trichycorporation.gov.in Check Tax Dues & Payment history : Trichy Municipal Corporation Tamil Nadu

Organization : Trichy Municipal Corporation Tamil Nadu

Facility : Check Tax Dues & Payment history

Applicable City : Trichy

Website : http://www.trichycorporation.gov.in/index.php

| Want to comment on this post? Go to bottom of this page. |

|---|

Contents

What is Online Tax Balance Enquiry?

Online Tax Balance Enquiry facilitates you to view the total balance due on your assessment. Also you can view your recent payments applied to the tax balance due. Any payments you have made recently by Cheque, may not yet be showing on your account as it may not have realized.

Related / Similar Service : TNPDS Apply New Ration Card

How To Check Trichy Corporation Tax Dues?

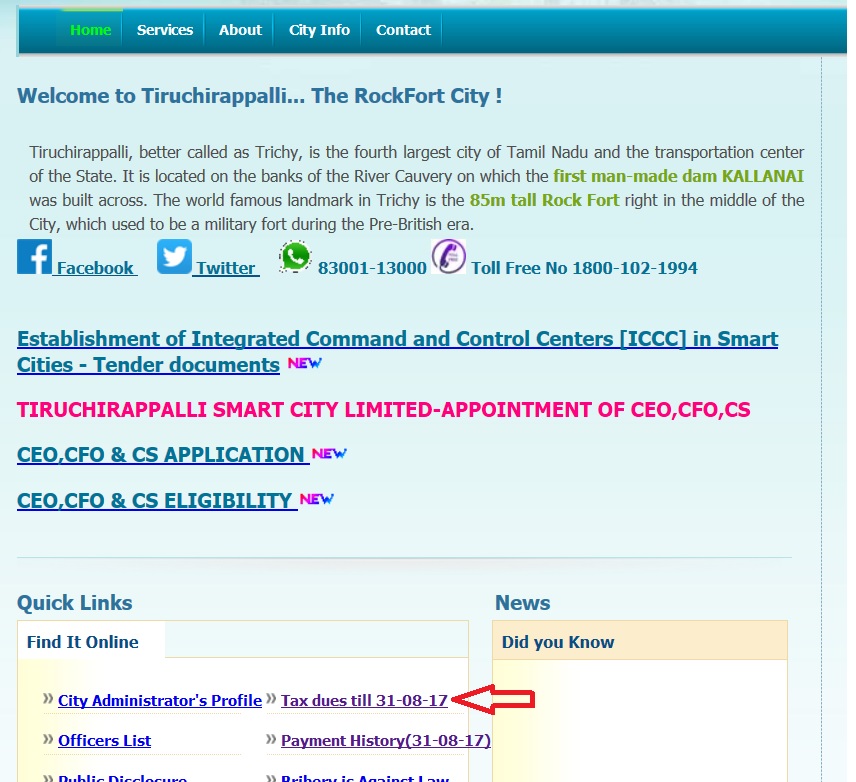

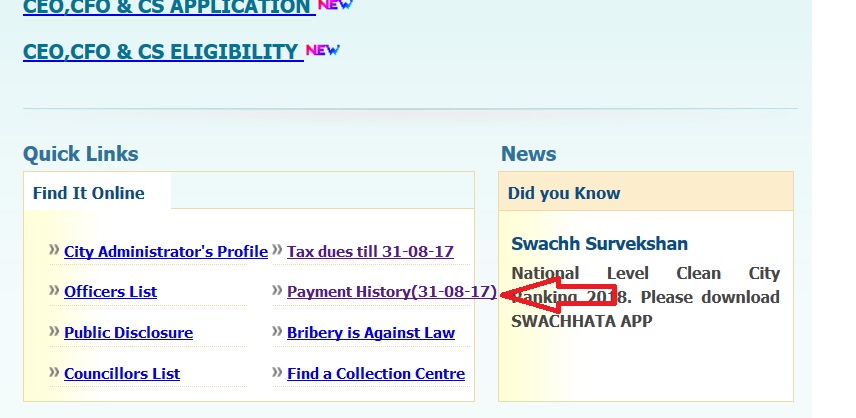

Go to Municipal Corporation official website of Trichy. Click the link Tax dues under Quick Links tab.

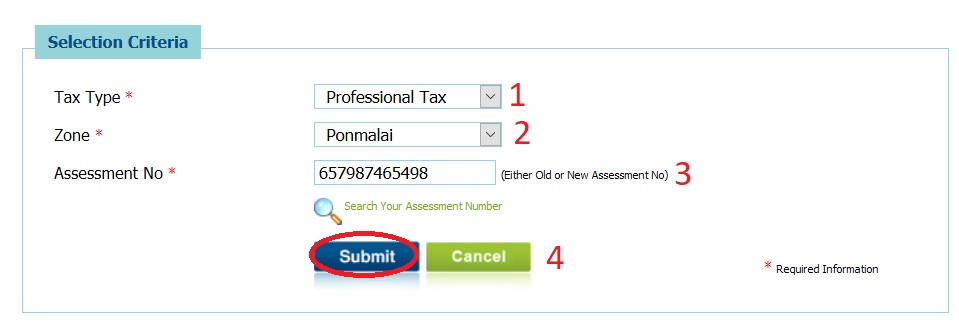

Enter all the required details to know your dues.

Step 1 : Select Your Tax Type From the Drop Down List (Eg : Non Tax)

Tax Types :

** Water Charges

** Property Tax

** UGD Charges

** Professional Tax

** Non Tax

** Vacantsite Tax

Step 2 : Select Your Zone (Eg : Ponmalai)

Zones :

** Ponmalai

** Ariyamangalam

** Srirangam

** K-abishekapuram

Step 3 : Enter Either Your Old or New Assessment No(Eg : 657987465498)

Step 4 : Click Submit Button

* Required Information

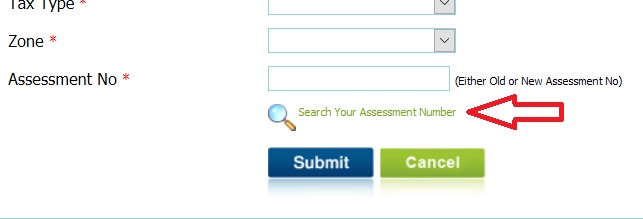

Search Your Assessment Number

If you forgot Your Assessment Number clicl the link ‘Search Your Assessment Number’ available in tax dues page.

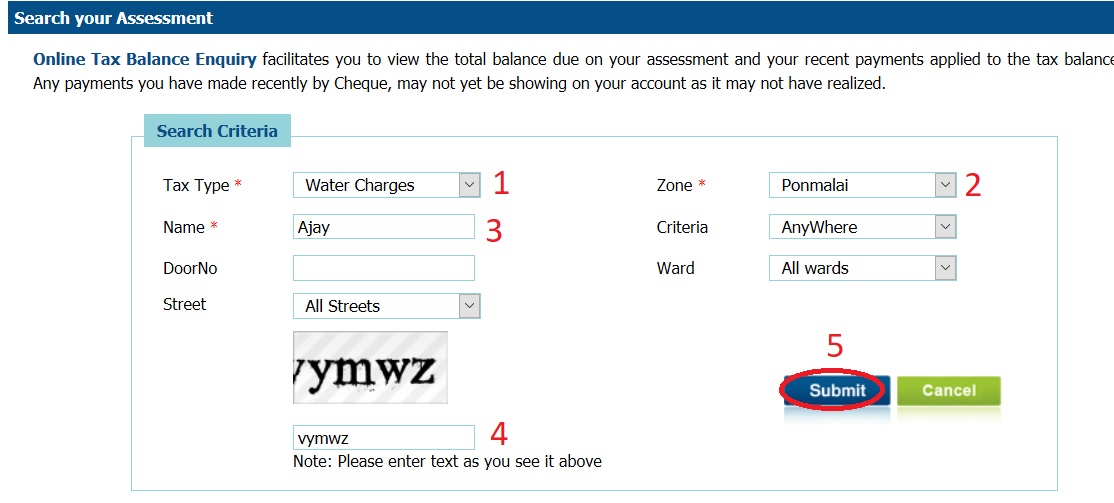

Step 1 : Select Your Tax Type From the Drop Down List (Eg : Non Tax)

Step 2 : Select Your Zone (Eg : Ponmalai)

Step 3 : Enter Your Name (Eg : Ajay)

Step 4 : Please enter text as you see it

Step 5 : Click Submit Button

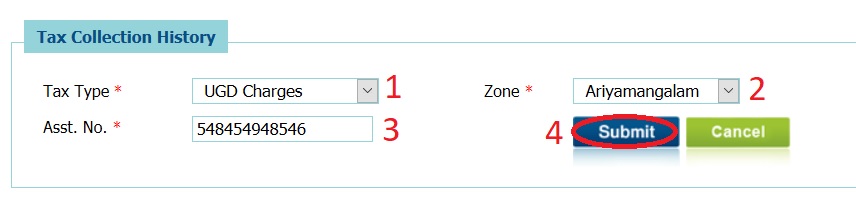

Tax Collection History

Go to the link of Tax Collection History as shown below.

You are required to provide all the below details to know the payment history.

Step 1 : Select Your Tax Type From the Drop Down List (Eg : Non Tax)

Step 2 : Select Your Zone (Eg : Ponmalai)

Step 3 : Enter Your Assessment No (Eg : 657987465498)

Step 4 : Click Submit Button

Online Tax Payment Method

You can now pay your Water Charges, Property Tax, UGD Charges, Professional Tax, Non Tax & Vacantsite Tax online through debit card, credit card & Net Banking.

Step 1 : Go to the link tnurbanepay.tn.gov.in to pay online.

Step 2 : Select Tax Option

Step 3 : Search Assessment Number

Step 4 : Enter Tax Amount

Step 5 : Make Payment

Step 6 : Choose Payment Option

Step 7 : View Payment Successful

Step 8 : Go to My Request

Step 9 : Print Your Bill

1. For Property Tax & VST : 086/Old Asst.No

2. For Water Tax, UGD, Prof tax & Non Tax

Srirangam Zone : 086/1/Old Asst. No

Ariyamangalam Zone : 086/2/Old Asst. No

Ponmalai Zone : 086/3/Old Asst. No

K-Abishekapuram Zone : 086/4/Old Asst. No

FAQs On Tax

Frequently Asked Question (FAQs) On Trichy Municipal Corporation Tax

I need to pay property tax & under ground drainage tax online for SRIRANGAM ZONE. Kindly intimate the web site.

You can pay your Property Tax dues till 31-08-17 through the website given above. You will be asked to select Tax type, zone & enter Assessment No. Select zone as Srirangam and proceed for payment.

My house is in Pappakurichi kattur. How can I pay house tax and water tax online. Can I sign up by own ID?

You need assessment number to pay your tax. There is an option to find your Assessment Number also if you forgot the same.

How to view my property tax paid status

How to pay the tax through online from outside India

my sisters son sivasubramanian contructed first floor in the existing house in73 b inbharathistreet ward no.38 in tiruchi corporation baed on aprroved plan whether separate tax is to be paid

as i have lost UGD DEPOSIT RECEIPT FOR Rs6000 pl PROVIDE ME EITH DUPLICATE COPY OF THE SAME OLD ASSESSMENT NO 2000215

HOW TO FIND ASSESSMENT NUMBER IF WE FORGET IT

its not exactly useful . please update your site and clearly mention how to check payment status of trichy property tax.

I had received the tax notice for 2022-23. In which UGD for Rs. 1440/- has been charged for 2021-22 which has been already paid.

Why there is a need to pay the UGD TAX for the same period with double the amount ?