pt.kar.nic.in : Pay Professional Tax Online Karnataka

Organization : Karnataka Commercial Taxes Department

Facility : How to Pay Professional Tax Online in Karnataka?

Applicable State : Karnataka

Home Page : https://pt.kar.nic.in/

| Want to comment on this post? Go to bottom of this page. |

|---|

Contents

How To Pay Karnataka Professional Tax?

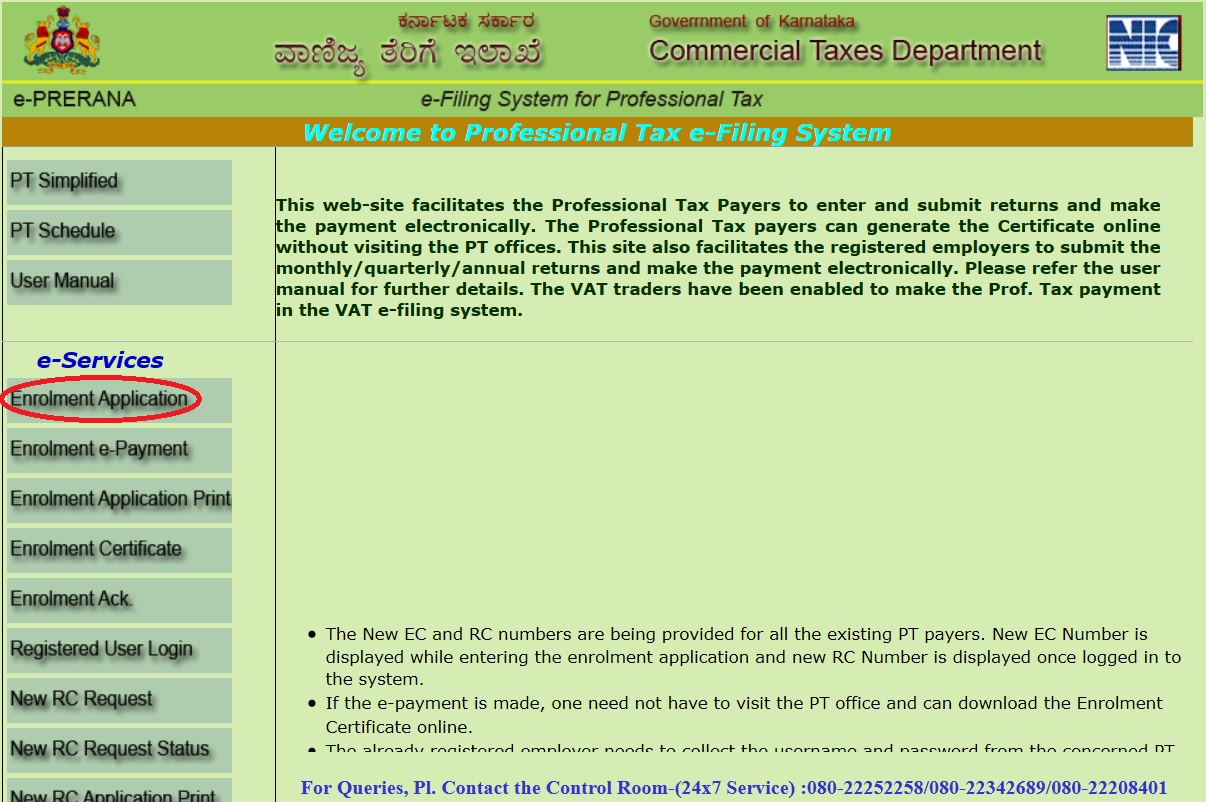

This facility for Professional Tax Payers is to enter and submit returns and make the payment electronically. The Professional Tax payers can generate the Certificate online without visiting the PT offices.

Related / Similar Service : ahara.kar.nic.in Apply for New Ration Card

This site also facilitates the registered employers to submit the monthly/quarterly/annual returns and make the payment electronically. The VAT traders have been enabled to make the Prof. Tax payment in the VAT e-filing system.

Every person (whether natural or juridical) who is engaged in any profession, trade, calling or employment in the State of Karnataka, specified in the second column of the schedule is liable to pay tax at the rate mentioned in the corresponding entry in the third column of the said schedule.

Timeline For Professional Tax Payment

Karnataka Professional Tax Payment Timeline

** Person who is already enrolled before the commencement of the year – Before 30th April of that year.

** Person who is enrolled after the commencement of a year – Within one month from the date of enrolment.

Enrolment Application

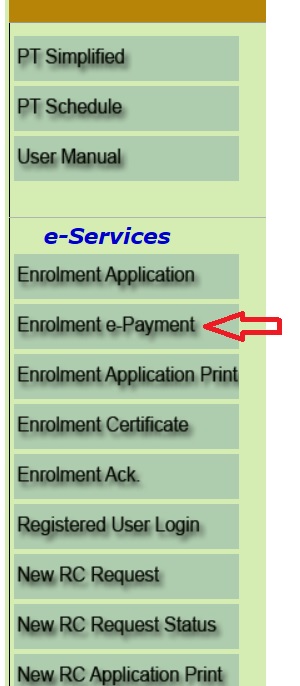

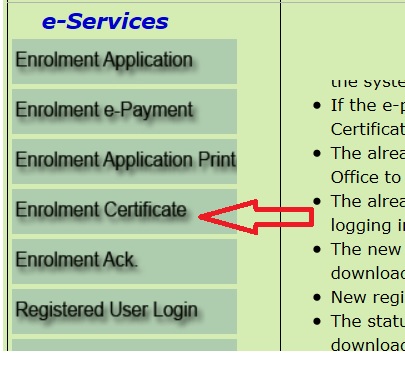

Please open the website of PT Karnataka provided above. There will be seven options displayed under heading e-Services.

I. Enrolment application

II. e-Payment

III. Application print

IV. Enrolment certificate

V. Enrolment Ack.

VI. Registered User’s Login

VII. New RC Request

If you are applying for enrolment certificate or for revised enrolment certificate or filing an annual return in all these three cases, then click Enrolment Application on the main page.

You will find the option as new or enrolled one.

First lets see about new enrollment.

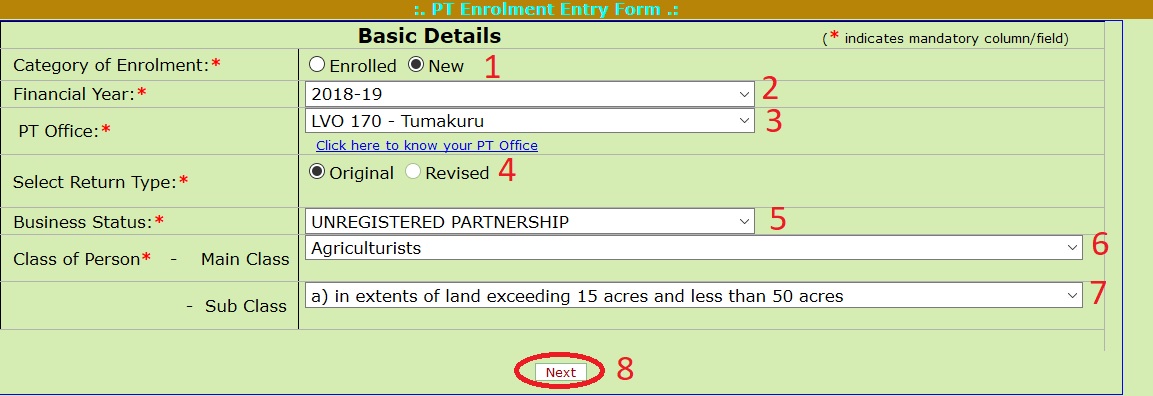

Step 1 : Select the category as New by clicking the appropriate Readio Button

Step 2 : Enter the required financial year for which the tax is due (Eg : 2018-19)

Step 3 : Select the PT office on the basis of PIN code of your place of profession /business from the drop down menu.(Eg : VSO-171 – Tiptur)

Step 4 : Select Return Type as Original or Revised

Step 5 : Select Business Status From Drop Down List (Eg : Trust)

Step 6 : Select the appropriate class of person to which you belong from the drop down menu (Eg : Bankers)

Step 7 : After selecting the appropriate class of persons, the person has to select the sub – class applicable to him.

Step 8 : Click Next Button

(* indicates mandatory column/field)

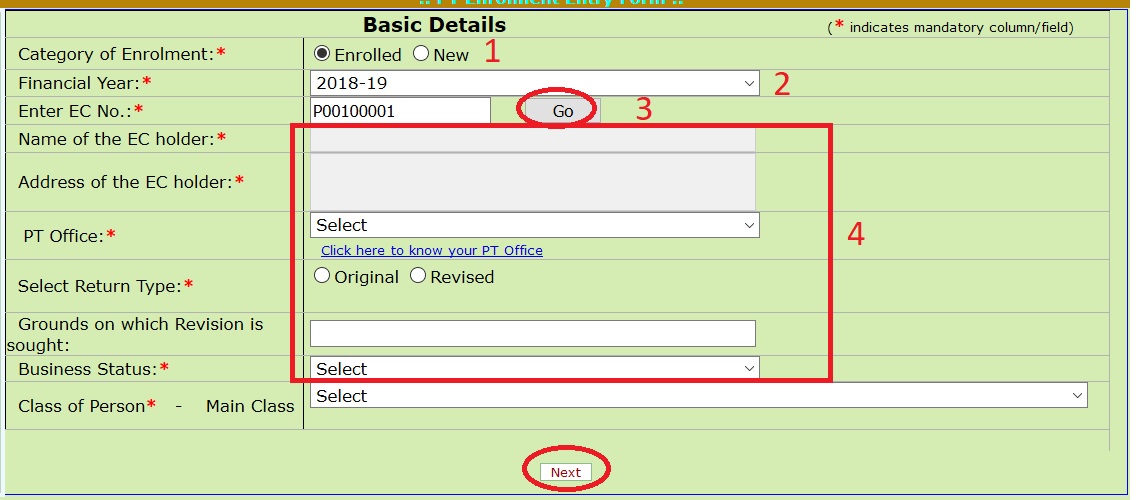

If you are a enrolled person, then follow the below procedure.

Step 1 : Select the category as Enrolled by clicking the appropriate Readio Button

Step 2 : Enter the relevant year for which you are filing an application for revised enrolment certificate or filing a return and making payment of tax. (Eg : 2018-19)

Step 3 : Enter the enrolment certificate number which is a alpha numeric of 9 characters (Eg : P00100001)

Step 4 : The system will validate the certificate number from the data base and if the number is correct then the name of the certificate holder, address, office in which he is enrolled and business status will be populated.

Step 5 : Click Next Button

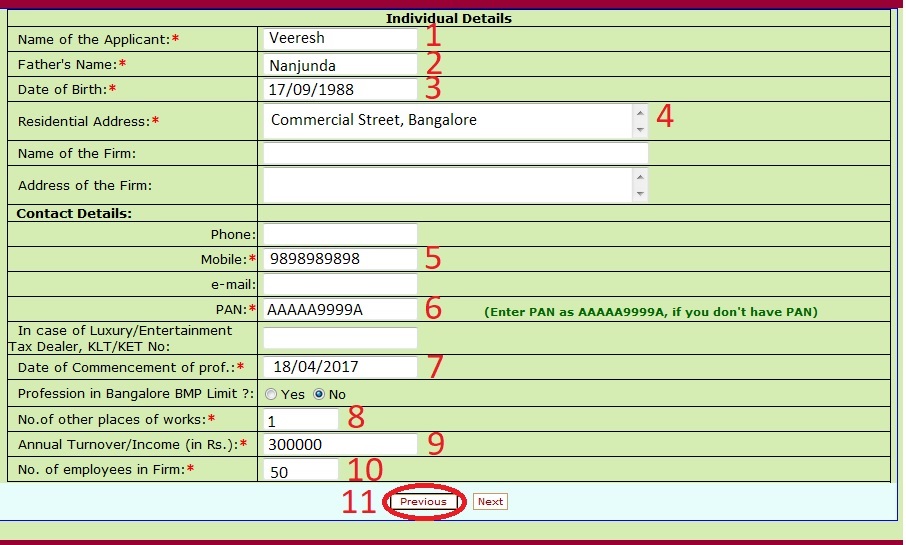

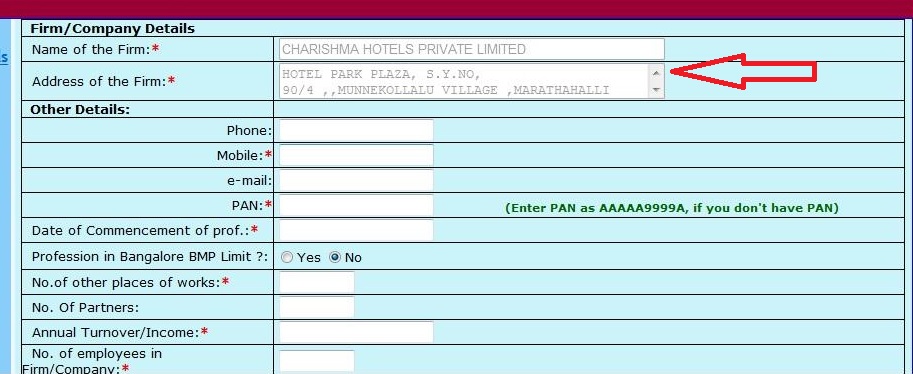

After selecting the appropriate sub-class and clicking on ‘Next’ the following screen will appear. This screen depends on the business ‘business status’ you have selected in the earlier screen. Enter the information in the fields as applicable. If the person has chosen the status as an individual the following screen will be displayed.

Step 1 : Enter Name of Applicant (Eg : Veeresh)

Step 2 : Enter Your Father’s Name (Eg : Rupesh)

Step 3 : Enter Your DOB (Eg : 17/09/1988)

Step 4 : Enter Your Residential Address (Eg : Commercial Street, Bangalore)

Step 5 : Enter Your Mobile Number (Eg : 9876643210)

Step 6 : Enter Your PAN Number if available. [Enter Pan as AAAAA9999A, if you dont have PAN]

Step 7 : Enter Date of Commencement of prof (Eg : 14/06/20170

Step 8 : Enter Number of Other Places of Works (Eg : 1)

Step 9 : Enter Your Annual Turn Over/ Income (Eg : 500000)

Step 10 : Enter Number of Employees in the Firm (Eg : 100)

Step 11 : Click Next Button

Firm/ Details :

If a person is a partnership firm then the relevant details of partners shall be entered. The details relating to the company shall be entered if the person is a company

After entering all the details Click on “next’. A screen for additional places of business will be displayed.

Additional places of business :

Only in case where there are additional places of business (branches) then the said details shall be entered. After such entry or otherwise click on Next button.

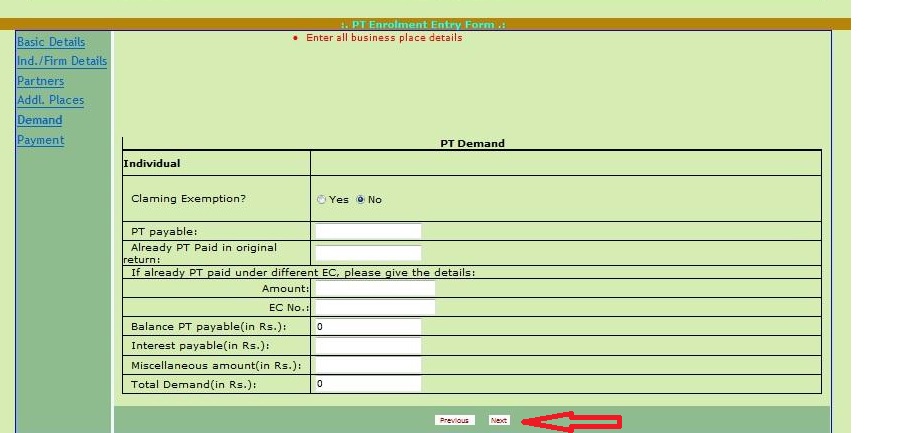

Demand : ( Tax liability)

** The tax payer has to enter the correct tax applicable to him by referring to the PT Schedule displayed on the main page.

** After entering the tax details click on Next.

** In the next screen you have to select the mode of payment by clicking on either of the two radio buttons namely 1) e-Payment 2) Cheque/ DD/Cash/Challan.

** After selecting the mode of payment click on Submit.

** A unique number called PTN No is generated and displayed.

Payment of Taxes

After entering the tax payable, the person has to pay the tax. The payment of tax can be made through:

a) e-payment

b) Cash/Cheque/DD/Challan

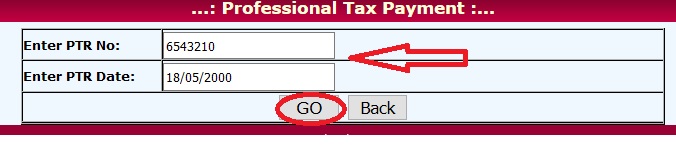

Go to the main menu and click on e-payment. Enter PTN number and PTN Date and click on ‘Go’ . You will be taken to the e- payment website

Immediately after making e-Payment the person will be enabled to obtain the certificate of enrolment for new cases and also for the persons who are already enrolled and have submitted application for revised enrolment certificate.

For the persons who are already enrolled and making payment as per the enrolment certificate by filing a return in Form 4A, an acknowledgement will be generated for having paid the tax.

In case the person opts to pay the tax through instruments then the details like cheque number, date, MICR code, bank and amount to be paid are required to be entered.

Visit the jurisdictional PT office with this unique number(PRN number) and physically submit the Cheque/DD/ Cash/Challan to get this application/return acknowledged by the concerned PTO.

After acknowledgement by PTO The person may generate the application for enrolment submitted electronically by clicking on the Enrolment application from the main menu

Payment Process

Go to the link of Enrollment Payment available in the main menu.

Enter the PTN No. and PTN Date and click on Go button.

i. The details such as EC No., Name, Address, Tax period, Tax amount will be displayed automatically.

ii. Next, the person selects the Bank for e-Payment from a drop down list.

iii. The system displays the banks who have integrated the e-payment process with Commercial Taxes Department.

iv. After asking the person to verify and confirm the details entered, he will be asked to click submit button.

v. The system saves these details and a unique number called the CTD Reference Number is generated and displayed to the person.

vi. The person should note this number for future use.

vii. The system then passes the data relating to payment entered by the person to the selected bank’s web-site and opens the bank website.

viii. The login page of the bank website will be opened and person authenticates by entering his credentials, username and password, as given by the bank.

ix. The bank site now displays the Tax Category, RC No., CTD Reference Number and Amount of payment.

x. Once the person confirms the payment, the transaction will be carried out in core banking system person has to wait for thirty to forty seconds after carrying out the transactions successfully.

xi After completion of payment process, the bank’s web-site will return to the CTD website.

xii. During the return to the CTD website, the payment details from the bank site will travel to the CTD website and the same is updated into the database.

Generation of Enrolment Certificate and Acknowledgement :

Immediately after submission of the instrument like Cheque/ DD/Cash/ Challan and the same being acknowledged by the jurisdictional PTO, the person will be enabled to obtain the enrolment certificate and the acknowledgment through the web.

Download User Manual :

www.indianin.org/wp-content/uploads/pdf2018/9778-tax.pdf

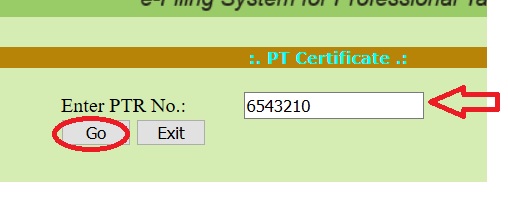

You can also download Enrolment Certificate by entering PTR number in the appropriate page.

Enter PTR number and click go button.

how to recollect the PTR No after payment ( paid the amount but not made a note of PTR no to download the Enrolment Certificate)

how to recollect the PTR No after payment

how to recollect the PTR No after payment