gvmc.gov.in Pay Property Tax & Check Status : Greater Visakhapatnam Municipal Corporation

Organization : Greater Visakhapatnam Municipal Corporation

Facility : Pay Property Tax & Check Status

City : Visakhapatnam

Home Page : https://www.gvmc.gov.in/wss/

| Want to comment on this post? Go to bottom of this page. |

|---|

Contents

What is GVMC Online Payment Service?

Online Payment Service is a simple and convenient way provided by Greater Visakhapatnam Municipal Corporation(GVMC) to the citizens to pay their Property Taxes. It allows and enables the citizen to make payment online through GVMC’s website instantly with multiple options like credit card and debit card.

Related / Similar Service : Greater Hyderabad Municipal Corporation Check Property Tax Dues

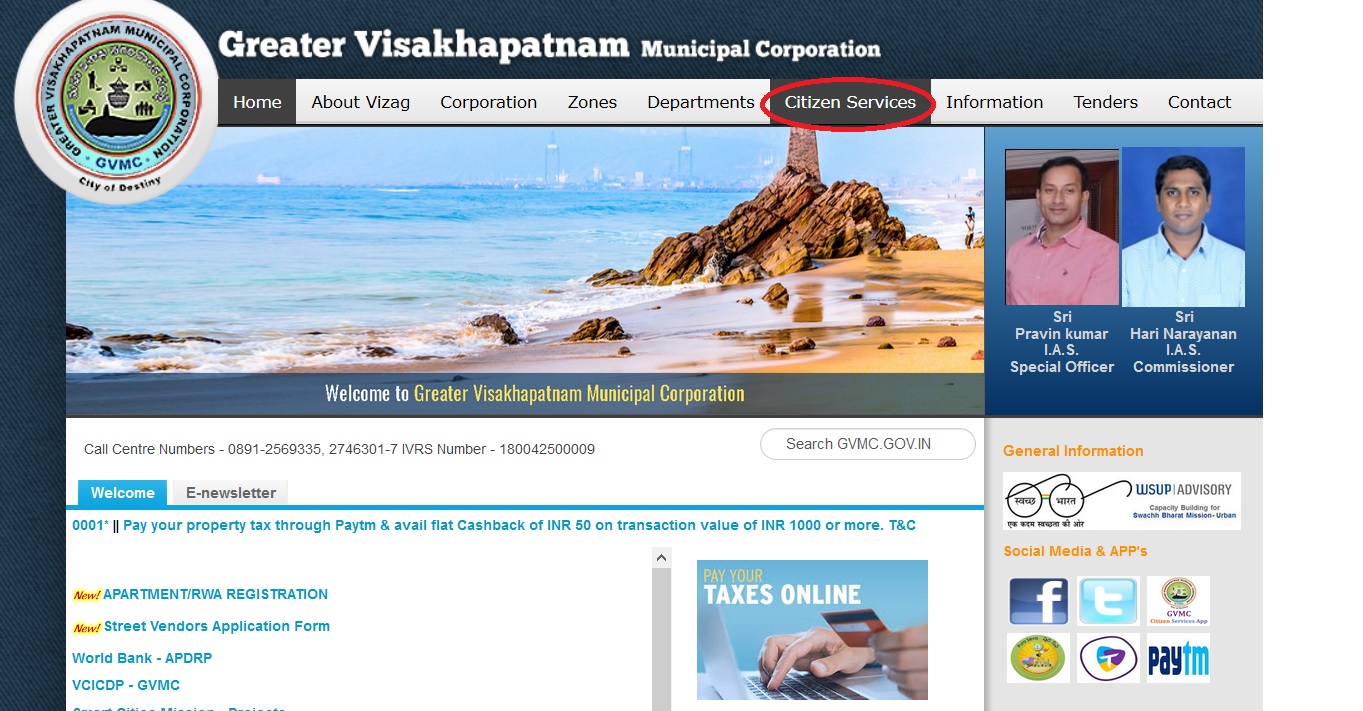

Go to GVMC home page and click Citien Services tab to know about online services.

Virtual Civic Center (Online Service)

Welcome to Greater Visakha Municipal Corporation’s Virtual Civic Center, which is simple and convenient way for citizens to access various services from any where at any time. The services of Virtual Civic Center can be accessed without paying any additional charges.

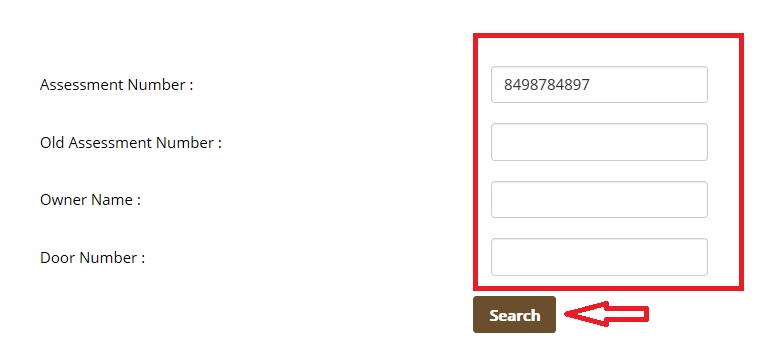

Enter your Assessment number in place of ‘Old Assessment Number’ & note your New Assessment Number .

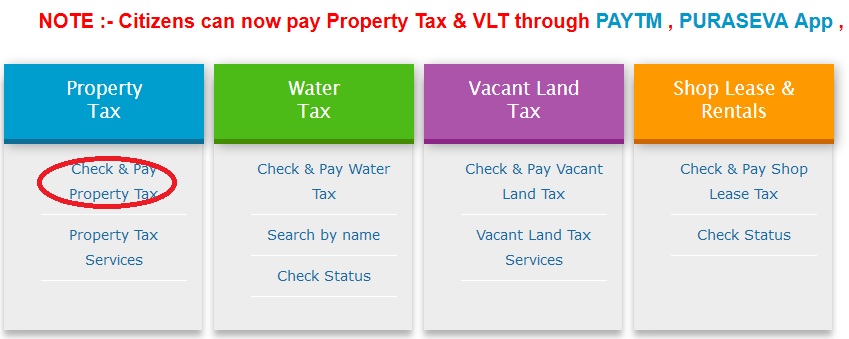

Click the link Check & Pay Property Tax.

You can search the property by any one of these criterias.

** Assessment Number

** Old Assessment Number

** Owner Name

** Door Number

Note :- Citizens can now pay Property Tax & VLT through PAYTM , PURASEVA App , Smart Vizag App & Any EMI with your new Assessment Number.

Property Tax Services :

You can avail these list of services under GVMC Property Tax website.

** Property Tax Online Payment

** Property Mutation Online Payment

** Know Your Property Dues

** File Your Assessment

** File Your Additional / Alteration

** File Your Revision Petition

** File Your General Revision Petition

** File Your Mutation (Transfer of Ownership)

** File Your Vacancy Remission

** File Your Demolition (Convert House Tax to Land Tax)

** File Your Tax Exemption

** Download Notices/Special Notices/Demand Notices etc.,

How To Check & Pay GVMC Water Tax?

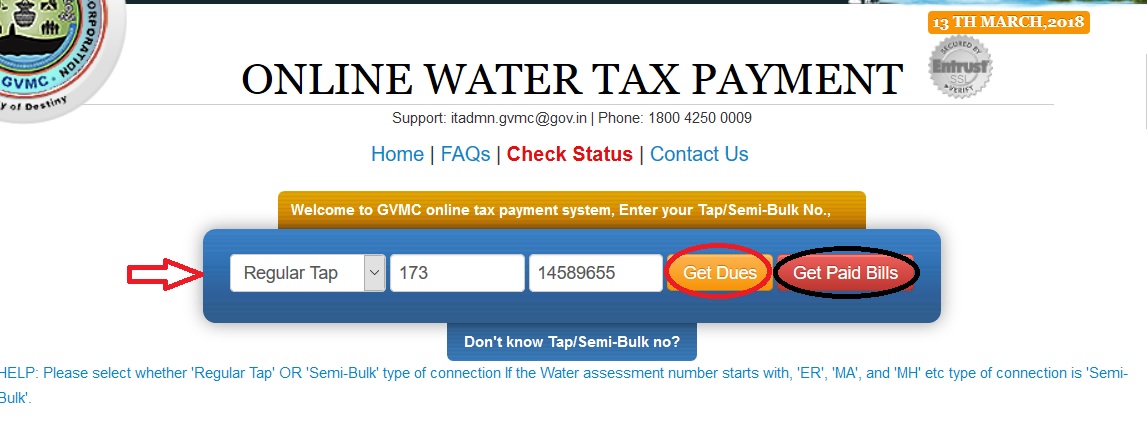

Visit the website of GVMC. Click the link Check & Pay Water Tax available under online services page.

Help:

Please select whether ‘Regular Tap’ OR ‘Semi-Bulk’ type of connection If the Water assessment number starts with, ‘ER’, ‘MA’, and ‘MH’ etc type of connection is ‘Semi-Bulk’.

Enter your Tap/Semi- Bulk No to know the bill.

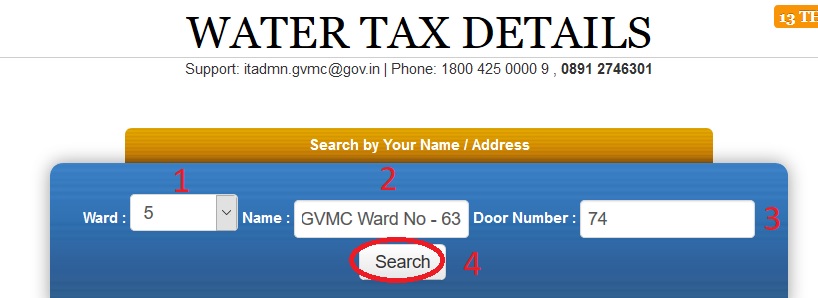

Search by Your Name / Address :

Click Search by Name available in the home page.

Step 1 : Select Ward

Step 2 : Enter Name

Step 3 : Enter Door Number

Step 4 : Click Search Button

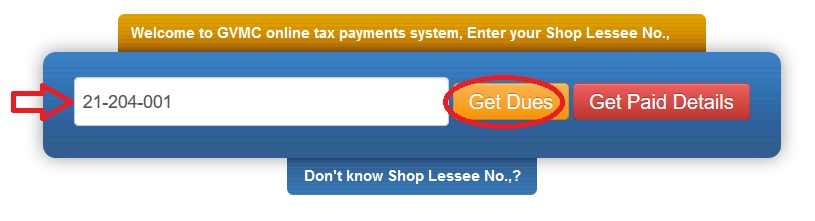

Check & Pay Shop Lease Tax

Click the respective link of Shop Lease Tax available in Online Services page. You will be taken to GVMC online tax payments system. Enter your Shop Lessee No to know the details.

Shop Lessee No., can be found on your any previous bills. If you still have trouble to find Lessee No.,call support 180042500009

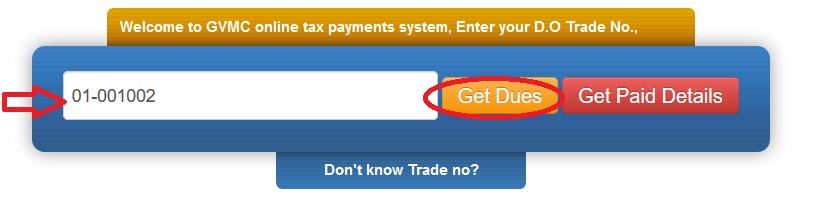

Check & Pay D & O Trade Tax :

Click Check & Pay D & O Trade Tax link which is available under online Services. Enter Enter your D.O Trade No to know the bill.

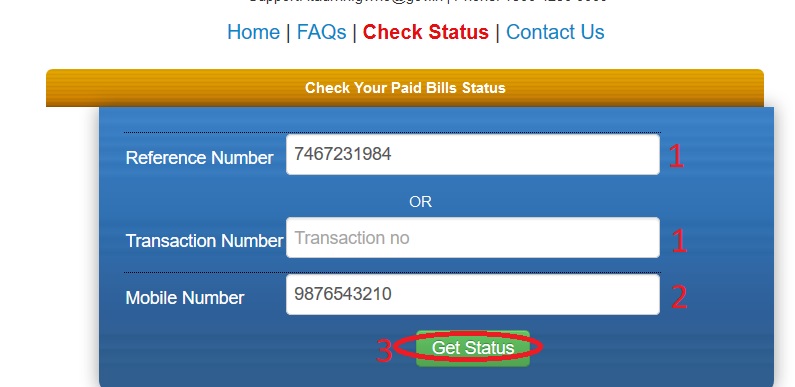

Check Your Paid Bills Status :

Click Check bill status link which is available in the water tax page.

Step 1 : Enter Reference Number OR Transaction Number

Step 2 : Enter Mobile Number

Step 3 : Click Get Status Button

FAQS On GVMC Payment

Frequently Asked Question (FAQs) On GVMC

Who can make online payment and what is required for it?

Online payment can be made by any citizen having valid assessment number of the property for which s/he wants to make payment. The payer needs to have either a Master/VISA Credit Card or a Master/VISA Debit Card or Net banking credentials.

How do I make payment using Master/VISA Credit or Debit Card?

First ensure that your card has been enabled by VBV (verified by VISA) OR VBM (verified by MASTER) if yes then use your PIN number issued by your bank for making online payment. To obtain PIN number you need to call your bank, who will furnish it to you by E-Mail or SMS.

My account is debited but Property Tax receipt is not generated?

If the status is shown as pending, the transaction amount will be reflected to your tax after few hours.

Can I make multiple payments for different assessment numbers?

Yes, but payment is allowed for only one assessment number at a time. You can continue to pay once the status is shown as “success” in “check status page”. You need to initiate another transaction for making payment for another assessment.

Can I reprint my transaction receipt?

Yes, you can reprint your transaction receipt from the Paid Dues Page

Can I make part payment?

Part payment is not allowed.

Do I have to pay any service fee/charge to use this ePay Service?

Yes. Transaction fees for various modes of payment are as follows: * Below Rs.10,000/- :Rs.15/- + 14% on Rs.15/- (Transaction fee + service tax) * Above Rs.10,000/- :Rs.30/- + 14% on Rs.30/- (Transaction fee + service tax)

I have queries regarding the transaction I had carried out, whom should I contact?

You can send your query by email to itadmn.gvmc @ gov.in. In that you need to mention your Assessment No., Transaction ID, Reference No. and Transaction Date for tracking purpose.

The property related information displayed on the website is having typographic error or is incorrect, whom should I contact?

The property related information is based on the Assessment & Recovery data made available through respective Zone’s Assessment & Recovery Department. In case of correction, you may contact Assessment & Recovery Department of the respective zone office.

Complaint Registration

If you have any concern, you can raise a compliant online by following the below guidelines.

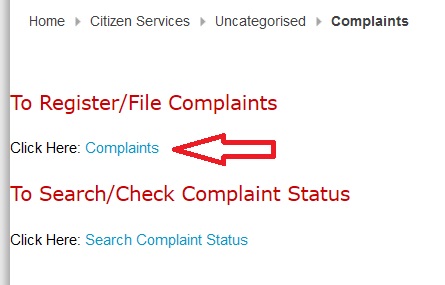

Click Register a Complaint link available under Complaint Registration tab.

If you want to register complaints, click Complaints link.

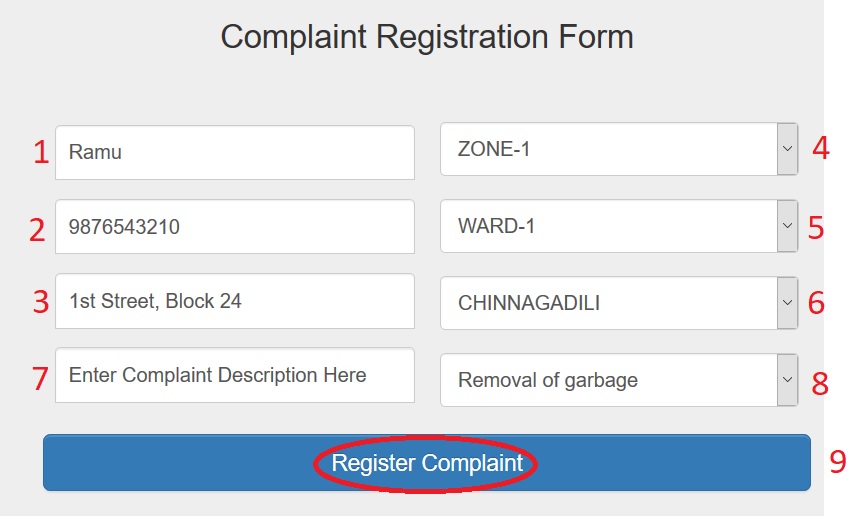

Step 1 : Enter Complainer Name

Step 2 : Enter Phone Number

Step 3 : Enter Address

Step 4 : Select Zone

Step 5 : Select Ward

Step 6 : Select Area

Step 7 : Enter Complaint Description

Step 8 : Select Nature of Complaint

Step 9 : Click Register Complaint Button

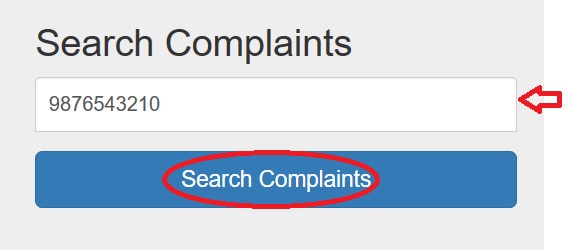

Search/Check Complaint Status :

You can check the staus of complaint by clicking the search status link available. Enter your complaint id or PhoneNumber & then click on Search Complaints Button.

View Status of Professional Tax

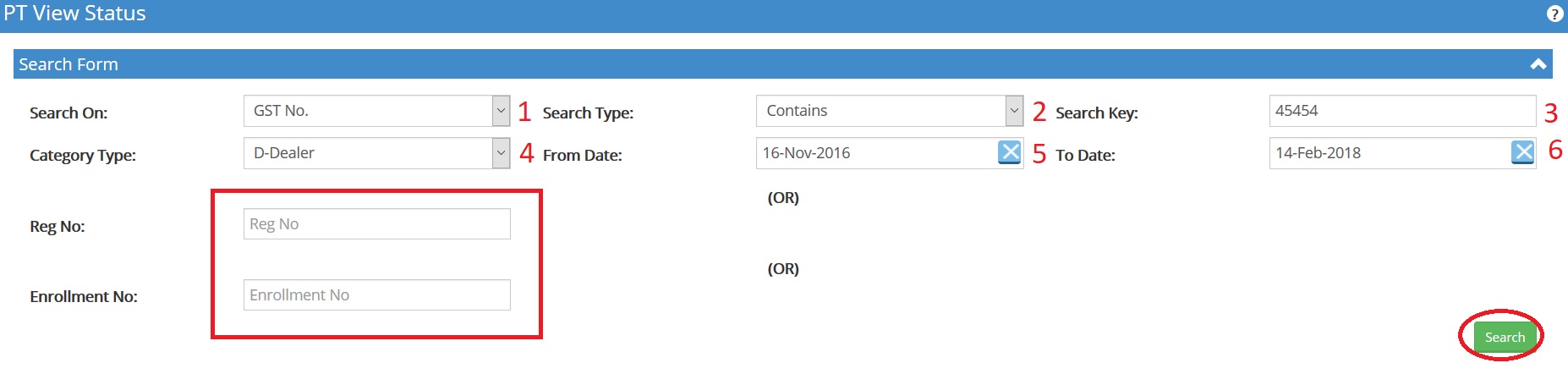

Go to the link of View Status under Professional Tax.

Step 1 : Select search on from the drop down list.

You can search through GST No, Pan No, Zone & Ward

Step 2 : Select Search Type

You can select Contains, Starts WIth & Equals to

Step 3 : Enter Search Key as per your selection

Step 4 : Select Category Type as Dealer or Employer

Step 5 : Select From Date

Step 6 : Select To Date

Or you can search through Reg No (OR) Enrollment No

Step 7 : Click Search Button

Pay Trade License :

** Enter website address gvmc.gov.in

** Select Payments menu and Select Pay trade license.

** Then you transfer to trade enquiry page. Enter your Valid Shop Id ,Then you will get total demand and collection of given shop id number.

** After getting the details, Click to pay trade license button appear on the screen.

** After clicking on that button, It will be transfer to payment mode of easy2pay with asking debit or credit card number , valid month , year of the card and cvv2/cvc2 is the three digit security code printed on the back of your card , email address , mobile number and word verification and submit with valid data .

** After successful payment you will be transfer to another page.

** On that page you will get the certificate.

** Print it and keep the license while requesting the trade license you need to show that license to the officers who requested

I paid property tax on 28.2.19 for Rs.7564 through GVMC property tax payment online portal through internet. Funds transmitted through CFMS payment gateway under ID 886814. It shows some technical problem and status shows as pending. Complaint made online with reference number 301031900085. It is not resolved so far. There is some problem in the website.

sir,

please send message to your area ZC/ Main commissioner through whats up/online complaint, the will solve easily.

I paid property tax on line on 13th apr 2020,the ammount of 4,735 rupees.Pos#80700068 at CFMSAND)THDRCARD txn#010450037759.Till now tax showing due.Whom should I contact.

xtended last date for property btax payment in GVMC

Hi All,

I have got my name printed wrongly in the vacant land tax assessment my name wrongly printed. But they are asking us to pay the vacant land tax with the wrong name. Also the plot number is missing. what can we do to resolve this.