indiapost.gov.in Post Office Monthly Income Scheme POMIS

Organisation : Department of Posts, Ministry of Communications, Government of India

Scheme Name : Post Office Monthly Income Scheme – POMIS

Applicable States/ UTs : All Over India

Website : https://www.indiapost.gov.in/Financial/Pages/Content/Post-Office-Saving-Schemes.aspx

| Want to comment on this post? Go to bottom of this page. |

|---|

POMIS Post Office Monthly Income Scheme

Post Office Monthly Income Scheme 2018 is a best five year investment with maximum ceiling of Rs. 9 lakh under joint ownership and Rs. 4.5 lakh under single ownership.

Related / Similar Scheme : EPF India PMRPY

Central government now fixes interest rate at 7.3% p.a (w.e.f 1 Jan 2018) payable monthly.

All those candidates who wants to earn regular income every month can make investment.

The maturity period is 5 years while premature withdrawal is subject to deduction in the principal amount.

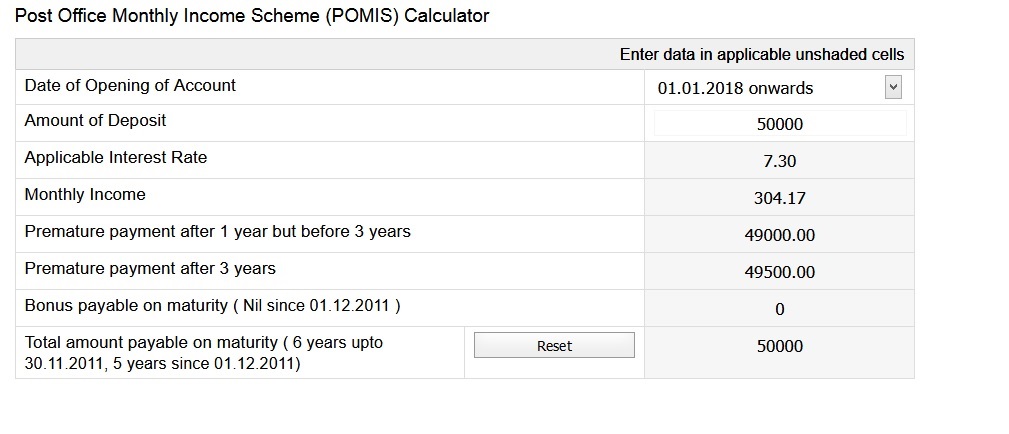

POMIS Calculator

Go to the link finotax.com/misc/po-calc#x5 and Enter data in applicable unshaded cells the amount of deposit then click enter button and get your Interest rate/Montly Income/etc.

Example :

Monthly Income Scheme Offers an annual interest rate of 7.3% p.a. So, an amount of 50,000 deposited in mis account yields a monthly payout of Rs.304.17 every month.

POMIS Account

Interest Rate & Amount :

| Interest payable, Rates, Periodicity etc. | Minimum Amount for opening of account and maximum balance that can be retained |

| From 1.01.2018, interest rates are as follows:-

7.3% per annum payable monthly. |

In multiples of INR 1500/-

Maximum investment limit is INR 4.5 lakh in single account and INR 9 lakh in joint account An individual can invest maximum INR 4.5 lakh in MIS (including his share in joint accounts) For calculation of share of an individual in joint account, each joint holder have equal share in each joint account. |

Features

Salient features including Tax Rebate :

** Account may be opened by individual.

** Account can be opened by cash/Cheque and in case of Cheque the date of realization of Cheque in Govt. account shall be date of opening of account.

** Nomination facility is available at the time of opening and also after opening of account.

** Account can be transferred from one post office to another.

** Any number of accounts can be opened in any post office subject to maximum investment limit by adding balance in all accounts.

** Account can be opened in the name of minor and a minor of 10 years and above age can open and operate the account.

** Joint account can be opened by two or three adults.

** All joint account holders have equal share in each joint account.

** Single account can be converted into Joint and Vice Versa.

** Minor after attaining majority has to apply for conversion of the account in his name.

** Maturity period is 5 years from 1.12.2011.

** Interest can be drawn through auto credit into savings account standing at same post office, through PDCs or ECS./In case of MIS accounts standing at CBS Post offices, monthly interest can be credited into savings account standing at any CBS Post offices.

** Can be prematurely en-cashed after one year but before 3 years at the discount of 2% of the deposit and after 3 years at the discount of 1% of the deposit. (Discount means deduction from the deposit.)

A bonus of 5% on principal amount is admissible on maturity in respect of MIS accounts opened on or after 8.12.07 and up to 30.11.2011. No bonus is payable on the deposits made on or after 1.12.2011.