gras.mahakosh.gov.in : Make Online Payment Without Registration Maharashtra

Organization : Finance Department Maharashtra

Facility : Pay Without Registration

Applicable State : Maharashtra

Home Page : https://www.mahakosh.gov.in/m/

| Want to comment on this post? Go to bottom of this page. |

|---|

Contents

How To Do GRAS Maharashtra Pay Without Registration?

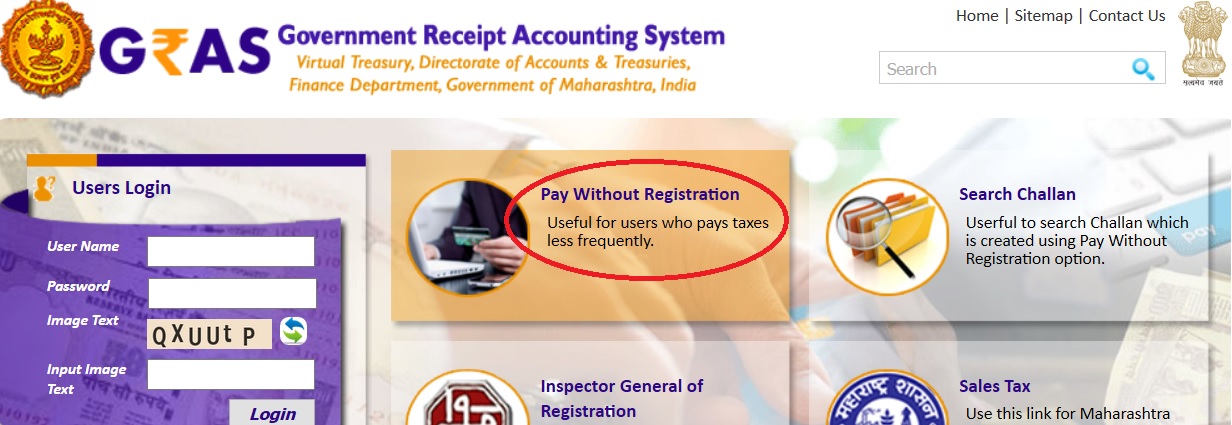

This facility will help the user to make payment of Government taxes and non user should have Internet enabled banking account for e payment. This is useful for users who pays taxes less frequently.

Related / Similar Service : sevaarth.mahakosh.gov.in Pay Slip

This is a 24X7 facility and citizen can make the payment any time of the day. On-Line Filling of single challan form facilitates minimum fields of the challan to be filled.

Instant online receipts for payment made and instant online banks transaction number becomes available. One can pay personal taxes as well as behalf of the firm,company and others.

Audience :

The target audience is unregistered user/ Guest user. This module has been developed taking into consideration the requirement of the user.

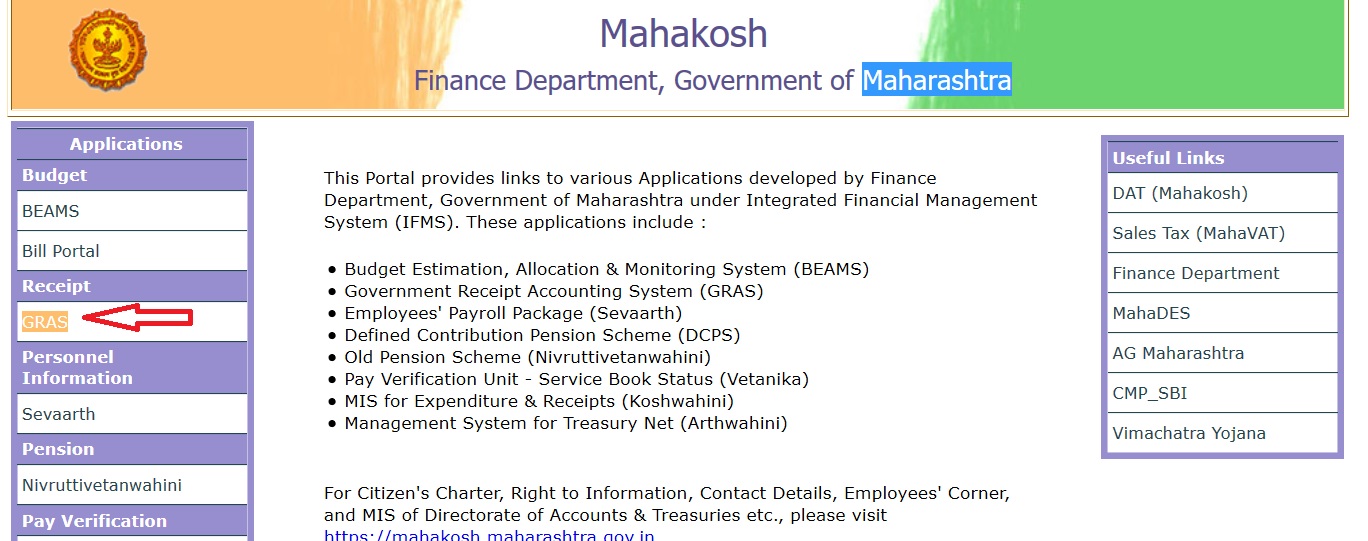

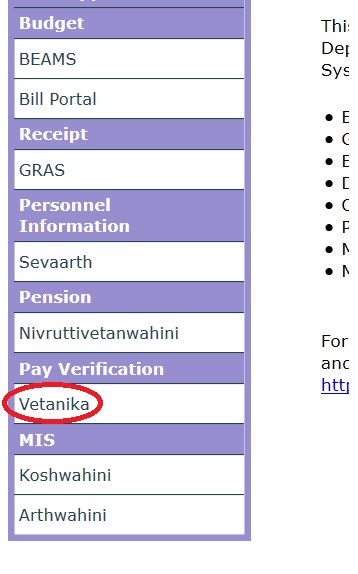

Go to the official website of Mahakosh Department, Maharashtra. Click GRAS link available in the list of applications in the left panel of website.

Go to the link Pay Without Registration.

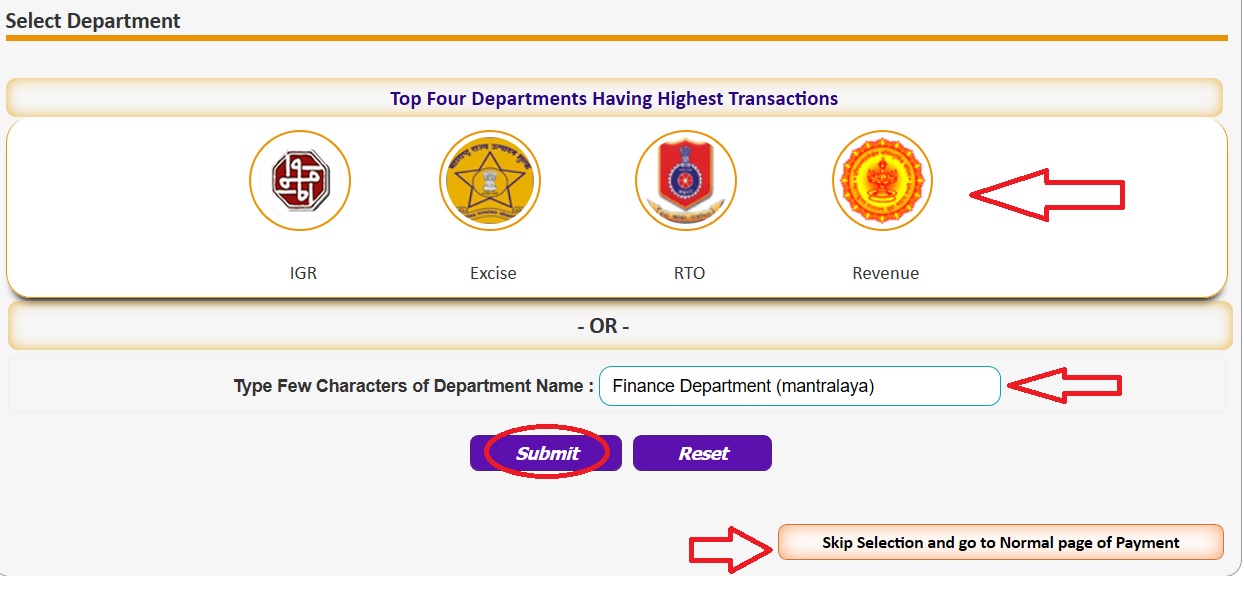

Top Four Departments Having Highest Transactions will be displayed.

** IGR

** Excise

** RTO

** Revenue

You can select from any of these departments or Type Few Characters of Department Name in the text box. Then click on submit button.

You can also skip this selection and go to normal page of payment.

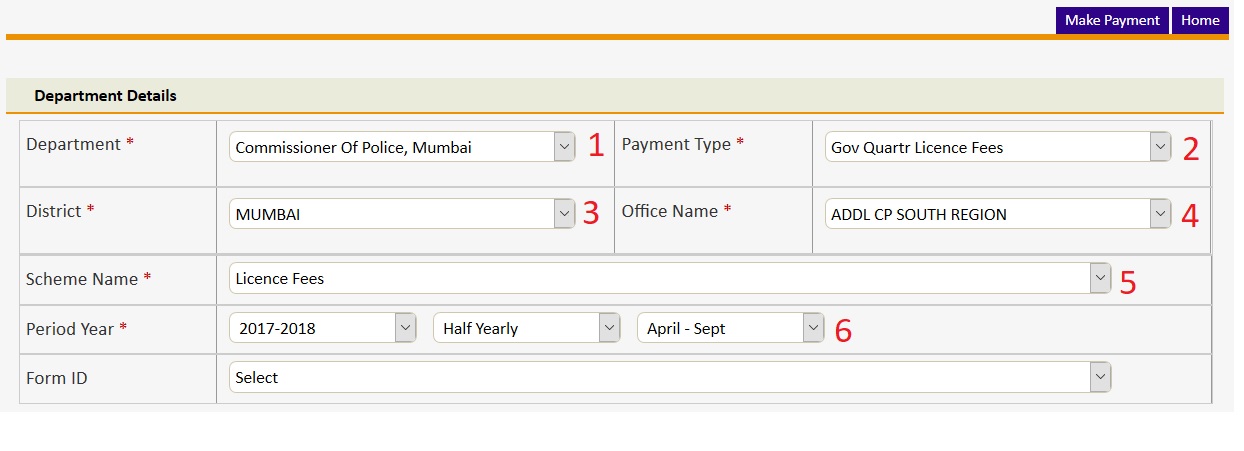

Step 1 : Select Your Department From Drop list (Eg : Chief Electrical Inspector)

Step 2 : Select the Payment Type From Drop list (Eg : Interest Receipts)

Step 3 : Select Your District From Drop list (Eg :Mumbai)

Step 4 : Select Your Office Name From Drop list (Eg : ADD CP North Region)

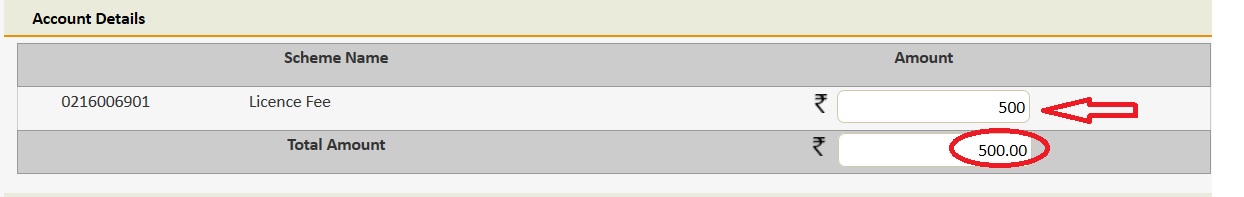

Step 5 : Select Scheme Name (Eg : License Fees)

Step 6 : Select Period Year ie year & Month

Enter the amount and total amount will be calculated as per your entries.

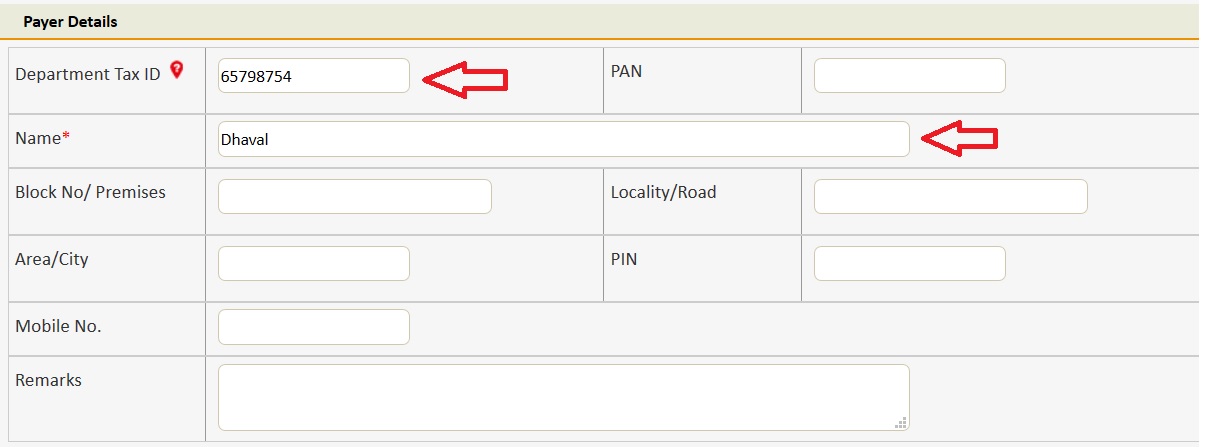

Enter Department Tax ID & Name in Payer Details section.

Department Tax ID :

Unique Licence No. / Loan No. / Case No. / Permit No. / Registration No. given by the department

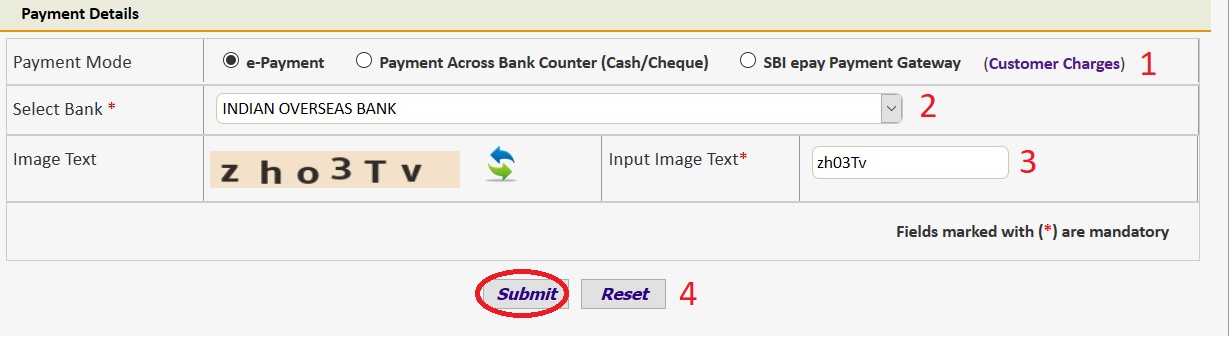

Step 1 : Select Payment Mode from these 3 options

e-Payment :

Select e-payment option when you have internet banking account with any of the available banks on this portal to transfer the amount online to governments account.

Payment Across Bank Counter (Cash/Cheque) :

Select Payment Across Bank Counter/Deferred Payment option when you don’t have internet banking account with any of the banks on this portal and you want to pay challan across bank counter.

SBI epay Payment Gateway :

Customer will have to pay the payment gateway charges.

Step 2 : Select Bank (Eg : ICICI)

Step 3 : Input Image Text

Step 4 : Click Submit Button

Fields marked with (*) are mandatory

Customer Charges :

| r.No. | Payment Channel | Transaction Particulars | Amount Slab | Payment Gateway Charges to be Paid by Customer for each Transaction |

|---|---|---|---|---|

| 1 | Internet Banking | 19 Banks | Up to Rs. 500/- | Rs. 5/- per transaction |

| Rs.501/- and above | Rs. 10/- per transaction | |||

| 2 | Credit Card | Master, Visa,AMEX | All Amount | 1.00% of the transaction amount |

|

||||

| 3 | Debit Card | Master, Maestro, RuPay, SBI Maestro & Visa | Up to Rs. 2000/- | Rs. 0.75%/- of the transaction amount |

| From Rs. 2001/- and above | 1% of the transaction amount | |||

|

||||

| 4 | IMPS | Mobile Banking | Up to Rs. 5000/- | Rs. 5/- per transaction |

| Rs. 5001/- to Rs. 25000/- | Rs. 7/- per transaction | |||

| Rs. 25001/- to 50000/- | Rs. 8/- per transaction | |||

| Rs. 50001/- to Rs. 100000/- | Rs. 9/- per transaction | |||

How To Do GRAS Registration?

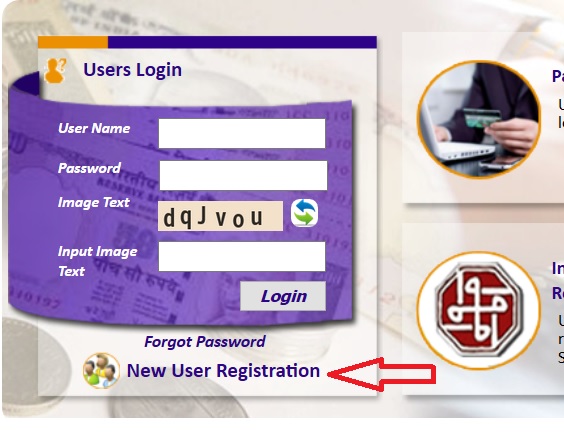

If you are a new user, please register by following the below steps. Go to the link of GRAS. Click the new user registration available under the login section.

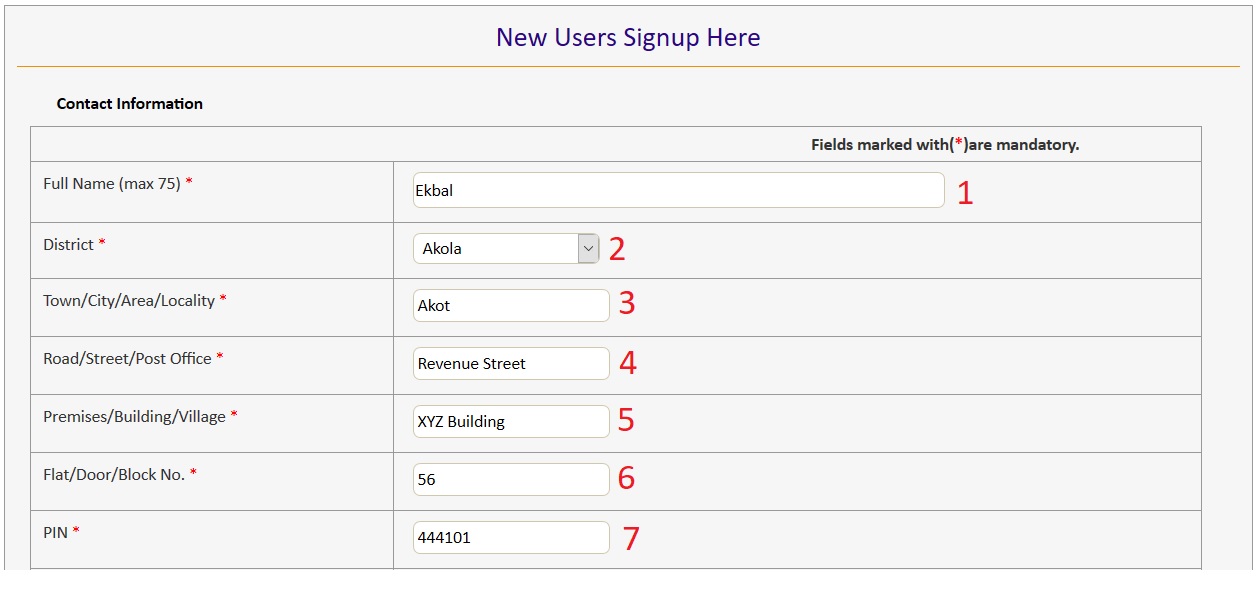

Contact Information :

Step 1 : Enter Your Full Name [Max 75 Characters] (Eg : Ayyan)

Step 2 : Select Your District (Eg : Amravati)

Step 3 : Enter Your Town/City/Area/Locality Name (Eg : Achalpur)

Step 4 : Enter Your Road/Street/Post Office Name (Eg : Kathora)

Step 5 : Enter Your Premises/Building/Village Name (Eg : Tiwasa)

Step 6 : Enter Your Flat/Door/Block No (Eg : 31 D)

Step 7 : Enter Your PIN Number (Eg : 444102)

Personal Information :

Step 8 : Enter Your User Name (Eg : Aake)

Minimum 4 characters are required.Please Enter Lowercase characters only

Step 9 : Create Your Password

(Should have atleast one special character,one digit and one Uppercase letter.)

Minimum 8 Characters are required.

Step 10 : Renter Your Password

Step 11 : Select Security Question from Drop Down List (Eg : What is your Birth Date?)

Step 12 : Enter Your Answer (Eg : 31/12/1987)

Step 13 : Type the characters you see in picture. Letters are case sensitive.

Step 14 : Click Save Button

Fields marked with(*)are mandatory.

Users Login :

Registered user can login with the following details.

Step 1 : Enter Your User Name (Eg : Avigyan)

Step 2 : Enter Your Password

Step 3 : Input Image Text

Step 4 : Click Login Button

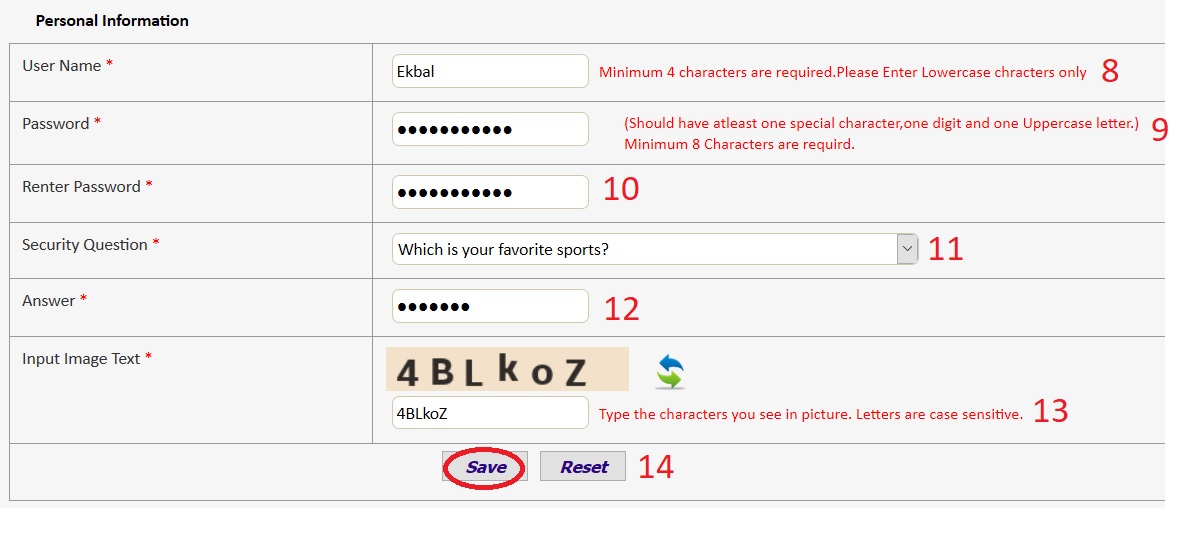

Forgot Password :

Step 1 : Enter Your User Name (Eg : Ayyan)

Step 2 : Select Security Question from Drop Down List (Eg : Which is Your Favorite Sports?)

Step 3 : Enter Your Secured Answer (Eg :Cricket)

Step 4 : Input Image Text

Step 5 : Click Reset Password Button

* fields are compulsory

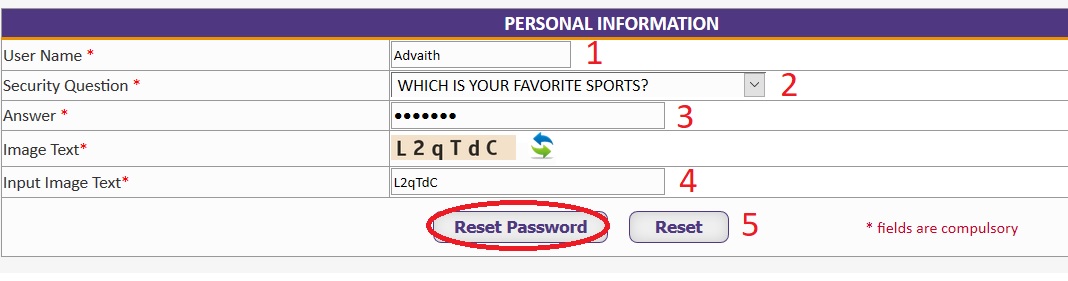

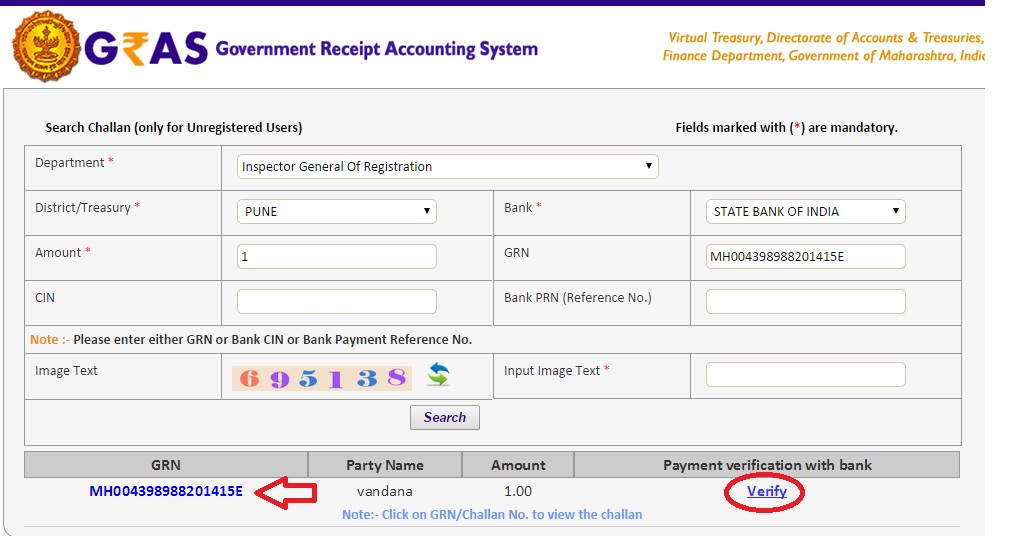

How To Search Challan?

You can search challan which is created using Pay without Registration Option ie this is only for Unregistered Users.

Fields marked with (*) are mandatory

Step 1 : Select any one Department From Drop Down List (Eg : Chief Electrical Inspector)

Step 2 : Select Your District/Treasury (Eg : Amravati)

Step 3 : Select the specific Bank Name from the list available (Eg : Bank of India)

Step 4 : Enter the Amount of challan (Eg : 50000)

Step 5 : Enter Either Your GRN or Bank CIN (Eg : MH004398988201415E) [18 Digits]

GRN No :

User must know the GRN Government Reference Number (GRN) generated on the Challan to uniquely identify the payment to be made by the user.

(OR)

2. Bank CIN:

User gets bank CIN No. of that respective bank after the successful completion of the transaction. CIN (Challan Identification Number) is generated as an acknowledgement for payment made online. If user does not remember CIN then please check it in respective bank transaction by login net banking account of respective bank.

(OR)

3. Bank PRN:

User gets bank Payment Reference No. of that respective bank. If user does not remember PRN then please check it in respective bank by login net banking account of respective bank.

Step 6 : Input Image Text

Step 7 : Click Search Button

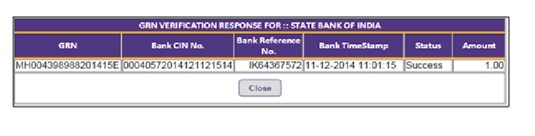

Please update the bank CIN by clicking on “Verify”.

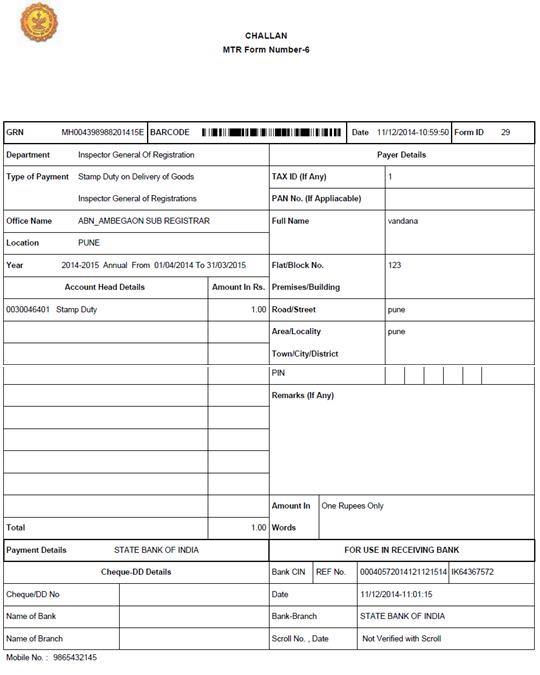

Click on GRN/ Challan No to view the challan.

After verification you will be receiving the following screen with status as success.

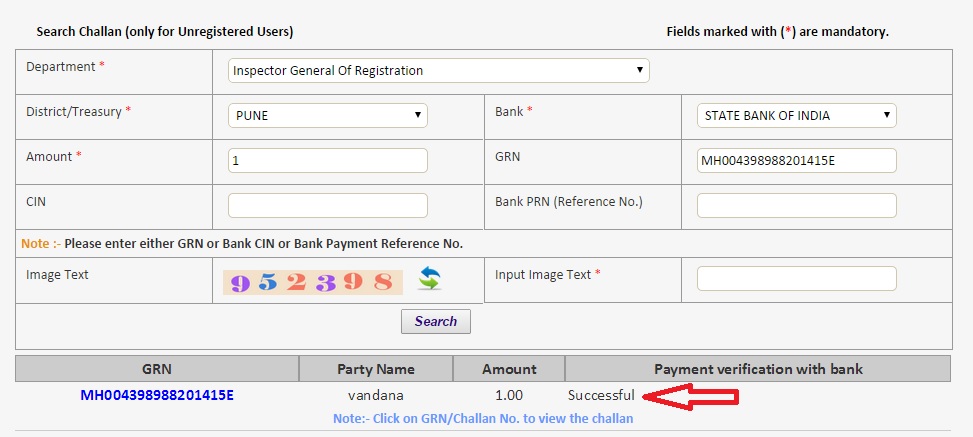

Again follow the same process of search challan. Click on “search button” user will get the following screen.

Click on GRN No to view your challan.

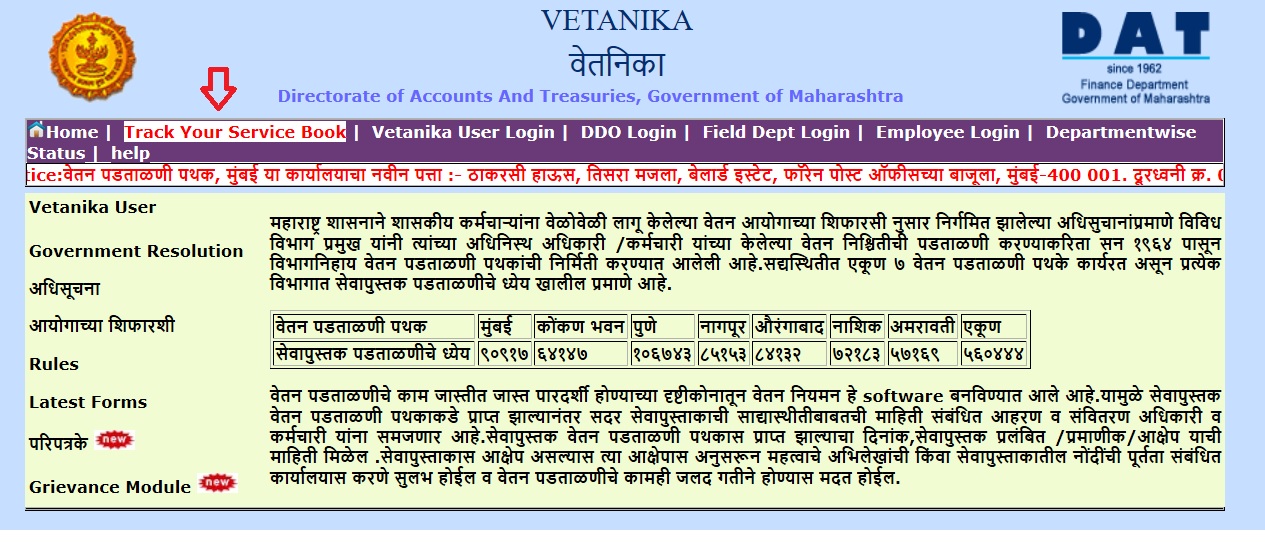

Sevaarth Service Book Status

Go to the link of Vetanika available in the official website.

Click Track Your Service Book Status link in the newly page opened.

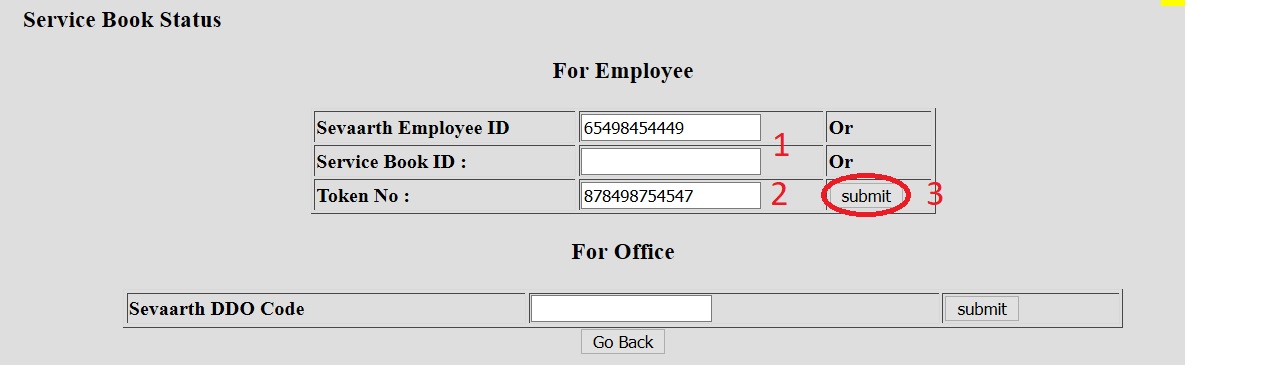

Step 1 : Enter Your Sevaarth Employee ID or Service Book ID (Eg : 1258748963)

Step 2 : Enter Your Token No (Eg : 6985478523)

Step 3 : Click Submit Button

For profession tax, which department should I choose?