RBL Bank Online Credit Card Application Status Track : rblbank.com

Organization : RBL Bank

Service Name : Online Credit Card Application Status Track

Applicable For: India

Website : https://www.rblbank.com/static-pages/track-your-credit-card-application

| Want to comment on this post? Go to bottom of this page. |

|---|

Contents

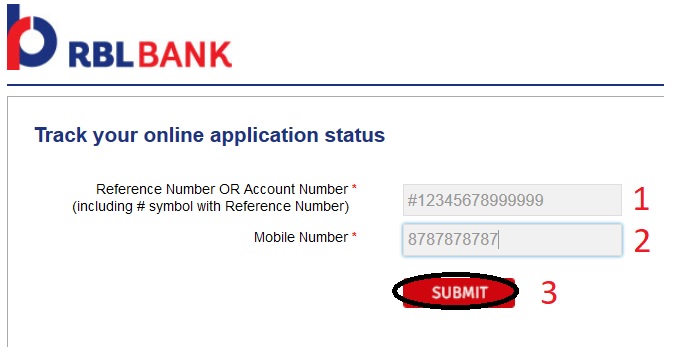

How To Track RBL Credit Card Application Status?

To Track RBL Credit Card Application Status, follow the below steps

Step 1 : Enter Reference Number OR Account Number (including # symbol with Reference Number)

Related / Similar Service : Axis Bank Credit Card Application Status

Step 2 : Enter Mobile Number

Step 3 : Click Submit Button

How To Apply For Credit Card?

These are the list of credit cards you can apply for

1. ShopRite Credit Card

2. Titanium Delight Credit Card

3. Platinum Maxima Card

4. Platinum Delight Card

5. Movies & More Delight Card

6. BlockBuster Credit Card

7. Icon Credit Card

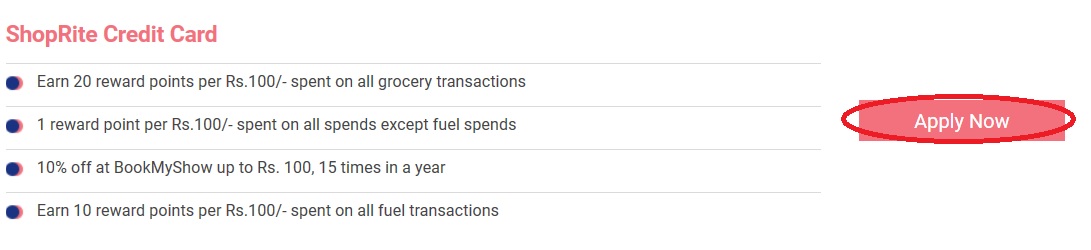

ShopRite Credit Card :

Click on apply now button for which you want to apply for credit card.

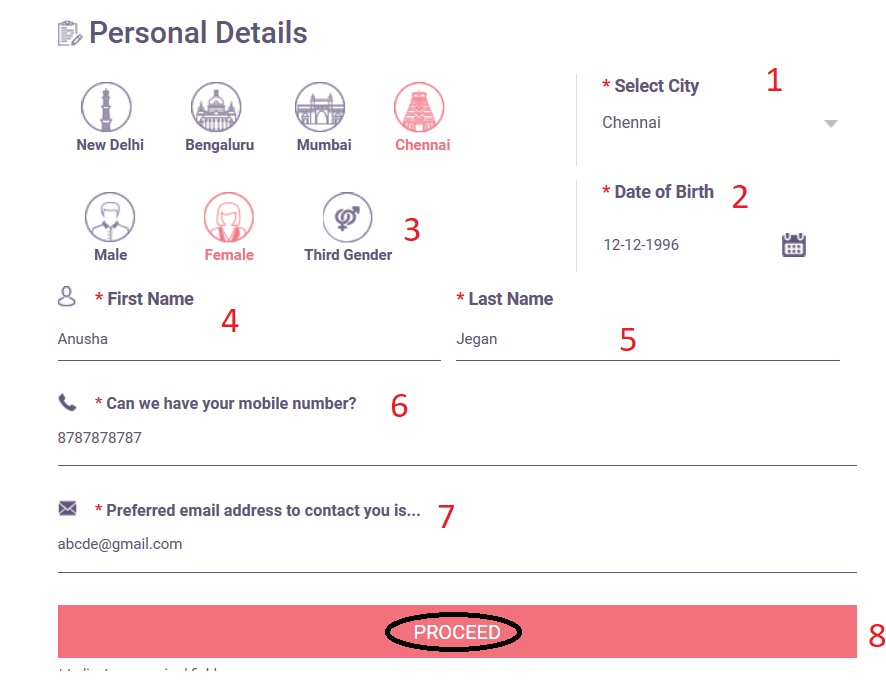

Enter all the required personal details as below.

Step 1 : Select City

Step 2 : Enter your date of birth as per your id proof

Step 3 : Select Gender

Step 4 : Enter your First Name

Step 5 : Enter your Last Name

Step 6 : Enter your Mobile Number

Step 7 : Enter your Preferred email address to contact you

Step 8 : Click Proceed Button

Then you will be asked to fill work details and continue for instant approval.

Advantages :

Earn 20 reward points per Rs.100/- spent on all grocery transactions

1 reward point per Rs.100/- spent on all spends except fuel spends

10% off at BookMyShow up to Rs. 100, 15 times in a year

Earn 10 reward points per Rs.100/- spent on all fuel transactions

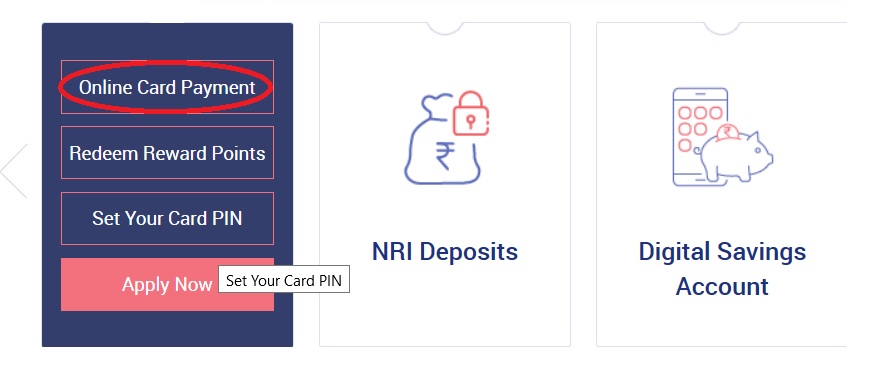

How To Do Credit Card Online Payment?

Click Online Card Payment available in credit card home page.

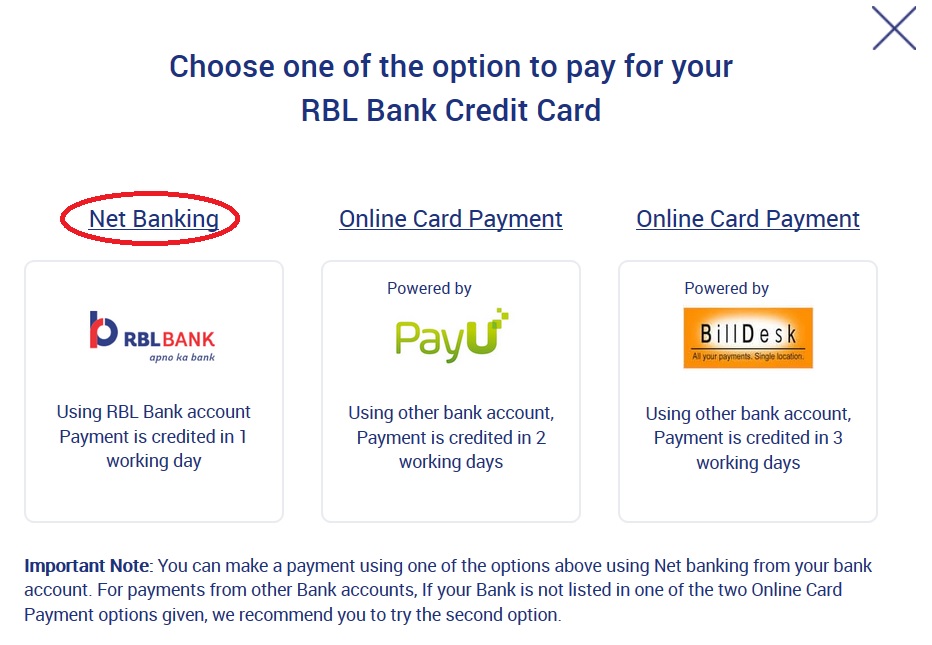

Choose one of the option to pay for your RBL Bank Credit Card

Important Note :

You can make a payment using one of the options above using Net banking from your bank account. For payments from other Bank accounts, If your Bank is not listed in one of the two Online Card Payment options given, we recommend you to try the second option.

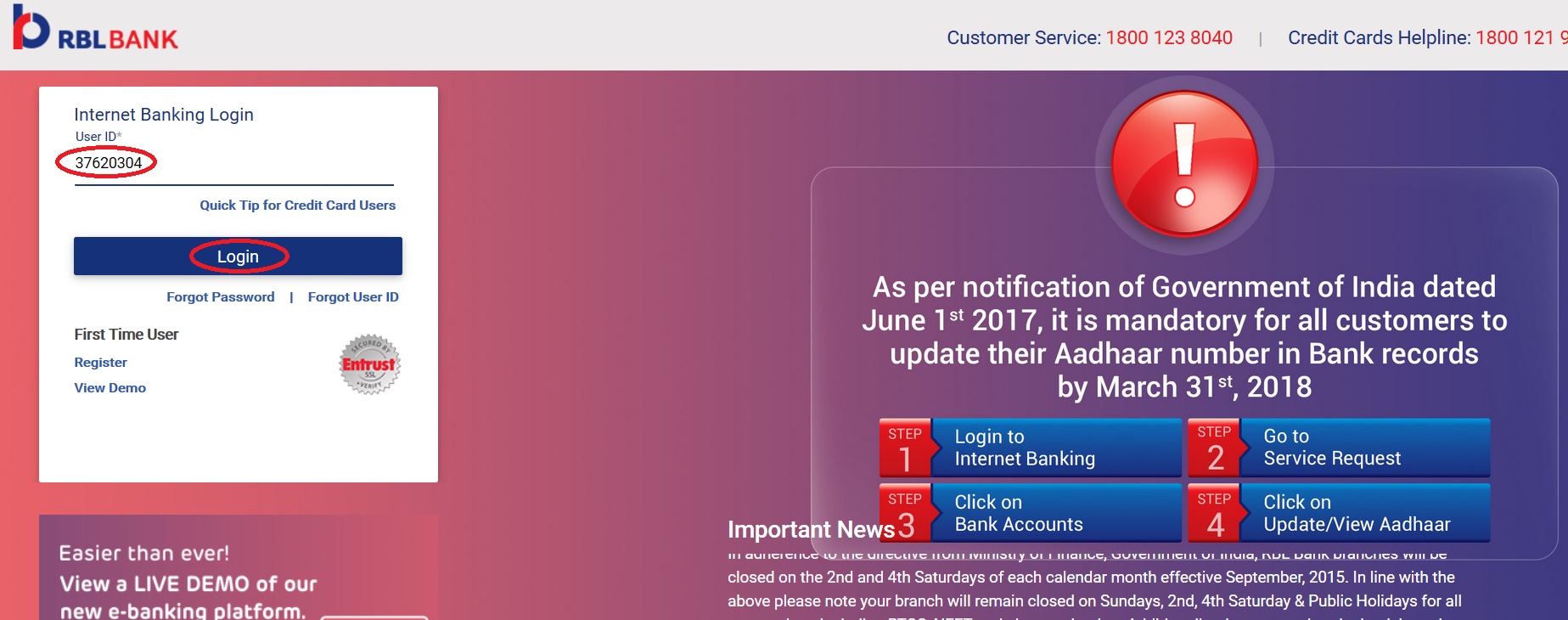

Net Banking

Using RBL bank Account Payment is credited in 1 working day. Enter User id & click login button to proceed for payment of credit card.

Enter your password and click login button

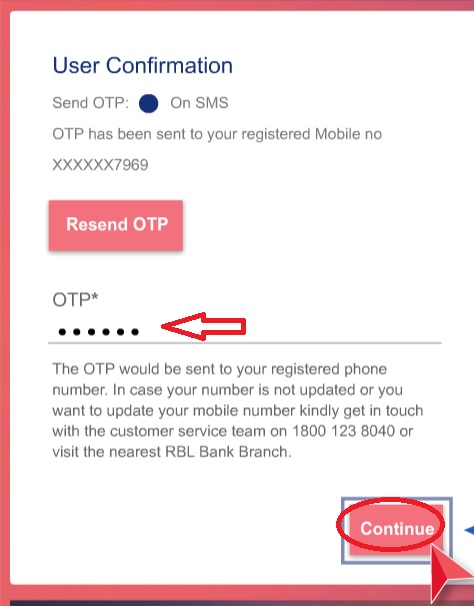

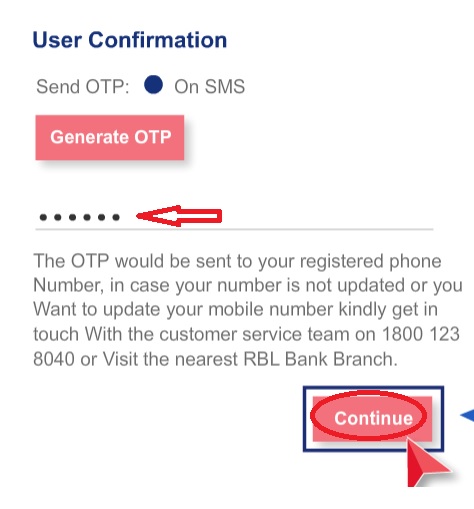

OTP has been sent to your registered mobile number. Enter that OTP and click continue button

The OTP would be sent to your registered mobile number. In case your mobile number is not updated or you want to update your mobile number kindly get in touch with the customer service team on 1800 123 8040 or visit the nearest RBL bank branch.

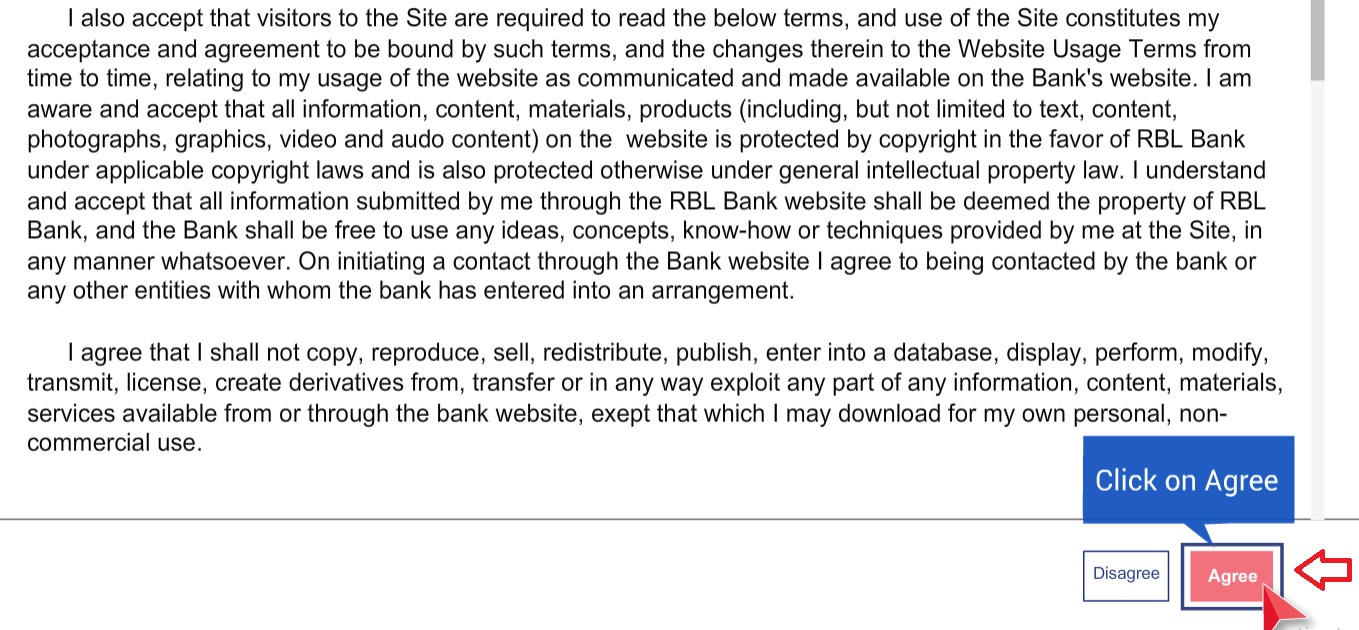

Agree the terms & conditions.

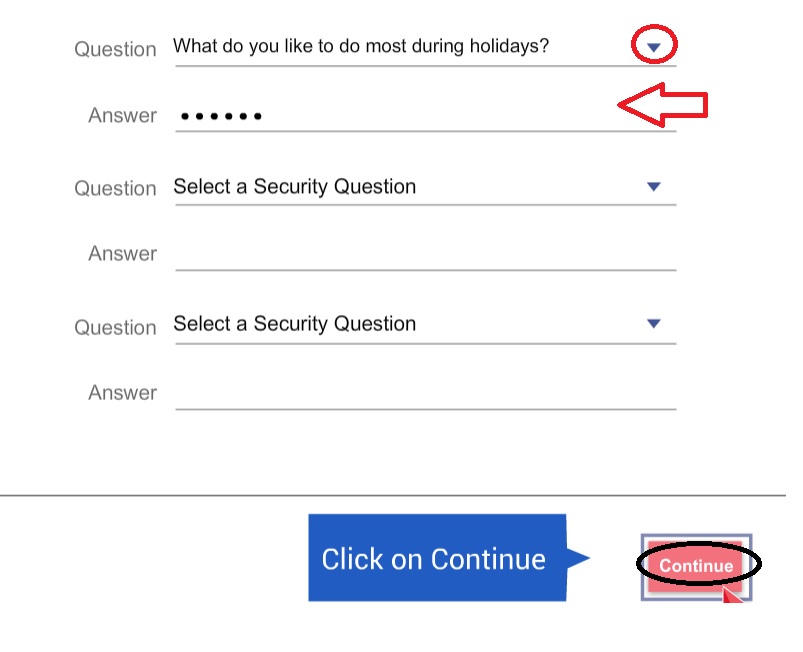

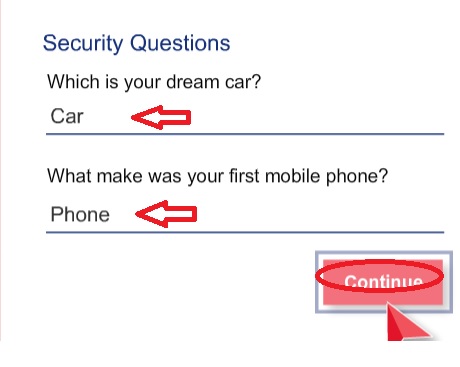

Security Questions :

1. The Security Questions you are registering here will be used for your password reset in case you forget your password.

2. Please answer all the questions from the list of questions available in drop down

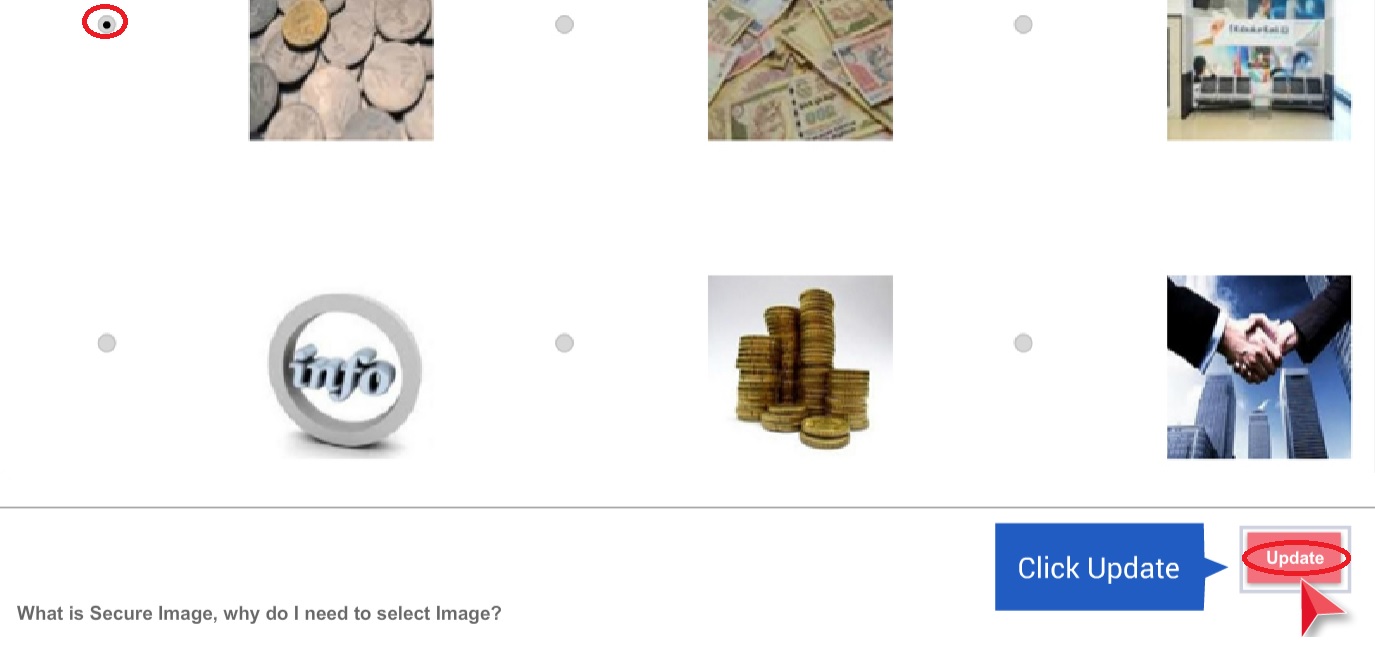

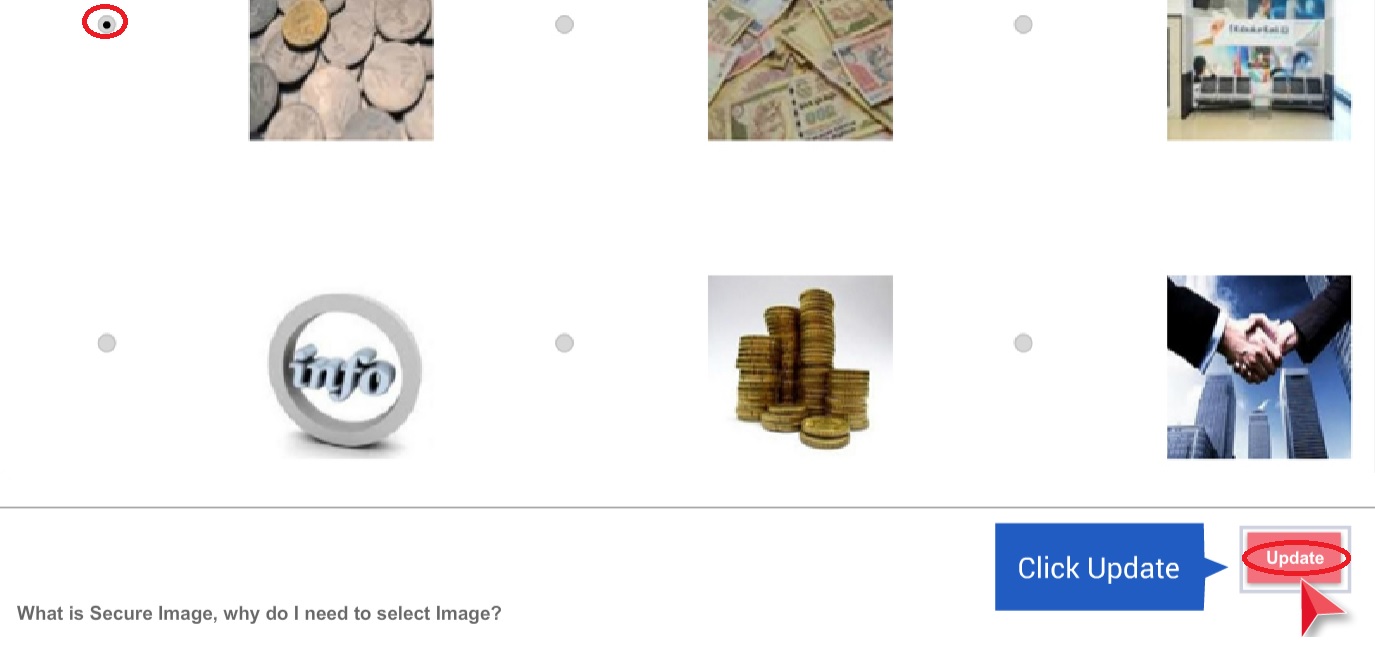

Update Phrase details & Select secure image. Then click on update button

What is Secure Image? Why do I need to select Secure Image?

Secure Image is to protect customer from phishin sites, Fraudulent website are designed to look similar to actual Banking site. In such scenarios Secure Image on the password page helps customer to differentiate between original & fraudulent website (as every customer can choose their own image)

New Registration

You can register using several modes.

1. Customer Id :

Step 1 : Enter Customer Id

You can find Customer ID on Passbook,Cheque Book, MoBank or Statement.

Step 2 : Enter Pan No

Step 3 : Click Submit Button

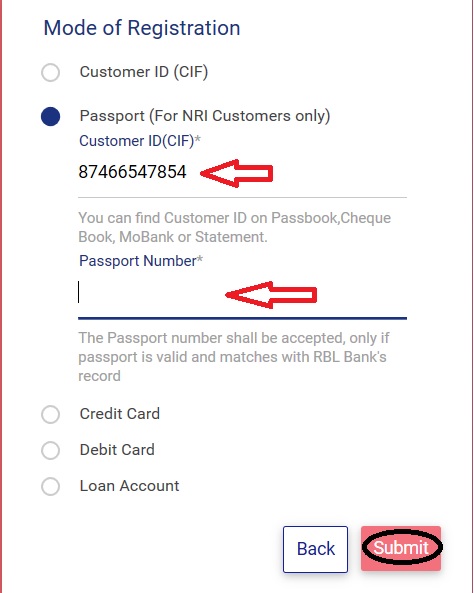

2. Passport (For NRI Customers only) :

Step 1 : Enter Customer Id

Step 2 : Enter Passport No

Step 3 : Click Submit Button

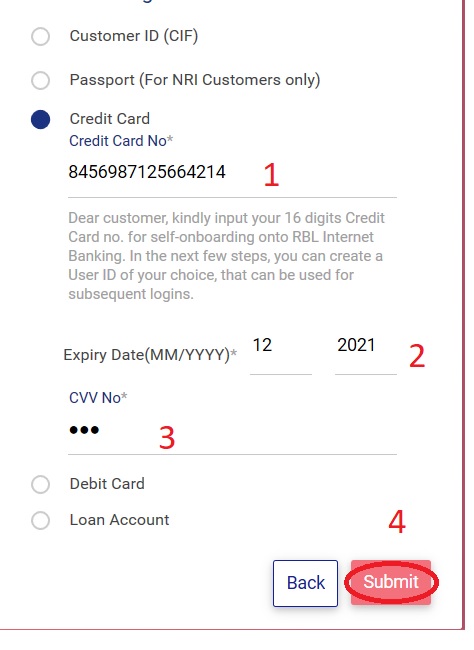

3. Credit Card :

Step 1 : Enter Credit Card no

Kindly input your 16 digits Credit Card no. for self-onboarding onto RBL Internet Banking. In the next few steps, you can create a User ID of your choice, that can be used for subsequent logins.

Step 2 : Enter Expiry Date(MM/YYYY)

Step 3 : Enter CVV No

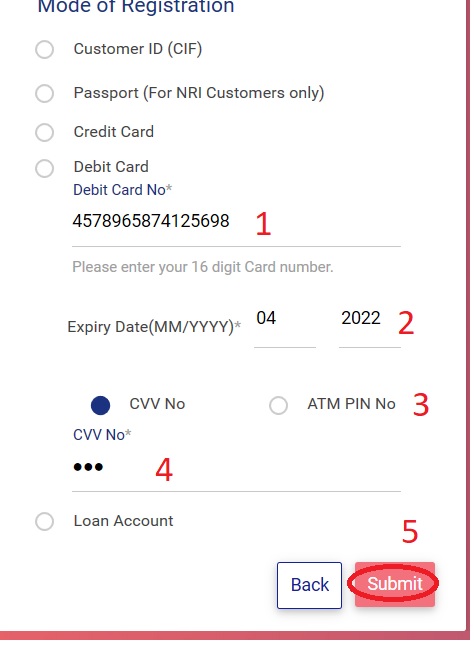

4. Debit Card :

Step 1 : Enter Debit Card no

Please enter your 16 digit Card number.

Step 2 : Enter Expiry Date(MM/YYYY)

Step 3 : Enter CVV No

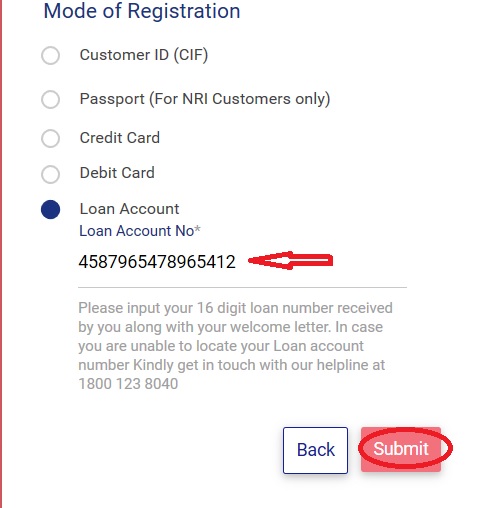

5. Loan Account :

Please input your 16 digit loan number received by you along with your welcome letter. In case you are unable to locate your Loan account number Kindly get in touch with our helpline at 1800 123 8040

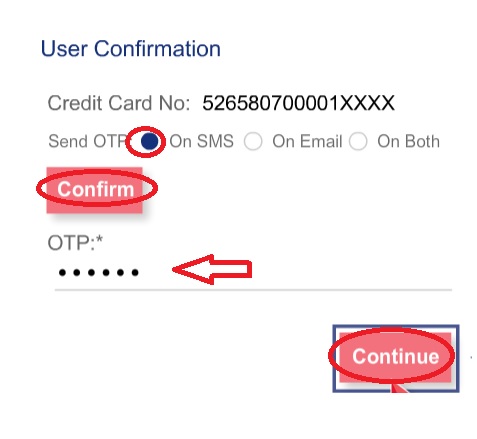

Then user confirmation page will be opened. OTP will be sent as SMS or email or both as per your selection. Then enter the OTP received and click on submit button.

Update Phrase details & Select secure image. Then click on update button

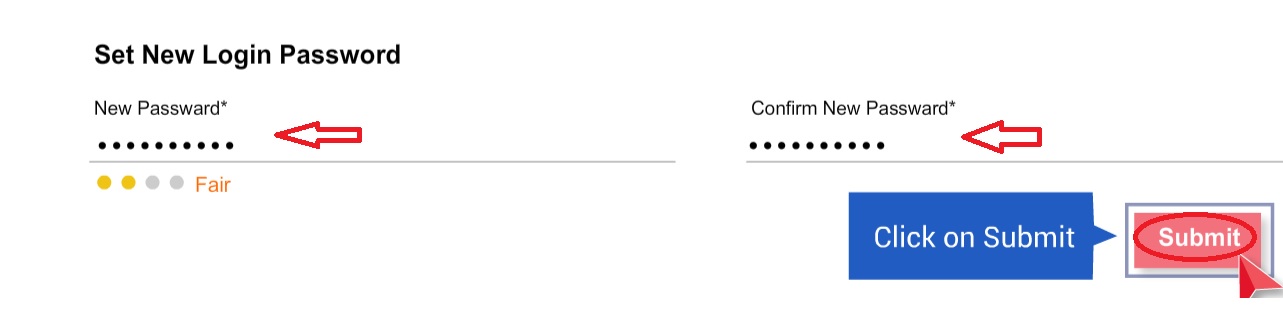

We strongly recommend you to change your login password. Once password is changed you can start using E-banking.

Please Note :

Your new internet banking password should be of maximum 28 character and all the combinations mention below are mandatory.

1. Alphabet (Capital & Small)

2. Numbers

3. Special Character (#, @ etc)

Your new password should not be limited to last 3 passwords.

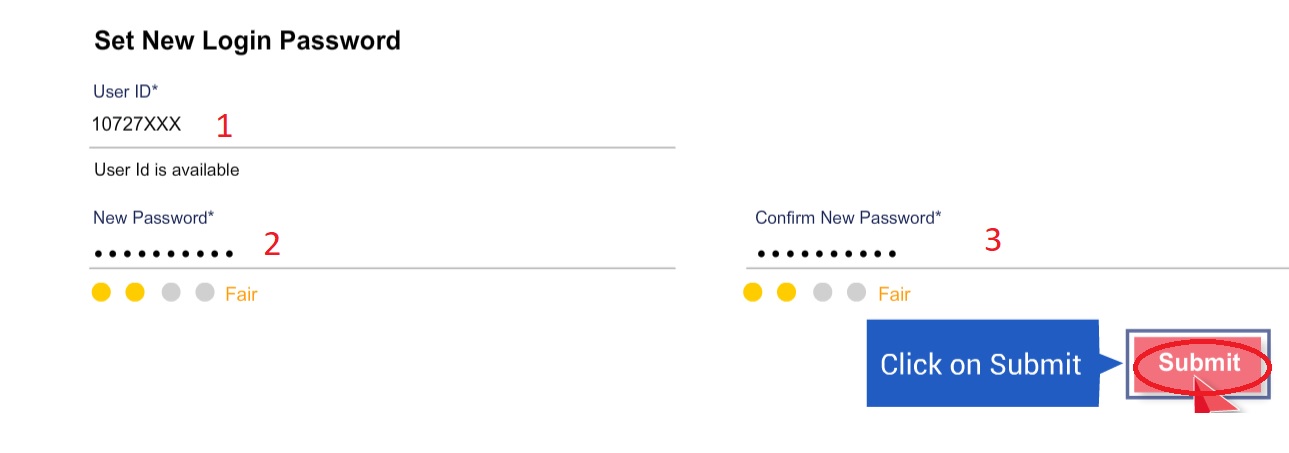

Step 1 : Enter User Id

Step 2 : Enter New Password

Step 3 : Confirm New Password

Step 4 : Click Submit Button

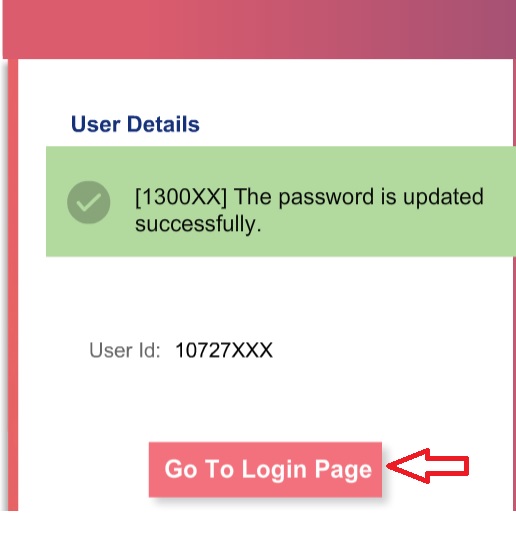

Your password will be updated successfully and now you can login with yopur new password.

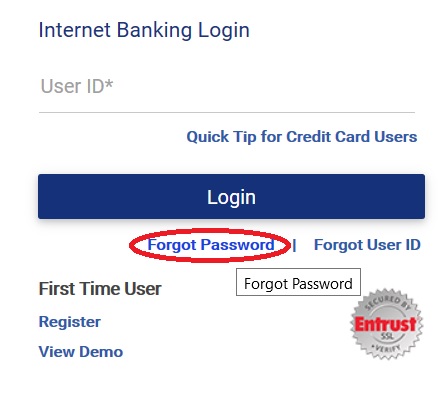

Forgot Password :

Click the link Forgot Password available in the login page.

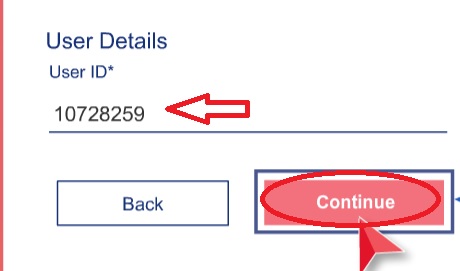

Enter user id and click on continue button

Answer your security questions.

Generate OTP on SMS and enter the same. Then click continue button.

Set new password and confirm the same again.

Update Aadhaar Number :

As per notification of Government of India dated June 1st 2017, it is mandatory for all customers to update their Aadhaar number in bank records by March 31st 2018.

Step 1 : Login to Internet Banking

Step 2 : Go to Service Request

Step 3 : Click on Bank Accounts

Step 4 : Click on Update/ View Aadhaar

FAQs On EBanking

Frequently Asked Question (FAQs) On EBanking

Can I change my personal details on EBanking?

** You can change your Nick Name, Preferences, and personalize the Dashboards in new EBanking system.

** For changes in email id, mobile number and communication / permanent address, please visit any of the nearest RBL Bank Branch.

Who can use Internet banking?

You can get free internet banking access if you have a Savings or a Current Account with RBL Bank

What are the charges for using Net Banking?

All account holders of RBL Bank have free access to Internet Banking.

Is my user id going to change?

Your User id will remain as your CIF ID or Nick Name, whichever is currently used for logging in RBL Bank net banking. However, you can change this user id by going to ‘My Profile’ section post login to EBanking.

I do not remember my Customer ID (CIF), where do I look for it?

You can find your CIF on your Cheque book, Passbook, Bank statement and in our app, RBL MoBank.

Will the existing password work or do I need to change the password to start transacting on the new EBanking system?

** The existing password will get validated at the time of First login.

** You need to reset the password post successful validation, as per bank’s password policy.

How many passwords do I have for EBanking?

** You will have only 1 password for logging into the EBanking system

** Unique OTP (One Time Password) will be sent to your mobile / email id for transactions to proceed.

How many Security questions are there?

There are 19 questions in the drop down. You have to mandatorily select 3 questions out of them. Answering these 3 questions is mandatory in new EBanking.

What is “Add Entry” on ‘Funds transfer’? What are the advantages?

You can do multiple funds’ transfers in one go by using ‘Add Entry’ features. All the entries added will get approved with a single OTP.

What are the advantages of IMPS?

You can send money instantaneously 24*7, 365 days using IMPS. The beneficiary account will be credited instantaneously with the amount.

What is a ‘Mail box’?

Your mailbox will have all the communication/offers sent you by the bank.

Can I order a cheque book online? How many leaves will this cheque book contain?

** Yes, you an order for a cheque book online

** The cheque book will contain 20 cheque leaves

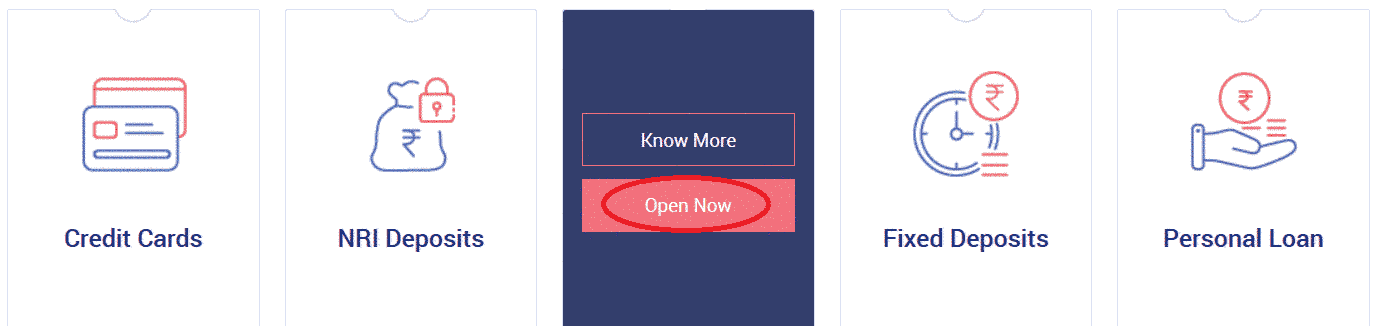

Open Digital Savings Account

RBL Bank’s Digital Savings Account is the fastest, convenient and secured way of account opening online.

All you need is your Aadhaar No. and PAN No. to open a Savings Account or Savings + Fixed deposit account.

** Zero Balance Account

** Instant & Paperless

** Higher Interest Rates

** Unlimited ATM Transactions

** Anytime Banking

Click Open now link on Digital Savings Account tab.

Select what would you like to apply for

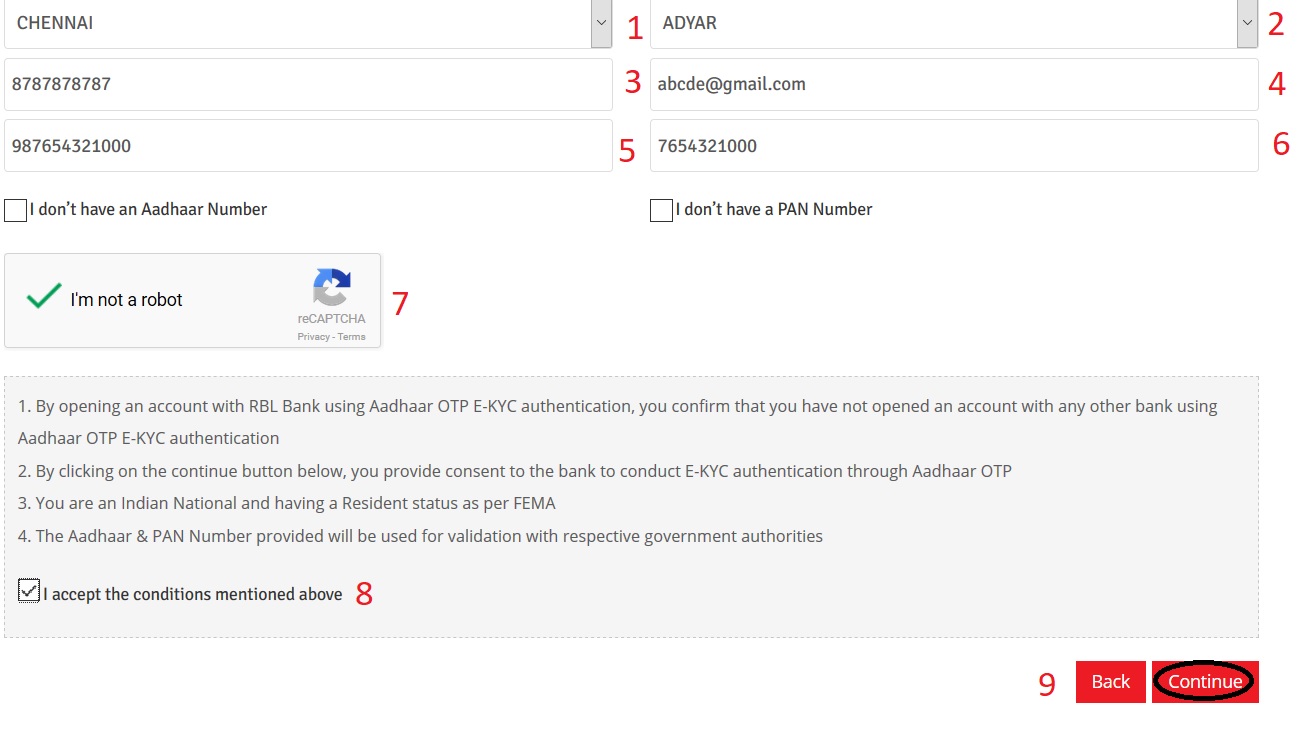

Step 1 : Select your City

Step 2 : Select your Branch

Step 3 : Enter your Mobile Number

Step 4 : Enter your Email id

Step 5 : Enter your Aadhaar Number

Step 6 : Enter your PAN Number

The online account opening works only if you have an Aadhaar & PAN. But don’t worry, give us your mobile number and e-mail ID by clicking “Get in touch” and we will do just that!

Step 7 : Click I am not Robot button

Step 8 : Accept the conditions

1. By opening an account with RBL Bank, you confirm that you have not opened an account with any other bank using Aadhaar OTP E-KYC authentication.

2. By clicking on the continue button, you provide consent to the bank to conduct E-KYC authentication through Aadhaar OTP

3. You are an Indian National and having a Resident status as per FEMA

4. The Aadhaar & PAN Number provided will be used for validation with respective government authorities

Step 9 : Click Continue Button

How to Login if you have a valid RBL Bank Credit Card and do not have a Bank account

Already a registered user on Cards Online for accessing your RBL Bank Credit Card

Step 1 – Login to rblbank.com

Step 2 – Click on Login and then Personal Banking

Step 3 – Enter your 16 digit Credit Card number as User ID

Step 4 – Click on Login and You will receive an OTP on your registered mobile number and enter the OTP

Step 5 – Select security questions and enter details and select security pictures

Step 6 – Create a password of your choice

Step 7 – You will be able to access card account and transactions details

If you are a first time user in Internet Banking you are required to register yourself.

Answered Questions

I want to know the status of my application number CCOP86PKKO.

Go to the following link “rblbank.rupeepower.com/application-status” and enter your Reference Number & Mobile Number in the relevant boxes to track your application status online.

My credit card is not working. What can I do?

Customer Service: 1800 123 8040

Credit Cards Helpline: 1800 121 9050

I need to write back to bank using my inbox. How can I do it?

RBL Bank is currently providing a Secured Mailbox. Mails received in Customer’s Inbox are a one way communication and cannot be used to write back to the bank.

Can I pay my bills on the due date?

** Yes, you can pay your bills on the due date.

** However, it takes 2 Business days for the Merchant settlement to happen.

** Our suggestion is to make the Bill Payments 3 working days prior to the due dates.