the commodity your business deals in and a list of available items will appear. Select the appropriate items and click Add Commodity Details

The next step is to add Addresses from where the Business operates. Remember to include Head Office, Warehouse, Showroom, etc. For the nature of the address, select appropriate option from the drop down list. This field is compulsory.

Scroll down after entering all the addresses and enter the Income Tax PAN No. (This is compulsory). You may also enter the VAT Reg No., Shop Act Reg No. and CST Reg No. if applicable.

Enter the Bank Account Details of the Business’s principal bank account. This is also compulsory

Enter the Bank Account Details of the Business’s principal bank account. This is also compulsory.

After entering the Bank Details, you may enter the addresses and designations of all key people in your business, e.g. Directors, Partners, etc. you may also fill up the declaration indicating the share of ownership of each partner in a partnership firm.

These details are not compulsory. Click Save to proceed further.

The next screen will capture details of the year since when your business crossed the thresholds to become eligible for paying Local Body Tax.

Fill-in the date and amount details by selecting the relevant options. Also indicate change of ownership or partnership details with dates on this page.

Attach any supporting documents required by using the button at the bottom of the screen. Click Submit to proceed.

Your registration is now complete. The same will be sent to relevant authorities in the LBT office for approval. You will be able to start paying your taxes after the approval. You will be notified of the approval via email.

You will receive a registration receipt similar to the one shown below. You may print this for your records. A registration fee of INR 100 has to be payed at this stage. You may pay the same online or print the challan attached to this receipt and visit the indicated bank branch for payment.

To make the payment online, click the Make Payment button at the bottom of the page. You will be taken to the common payment gateway from where you can select the appropriate payment option and proceed with the payment.

Once the payment is successful, you will be bought back to the LBT site and the receipt issued.

(Online payments can be made through Credit Card, Debit Card or Netbanking)

Dealer Menu :

Once your registration is approved, you will see the following screen. The menu options on the left allow you to manage your account, make payments, review notices, etc.

Change Password :

Follow these instructions to change your password.

** Click “Change Password” from the menu on the left.

** The options will be displayed on the right

** Enter your existing password in the “Old Password” field

** Enter the new passowrd in the “New Password” field

** Re-enter the new password in the “Confirm New Password” field for confirmation.

** Click Save. Your new password will be saved. Use this new password for login next time onwards.

Appeal :

Incase you wish to Appeal against a demand notice issued to you, you may do so form the Menu Option “Appeal.”

** Click on “Appeal”

** Enter complete and accurate details in the “Form S” displayed on the right.

** Click “Save Appeal”

The saved appeal will be sent to the relevant officer for review and you will receive the response from the department.

How To Create E-Challan?

To create an e-challan follow these instructions:

** Do a self-assessment of the amount of tax to be paid

** Click on “e-Challan” from the menu options

** Select the correct date range

** Enter the correct amounts

** Click “Save”

After clicking save, the e-Challan will be displayed on your screen. You can either take a print of this challan and visit one of the Bank Branches listed for payment, or make the payment online by clicking the “Make Payment” button at the bottom.

Online Payment :

If you choose to make the payment online and click the “Make Payment” button, you will be taken to a payment gateway.

Enter your account and password details and confirm the payment. Upon successful payment your will receive a confirmation mail and receipt for the same.

If your have user name & password you can login using the same.

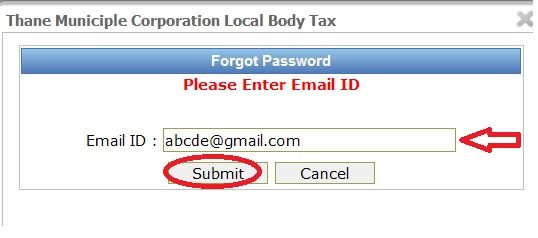

Forgot password :

Enter Email ID to retrieve your forgotten password.

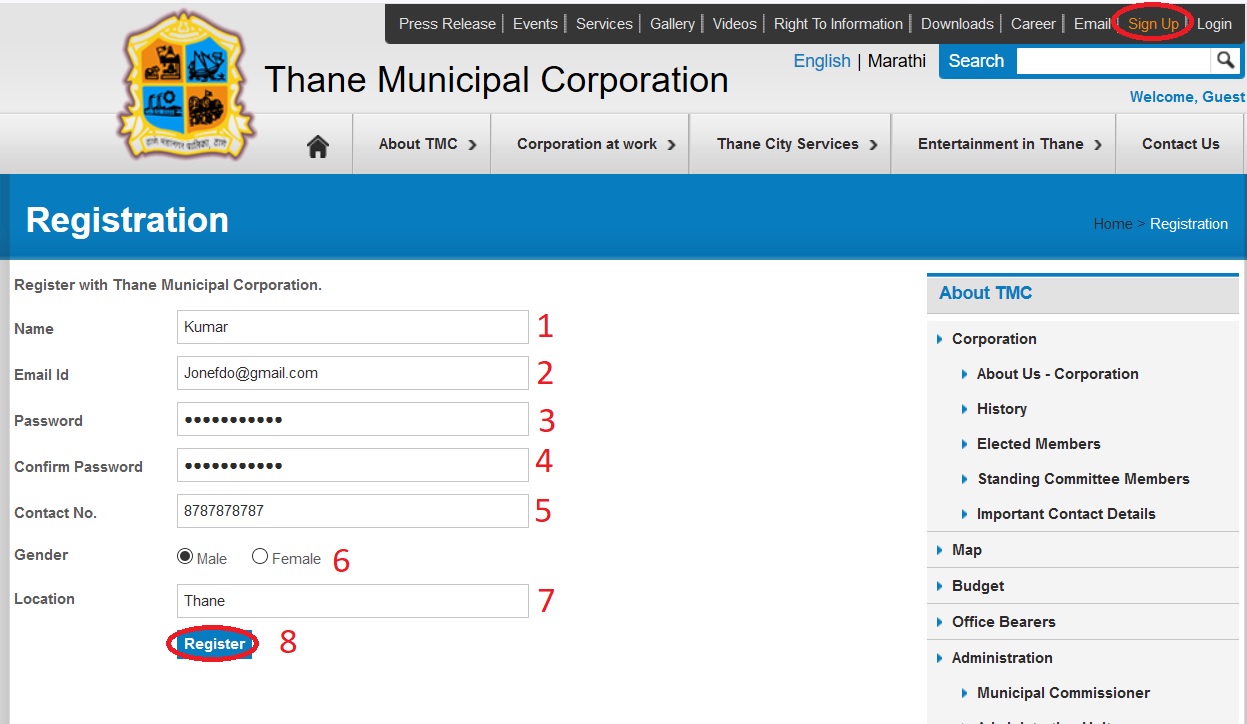

New Registration

You can sign up for new registration in Thane Municipal Corporation

Click sign up link available in the right top corner of home page.

Step 1 : Enter your Name

Step 2 : Enter your Email Id

Step 3 : Enter Password

Step 4 : Confirm Password

Step 5 : Enter your Contact No.

Step 6 : Select Gender

Step 7 : Enter your Location

Step 8 : Click Register Button

SHOW MY E-PAYMENT OPTION TO PAY PROPERTY TAX.

i want to make payment on line but the same is not happening . please suggest

how do I get my receipt for property tax paid