tnreginet.gov.in Apply & View Encumbrance Certificate : Tamilnadu Registration Department

Organisation : Tamilnadu Registration Department

Facility : Apply & View Encumbrance Certificate

Applicable State : Tamil Nadu

Home Page : https://tnreginet.gov.in/portal/

| Want to comment on this post? Go to bottom of this page. |

|---|

Contents

What is Encumbrance Certificate?

The encumbrance certificate contains all the transactions registered relating to particular property for a period (as required). It is advisable to get encumbrance certificate before effecting any transactions as it will give information about previous transactions. This will also help in arriving at proper entitlement of the property.

Related / Similar Service : picme.tn.gov.in Pregnant Women Registration

It is true that issue of encumbrance certificate takes time, as the entries are searched manually before 1987. From 1987 onwards the indexes are computerised and the encumbrance certificates are issued on the spot. Special counters have been opened to receive applications and certificates are issued on demand without delay. Applications for Encumbrance Certificate can be submitted through Online Application Form and the Encumbrance Certificate will be delivered at your door step.

How To Apply For Encumbrance Certificate?

** This User Manual deals with the User Registration procedure in portal with step by step instructions to create a user Registration identification to apply for Encumbrance Certificate

** Only after creating a Registration ID can the user proceed to create a document online.

Steps :

Step 1 : Go the official web page Hold the cursor over the registration tab on the right side top of the screen. Select user registration option to proceed further for registering an user.

Create your account:

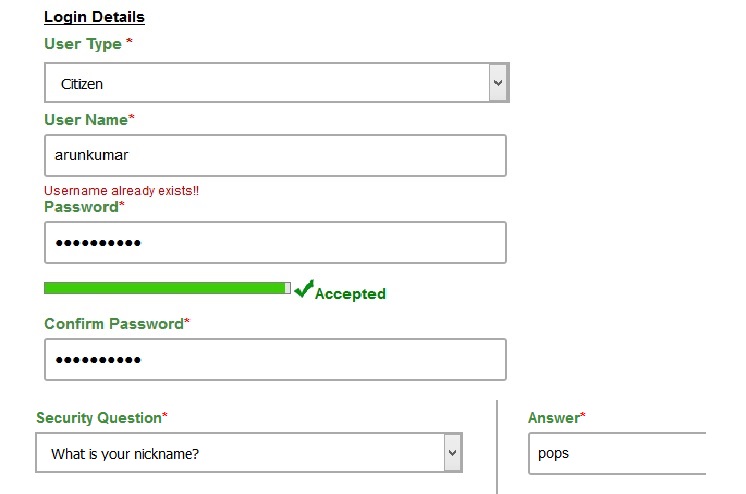

Step 1 : Login Details

Step 2 : Select User Type *

Step 3 : Enter User Name*

Step 4 : Enter Password*

Step 5 : Re Enter Confirm Password*

Step 6 : Select Security Question*

Step 7 : Enter Answer*

Personal Details :

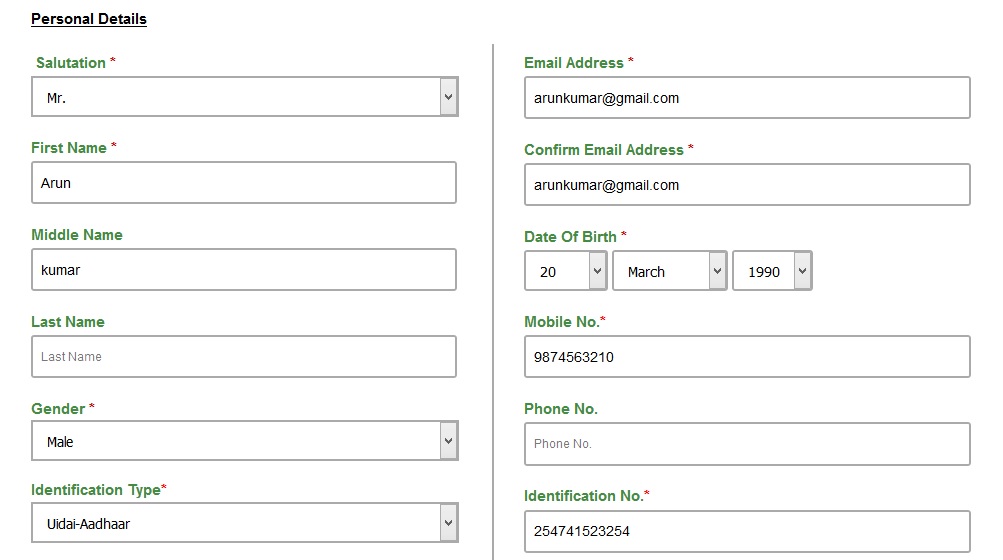

Step 1 : Select Salutation *

Step 2 : Enter First Name *

Step 3 : Enter Middle Name

Step 4 : Enter Last Name

Step 5 : Select Gender *

Step 6 : Enter Identification Type*

Step 7 : Enter Email Address *

Step 8 : Re Enter Confirm Email Address *

Step 9 : Enter Date Of Birth *

Step 10 : Enter Mobile No.*

Step 11 : Enter Phone No.

Step 12 : Enter Identification No.

Address :

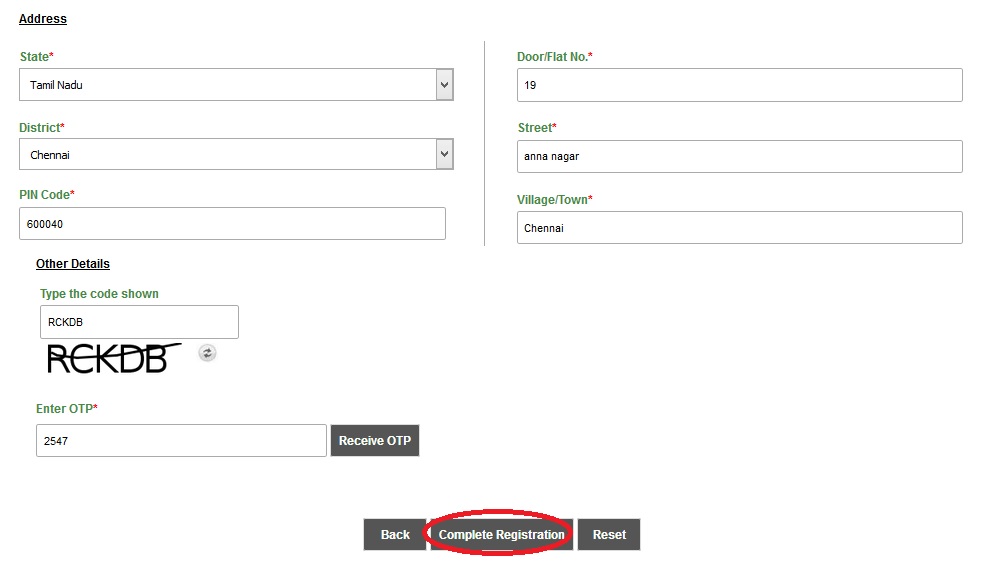

Step 1 : Select State*

Step 2 : Select District*

Step 3 : Enter PIN Code*

Step 4 : Enter Door/Flat No.*

Step 5 : Enter Street*

Step 6 : Enter Village/Town*

Step 7 : Type the code shown

Step 8 : Enter OTP*

Step 9 : Click on the complete registration button.

In case the user does not want to complete the registration, user can chose to click “Reset”

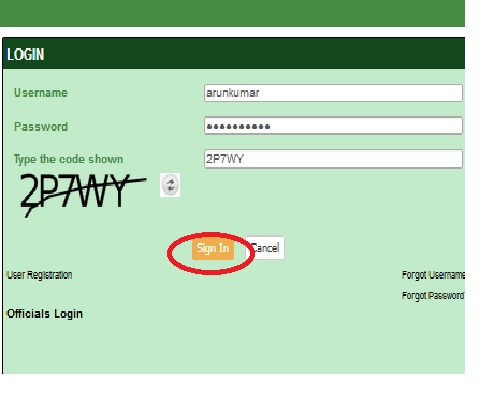

Login Details :

Now using the “Sign in” option, citizen can use the Portal

Step 1 : Enter User Name

Step 2 : Enter Password

Step 3 : Click on the login button.

Procedure For Applying

** SRO,Village,Survey No.,Subdivision and Dates are search criteria.Pls.carefully Fillup Those Columns.

** You can also Fillup the EC application in TAMIL using any TAB tamil font in Tamilnet’99 Standard.

** Enter all the known details for accuracy and to avoid delay.

** Enter Extent and declared owner for getting proper EC.

** ls. Mention LandMark near your Postal address and aslo mention your availability on that address in the remarks column.

** To Add more information about Ward No.,Block No.,Survey No.,Sub Div No.and Dates click “Add One More” Button.

** To avoid Date Entry Errors please check whether you have entered Valid Dates.

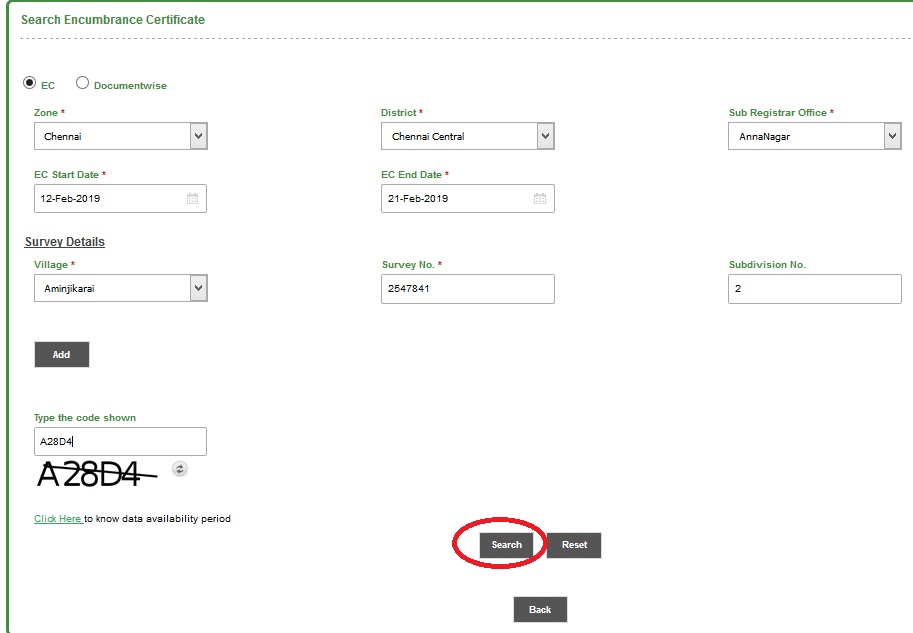

How To View Encumbrance Certificate?

You can search/ view Encumbrance Certificate online in TNReginet Registration department.

Steps :

Step 1 : Go to the portal of TNReginet Registration department. Click Search/ View EC button available under Encumbrance Certificate tab.

Enter the Follwoing details to view our Encumbrance Certificate

Step 1 : Select EC/Documentwise

Step 2 : Select Zone *

Step 3 : Select District *

Step 4 : Select Sub Registrar Office *

Step 5 : Select EC Start Date *

Step 6 : Select EC End Date *

Step 7 : Select Survey Details

Step 8 : Select Village *

Step 9 : Select Survey No. *

Step 10 : Select Subdivision No.

Step 11 : Type the code shown

Step 12 : Click on search button.

Getting ID instead of EC Details :

1. If the search result of provided Survey Numbers produces more than 200 property transactions, you will get ID. In this case, you can split the search duration (reducing number of years) and can make simple search and get EC immediately.

2. Now you are required enter the given ID in the space provided in the download link after the duration provided by the site. You will get EC as downloadable.

3. Your search ID will be valid upto 48 hours from the time of search. Then, it becomes invalid. Please try new search.

4. Please enter your document number and year in document search details provided in the same page and get the details.

5. Please make new EC search entering the correct details provided in the document search. Then you will get your property transaction in the EC.

FAQs On Encumbrance Certificate

Frequently Asked Questions (FAQs) On Encumbrance Certificate

1. “Encumbrance Certificates” are not being issued in time and the staff also do not respond properly to our requests.

It is true that issue of encumbrance certificate takes time, as the entries are searched manually before 1987. From 1987 onwards the indexes are computerised and the encumbrance certificates are issued on the spot.

Special counters have been opened to receive applications and certificates are issued on demand without delay. Applications for Encumbrance Certificate can be submitted through Online Application Form and the Encumbrance Certificate will be delivered at your door step.

2. What is the time limit for getting the Encumbrance Certificate?

As per the Standing Order 979(ii) “in respect of the offices and period which is not computerised the Encumbrance certificate shall be completed within 4 days from the date of admission of the application exclusive of that date and interveing holidays”.

3. What is an encumbrance certificate? Why do we need?

The encumbrance certificate contains all the transactions registered relating to particular property for a period (as required). It is advisable to get encumbrance certificate before effecting any transactions as it will give information about previous transactions. This will also help in arriving at proper entitlement of the property.

Apply For Certified Document

Registration of Documents :

** Before deciding to purchase a property, ascertain the transactions effected in respect of the property proposed to be purchased by getting the encumbrance certificate.

** Apply online and get EC at door step. Ascertain the value of the property from this site through Guideline value of page.

EC :

** Applications are available free of cost. You can also download the required form. You can also apply online for EC and get it delivered at your door step.

** Give full particulars of the property in the application with the required fee.

** Get legal opinion as to the title of the property and the genuineness of the seller.

Fees :

** E.C. Application Fee Re.1/-

** Search Fee for the I year Rs.15/-

** Search fee for every additional year Rs. 5/-

** Additional Fees For the Computerised Period ie from 1987 Rs.100/-

STAMPS :

** The list of stamp vendors licensed to vend stamps are given in the site/li>

** They are licensed to sell stamps at the face value

** If any extra demand is made, he is liable for criminal prosecution under the Act, besides getting his license cancelled.

** Stamp papers are also sold by The Sub Registrars, Treasuries, and Assistant Superintendent of Stamps, Chennai.

** Stamp duty may also be paid in cash or D.D.

** In chennai zone e-stamping has been introduced.

** Non_Judicial Stamp papers are also available in “Stamp Sales Depot” at the following location

DRAFTING OF DEEDS ONLY BY

** Executants of the document if they use the model deeds available on the registraion website.

** Advocates.

** Licensed Document Writers.

** Chartered Accountants having Document Writing License

Document Writing Fees :

** Fees for drafting / copying various kinds of deeds by the licensed writers is prescribed by the Government.

** Demand receipt for all the fees paid

Presentation :

When To Be Presented For Registration :

** Within FOUR Months from the date of execution

** The District Registrar may condone delay of four months with fine

** No time limit for Wills executed

Where To Be Presented For Registration :

** Documents relating to properties situated in Tamil Nadu shall be registered in Tamil Nadu only at the following offices

** In the Sub-Registrar’s office under its jurisdiction, the property situates (or)In the District Registrar’s office of that Registration District.

** Registration done out side from the state is null and void.

** If you don’t know the jurisdiction of registration offices please ascertain is from the site by provided the street name or village name or village name at Field offices detail.

Requirements :

** Documents Needed For Registration.

** Duty stamped signed and Executed document.

** By notification issued in the Tamilnadu Government Gazette No.6 dated 14.2.2001,under part II section 2,Registration act,Amendment No.28/2000 has been notified :

** it requires the claimant of the sale Document also to sign in the sale deed and also appear before the registering officer for registration of the sale deed.

** Patta Transfer application with court fee lable of Re. 7/- duly filled and signed.

Stamp Duty & Registration Fees

Conveyance (Sale) Gift :

Stamp Duty : 7% on the market value of the property

Registration Fee : 1% on the market value of property.

Exchange :

Stamp Duty : 7% on the market value of the greater value.

Registration Fee : 1% on the market value of greater value property.

Simple Mortgage :

Stamp Duty : 1% (on the loan amount) subject to a maximum of Rs40,000/-

Registration Fee : 1% on loan amount subject to a maximum of Rs.10,000/-

Mortgage with possession :

Stamp Duty : 4% on loan amount

Registration Fee : 1% subject to the maximum of Rs.2,00,000/-

Agreement to Sale

Stamp Duty : Rs.20

Registration Fee : 1% on the money advanced(1% on total consideration if possession is given)

Agreement relating to construction of building :

Stamp Duty : 1 % on the cost of the proposed construction or the value of construction or the consideration specified in the agreement whichever is higher

Registration Fee : 1 % on the cost of the proposed construction or the value of construction or the consideration specified in the agreement whichever is highe

Cancellation :

Stamp Duty : Rs.50

Registration Fee : Rs 50

Partition among family members

Stamp Duty : 1% on the market value of the property but not exceeding Rs.25000/- for each share

Registration Fee : 1% subject to a maximum of Rs.4000/- for each share.

Partition among Non family members

Stamp Duty : 4% on the market value of the property for separated shares

Registration Fee : 1% on the market value of the property for separated share

General Power of Attorney to SELL the immovable property (Power is given to family member)

Stamp Duty : Rs 100

Registration Fee : Rs 1000

Release among family members (co – parcenars)

Stamp Duty : 1% on the market value of the property but not exceeding Rs.25000/-

Registration Fee : 1% on the market value of the property subject to a maximum of Rs.4000/-

Release among non family members (co – owner & benami release)

Stamp Duty : 8% on the market value of the property

Registration Fee : 1% on the market value of the property

Lease below 30 years

Stamp Duty : 1 % on the total amount of rent, premium, fine etc

Registration Fee : 1% subject to a maximum of Rs.20000/-

Lease upto 99 years

Stamp Duty : 4 % on the total amount of rent, premium, fine etc

Registration Fee : 1% subject to a maximum of Rs.20000/-

Declaration of Trust (if property is there, it would be considered as sale)

Stamp Duty : Rs 180

Registration Fee : 1% on the Amount

Document Writers Fees

Commercial Taxes And Registration Department.

Amendments To Tamil Nadu Document Writers Licence Rules.

(G.O. Ms. No.49, Commercial Taxes and Registration (M2) Department 15th April 2010.)

Property Is Conveyed :

When the value specified in the document does not exceed Rs. 10,000/- :

Fees : Rs 50

When such value exceeds Rs. 10,000/- but does not exceed Rs. 50,000/- :

Fees : Rs 100

When such value exceeds Rs. 50,000/- but does not exceeds Rs. 1,00,000/- :

Fees : Rs 150

When such value exceeds Rs. 1,00,000/- but does not exceeds Rs. 2,00,000/- :

Fees Rs.200/-

When such value exceeds Rs. 2,00,000/- but does not exceeds Rs. 5,00,000/- :

Fees Rs. 300/-

When such value exceeds Rs. 5,00,000/- :

Fees : 400

Fixed Fee For The Following Documents :

Deposit of title deeds : Fees Rs. 100/-

Lease deed : Fees Rs. 100/-

Mortgage deed : Fees Rs. 100/-

Release deed : Fees Rs. 100/-

Trust deed : Fees Rs. 100/-

Partnership deed : Fees Rs. 100/-

** Acknowledgement Rs. 50/-

** Receipt Rs. 50/-

** Award Rs. 50/-

** Cancellation Rs. 50/-

** Divorce Rs. 50/-

** Power of Attorny Rs. 50/-

** Pronote Rs. 50/-

** Agreement Rs. 50/-

For Partition Document :

** When the document involves not more than two schedule Rs. 200/-

** When the document involves more than two schedules, fee for each schedule Rs. 100/-

** Maximum fees Rs. 500/-

For Buildings :

** For measuring house and preparing statement under sub-rule (1-A) of rule 3 of the Tamil Nadu Stamp (Prevention of under valuation of Instruments) Rules, 1968.

Fees : Rs. 100/- (for each 1-A statement)